Home » Industry Expertise » Bookkeeping For Non Profit Organizations

Experience Hassle-Free

Bookkeeping for Non Profit Organizations

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the US. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of US regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Bookkeeping and Accounting for Non-Profit Organizations in the US.

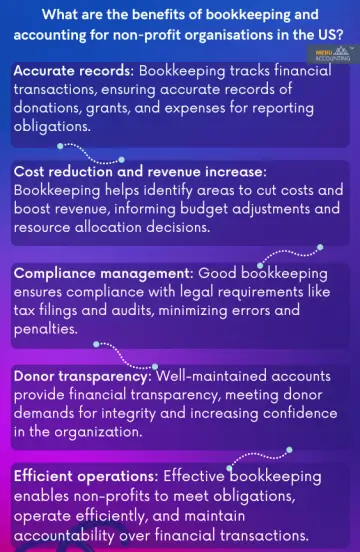

- Bookkeeping and accounting play a critical role in the financial management of non-profit organisations in the US. As non-profits operate with a mission to serve the public interest, their economic activities require specialised attention and compliance with regulations specific to the non-profit sector. Effective bookkeeping and accounting practices ensure transparency, accountability, and proper utilisation of funds.

- Non-profit bookkeeping and accounting follow principles similar to those in for-profit organisations but with additional considerations. Accrual accounting is commonly used to track revenues and expenses as they are earned or incurred, regardless of cash flow. This method provides a comprehensive view of the organisation’s financial activities.

- Not-for-profit organisations do not have business proprietors, and thus, they depend on reserves from commitments, participation contributions, program incomes, money-raising occasions, open and private awards, and venture salaries.

Here Are Some Key Aspects To Consider For Non-Profit Organisations:

1. Accrual Accounting

Non-profit organisations typically use accrual accounting, which records revenues and expenses when earned or incurred, regardless of when cash is received or paid. This method provides a more accurate representation of the organisation's financial position and performance.

2. Fund Accounting

Non-profits often have multiple funds or accounts designated for specific purposes, such as program funds, restricted funds, and general operating funds. Fund accounting ensures proper tracking and reporting of financial activities for each fund separately.

3. Grant And Donation Tracking

Non-profits heavily rely on grants, donations, and contributions. Accurate tracking and recording of these funds are crucial, ensuring they are used following donor restrictions and reporting requirements.

- Taxability of the donation received: It looks at all their yearly contributions. Non-profit organisations must record the gifts they take in and from whom they accept. However, non-profits are exempt from paying income tax, except for a few rules for property income or capital gains.

4. Restricted And Unrestricted Revenue

Non-profits often receive denied (designated for a specific purpose) or unrestricted (not limited to a particular user). Bookkeeping and accounting should properly differentiate and track these revenue categories.

- Unrestricted commitment incomes: If the giver does not express the reason for commitment, it will come under unhindered commitment incomes.

- Temporarily restricted net assets: If the giver explicitly states the donation's use, it would go under temporarily banned net assets.

- Permanently restricted net assets: These donations are those the receiver can never use in perpetuity.

5. Non-Profit-Specific Financial Statements

Non-profit organisations may need to prepare non-profit-specific financial statements, such as the Statement of Financial Position (Balance Sheet), Statement of Activities (Income Statement), and Statement of Cash Flows. These statements provide an overview of the organisation's financial health and performance

6. Compliance With IRS Regulations

Non-profit organisations must comply with the Internal Revenue Service (IRS) regulations to maintain their tax-exempt status. This includes proper record-keeping, annual reporting (e.g., Form 990), and adherence to charitable contributions, expenses, and governance guidelines.

7. Donor Reporting

Non-profit organisations often must provide financial reports to donors, grantors, and other stakeholders. These reports should accurately present how funds were used and demonstrate the impact achieved through the organisation's programs.

8. Transparency And Accountability

Non-profit organisations should maintain transparent and accountable financial practices. This includes maintaining proper documentation, implementing internal controls, conducting periodic financial reviews or audits, and ensuring adherence to ethical standards.

9. Budgeting

Approval of budgets by trustees- A budget estimates revenue and expenses over a specified period. After timely financial reports and planning reviews, the trustees approve the non-profit organisation.

Spending vs budgeting reports- Trustees make the budget report, the annual spending report is compared, and then a balance is made of all the expenditures.

10. Expense Allocation

Non-profit organisations must allocate expenses accurately among various programs, administration, and fundraising activities. This ensures transparency and allows stakeholders to assess the organisation’s resource efficiency and effectiveness..

- Accounting for Expenses: Expenses vs Expenditure done- Accounting of the costs done for the long run that can be encashed, and the cost incurred to meet everyday and current financial needs of the business, generally for a short term, is dealt with.

Here Are Some Tips For Non-Profit Organisations To Keep Their Bookkeeping Perfect

Establish A Chart Of Accounts

Develop a well-organized chart of accounts that aligns with the specific needs of your non-profit organisation. This will ensure consistent categorisation and tracking of revenues, expenses, and funds.

Segregate Funds

Maintain separate accounts or funds for different purposes, such as programs, grants, donations, and general operations. This helps track and report on the utilisation of funds accurately.

Consistent Recording

Regularly record financial transactions to prevent delays and ensure accuracy. Avoid letting transactions accumulate, as it can lead to errors or oversights.

Reconcile Bank Statements

Regularly reconcile your bank statements with your bookkeeping records to identify discrepancies and ensure that all transactions are accounted for accurately.

Document And Maintain Receipts

Keep proper documentation of all financial transactions, including receipts, invoices, and payment records. This helps in accurate record-keeping and facilitates future audits or reporting requirements.

Implement Internal Controls

Establish internal controls to safeguard financial assets and prevent fraud. Segregate duties, conduct periodic reviews, and ensure proper approval processes for financial transactions.

Seek Professional Assistance

Consider consulting with accounting professionals experienced in non-profit accounting. They can provide guidance, perform financial reviews or audits, and help ensure compliance with regulations.

Utilise Accounting Software

Implement reliable accounting software designed for non-profit organisations. This can streamline processes, automate tasks, and provide accurate financial reporting.

Ongoing Education And Training

Stay informed about changes in accounting regulations and best practices for non-profit organisations. Attend seminars, workshops, or webinars to enhance your knowledge and skills in non-profit bookkeeping.

Tax Obligations For Non-Profits

Understand and comply with state-level tax obligations, including sales tax and other taxes applicable to non-profit organisations. Additionally, be aware that non-profits must pay employment tax, even if they are exempt from federal income tax.

What Are The Benefits Of Bookkeeping And Accounting For Non-Profit Organisations In The US?

How Can Meru Accounting Help In Bookkeeping for Non-Profit Organisations?

Our team of experienced professionals offers tailored solutions to meet the specific needs of non-profit organisations regarding bookkeeping and accounting.

Our comprehensive bookkeeping services cover all aspects of non-profit accounting. Our experts will assist you in establishing a well-organized chart of accounts, ensuring accurate categorisation and tracking of revenues, expenses, and funds. For programs, grants, and donations, we understand the importance of segregating funds for different purposes, and we will help you maintain separate accounts to track and report on fund utilisation accurately.

With our expertise in accrual accounting, we will ensure that your financial transactions are recorded promptly and accurately, clearly representing your organisation’s financial position. Regular bank statement reconciliation will ensure discrepancies are identified and all transactions accounted for.

Considering donor restrictions and compliance requirements, Meru Accounting will help you develop systems for tracking and recording grants, donations, and contributions separately. Your stakeholders, board members, and grantors will also benefit from the timely and accurate financial reports that we provide.

The financial management tasks can be outsourced to Meru Accounting so that you can concentrate on your organisation’s mission. We will ensure compliance with IRS regulations, assist with tax filings, and help you stay abreast of the latest accounting best practices for non-profit organisations.

We are committed to supporting non-profit organisations to maintain accurate and efficient financial records, enabling them to thrive and fulfil their mission transparently and accountable.

Conclusion

Bookkeeping and accounting are essential for the success of non-profit organisations in the US. It helps them track their financial transactions, report to regulators, and make informed decisions about their operations. By outsourcing these services, non-profits can benefit from the expertise of professional accountants who can provide timely and accurate financial information.

Outsourcing bookkeeping and accounting services is a cost-effective option for small non-profits that need help to afford an in-house accountant. It allows them to focus on their core mission while leaving financial management tasks to experts.

By implementing good bookkeeping practices, such as maintaining accurate records and reconciling accounts regularly, non-profit organisations can build trust with donors and beneficiaries. They will also be better positioned to secure funding from government agencies or private entities.

Therefore, if you run a non-profit organisation in the US or plan on starting one soon, consider the importance of proper bookkeeping and accounting practices. Consider outsourcing these services to Meru Accounting today to reap all the benefits discussed above!

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

Help you with switching from your traditional software to Xero and Quickbooks.

- Cost-saving.

- Access to skilled and experienced professionals.

- Better management of books of accounts.

- Decreased chances of errors.

- Improve business efficiency.

- De-burdens in-office employee’s dependency.

- Better turnaround time.

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

Get a Free Quote

CONTACT US FOR ANY QUESTIONS