How Does Inventory Valuation Impact Financial Reporting in the Pharmaceutical Industry?

Inventory valuation is a critical component of financial reporting in the pharmaceutical industry. The pharmaceutical industry deals with a vast array of drugs, medical supplies, and other healthcare products, each with specific valuation methods that can significantly impact financial statements. Accounting in pharmaceutical industry practices ensure that inventory is valued appropriately, which influences profits, taxes, and overall business performance. Pharmaceutical industry accounting practices ensure that inventory is valued appropriately, which influences profits, taxes, and overall business performance.

Table of Contents

- Introduction to Inventory Valuation

- The Impact of Inventory Valuation on Financial Reporting in the Pharmaceutical Industry

- Challenges of Inventory Valuation

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction to Inventory Valuation

In the pharmaceutical industry, inventory represents a substantial portion of a company’s assets. Accounting in pharmaceutical industry practices ensure that inventory is valued appropriately, which influences profits, taxes, and overall business performance. Pharmaceutical industry accounting practices must be followed to ensure that inventory is valued in a manner that aligns with accounting standards like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Inventory valuation in pharmaceutical industry accounting can impact many aspects of the financial statements.

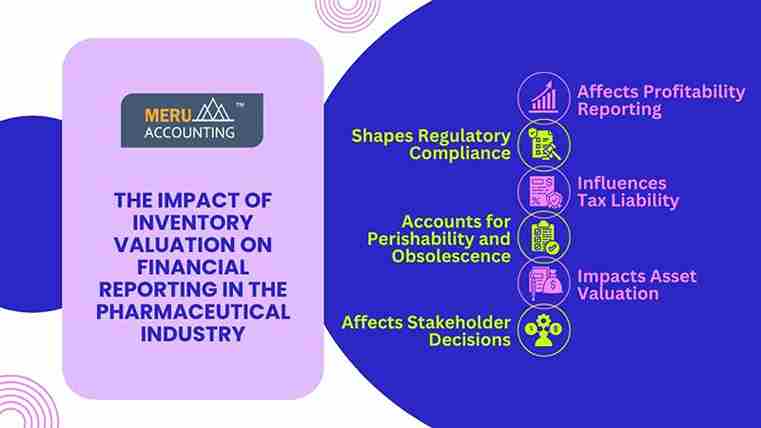

The Impact of Inventory Valuation on Financial Reporting in the Pharmaceutical Industry

- Affects Profitability Reporting

Inventory valuation directly impacts the Cost of Goods Sold (COGS), which is deducted from revenue to calculate gross profit.

- Higher Inventory Valuation: Results in lower COGS, leading to higher reported profits.

- Lower Inventory Valuation: Increases COGS, reducing profitability on financial statements.

This has a significant effect on how investors and stakeholders view the company’s financial health. Accurate accounting in the pharmaceutical industry is vital to maintain transparency and trust.

- Influences Tax Liability

The valuation method chosen for inventory significantly affects taxable income by altering COGS.

- Higher COGS (e.g., LIFO during inflation): Reduces taxable income, thereby lowering tax payments.

- Lower COGS (e.g., FIFO during inflation): Increases taxable income, leading to higher tax liabilities.

Effective tax management is essential in pharmaceutical industry accounting, as it directly impacts cash flow and long-term planning.

- Impacts Asset Valuation

Inventory is one of the largest current assets in the pharmaceutical sector and is reflected on the balance sheet.

- Overvalued Inventory: Inflates total assets, potentially misleading investors about financial strength.

- Undervalued Inventory: Understates assets, harming the company’s perceived financial position.

Accurate valuation provides a realistic portrayal of the company’s asset base, ensuring reliable financial statements.

- Shapes Regulatory Compliance

Pharmaceutical companies must comply with financial reporting standards such as GAAP or IFRS, which emphasize transparency and consistency.

- Non-compliance due to incorrect inventory valuation can result in penalties and reputational damage.

- Proper valuation ensures that financial reports meet regulatory expectations, reducing risks and enhancing credibility.

Adhering to standards is a cornerstone of accounting in the pharmaceutical industry.

- Accounts for Perishability and Obsolescence

Pharmaceutical inventories often include perishable products or items that may become obsolete quickly.

- Failure to Reflect Write-Downs: Can overstate inventory and profitability, creating inaccuracies in reporting.

- Proper Accounting: Captures the costs of expired or unsellable products, ensuring accurate and honest financial statements.

This aspect of pharmaceutical industry accounting is particularly critical due to the industry’s reliance on time-sensitive products.

- Affects Stakeholder Decisions

Inventory valuation influences financial metrics such as gross margin and net income, which guide stakeholders’ decisions.

- Investors: Rely on profitability reports shaped by inventory valuation methods.

- Creditors: Use inventory value to assess the company’s creditworthiness and lending terms.

Accurate reporting fosters trust and enables informed decision-making among stakeholders, strengthening the company’s position in the market.

Challenges of Inventory Valuation

- Expiration Dates: Pharmaceutical products are highly sensitive to expiration dates, which can make it difficult to manage inventory. An expired product may need to be written off, affecting inventory valuation and financial reporting.

- Price Volatility: The pharmaceutical industry is prone to price fluctuations, particularly with raw materials and active pharmaceutical ingredients (APIs). These fluctuations can affect inventory valuation, making it essential for pharmaceutical companies to use the most appropriate inventory valuation method.

- Regulatory Compliance: Pharmaceutical companies must comply with strict regulatory guidelines regarding inventory management. This includes ensuring that inventory is properly tracked, stored, and valued according to industry standards and regulations.

- Complex Product Lines: With a wide variety of drugs and medical products, inventory valuation in the pharmaceutical industry can become complex. Managing different product types with varying shelf lives, packaging, and costs requires robust inventory management systems and accurate financial reporting.

Frequently Asked Questions (FAQs)

Q1: What is inventory valuation in the pharmaceutical industry?

Ans: Inventory valuation refers to the process of assigning a monetary value to pharmaceutical inventories, including drugs and medical supplies, to ensure accurate financial reporting.

Q2: Why is inventory valuation important in financial reporting?

Ans: It impacts profitability, tax liabilities, asset valuation, regulatory compliance, and stakeholder decisions, making it essential for accurate and transparent reporting.

Q3: How does inventory valuation affect profitability?

Ans: Inventory valuation alters the Cost of Goods Sold (COGS), which directly influences gross profit and reported net income.

Q4: What role does inventory valuation play in tax liability?

Ans: It affects taxable income by influencing COGS, impacting the amount of taxes a company must pay.

Q5: How does inventory valuation impact asset valuation?

Ans: Overvalued inventory inflates assets, while undervalued inventory understates them, affecting the company’s financial position.

Q6: What are the regulatory implications of inventory valuation?

Ans: Accurate valuation ensures compliance with standards like GAAP or IFRS, reducing penalties and reputational risks.

Q7: Why is perishability a challenge in inventory valuation?

Ans: Pharmaceutical products have expiration dates, and failing to account for expired items can lead to overstated inventory and profits.

Q8: How does price volatility affect inventory valuation?

Ans: Fluctuations in raw material prices can complicate inventory valuation, requiring companies to use appropriate methods for accurate reporting.

Q9: What are the complexities of managing pharmaceutical inventory?

Ans: A wide variety of products with different shelf lives, costs, and regulatory requirements adds to the complexity of inventory management.

Q10: How does inventory valuation influence stakeholder decisions?

Ans: It shapes key financial metrics like gross margin and net income, guiding investors, creditors, and other stakeholders in decision-making.

Q11: Which valuation methods are commonly used in the pharmaceutical industry?

Ans: Methods like FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are commonly used, depending on market conditions and regulatory requirements.

Q12: How can pharmaceutical companies manage inventory valuation challenges?

Ans: By implementing robust inventory management systems and adhering to regulatory guidelines, companies can ensure accurate and compliant valuation.

Q13: How does inventory valuation ensure regulatory compliance?

Ans: It aligns financial reporting with standards like GAAP or IFRS, enhancing transparency and reducing risks of non-compliance.

Q14: What services does Meru Accounting offer for inventory valuation?

Ans: Meru Accounting provides solutions for maintaining accurate inventory records and adhering to industry standards for financial reporting.

Conclusion

Inventory valuation is fundamental to financial accuracy in the pharmaceutical industry accounting process. Choosing the right valuation method ensures compliance and supports transparent financial reporting, which is a critical aspect of accounting in the pharmaceutical industry. Meru Accounting understands the unique demands of accounting in the pharmaceutical industry, offering solutions that help companies maintain accurate inventory records and adhere to industry standards.