Home » What are the methods of cash flow analysis?

What are the methods of cash flow analysis?

Understanding cash flow is key to managing money. It helps track where cash comes from and where it goes. In the United States, there are many ways to study cash flow. Each method gives a different view of a person’s or firm’s money health. These tools help show how well cash is made and used. By looking at cash in and cash out, one can spot money gaps, plan costs, and shape better budgets. Good cash flow checks also lead to smart moves and strong money control.

What is Cash Flow Analysis?

- Cash flow analysis is the process of checking how money flows in and out of a business.

- It helps you understand your company’s financial health.

- It tells you if you have enough cash to pay bills, salaries, or invest in growth.

- It includes income from sales and expenses like rent, inventory, and more.

- Cash flow analysis is key to making good business decisions.

Why is Cash Flow Analysis Important?

- Helps track daily, monthly, or yearly cash movement.

- Prevents a shortage of cash during tough times.

- Aids in planning loans, investments, and budgets.

- Shows whether the business is growing or falling behind.

- Keeps you prepared for taxes and unexpected costs.

- Useful for investors, bankers, and management.

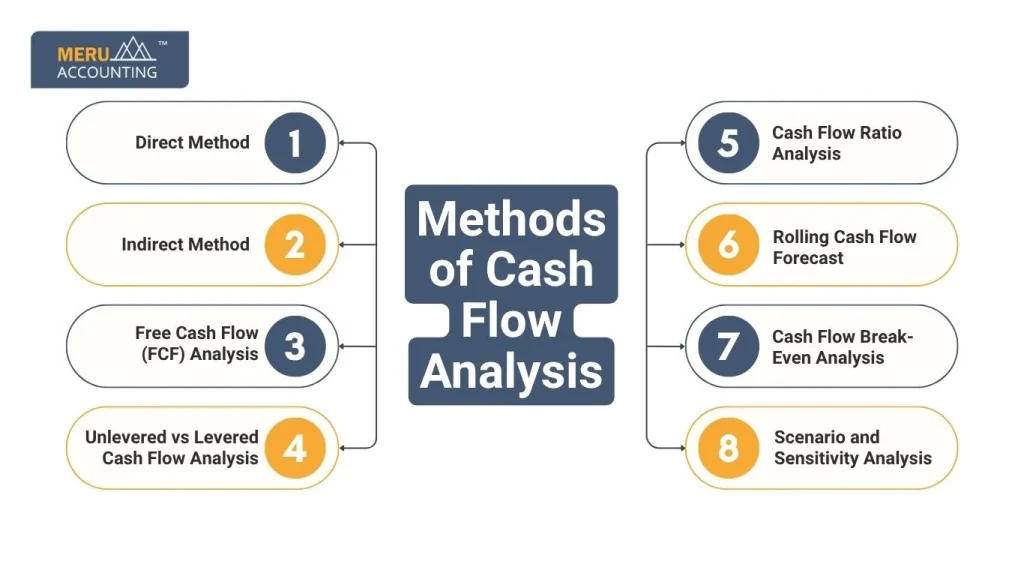

Methods of Cash Flow Analysis

What is cash flow analysis if not a way to view how cash moves? These methods help businesses make smart decisions.

1. Direct Method

- Shows actual cash received and paid during a period.

- Tracks cash from customers, payments to suppliers, and wages paid.

- Gives a clear view of cash flow for operations.

- Common in small businesses.

- Less used by large firms due to time-consuming tracking.

Example:

Received $10,000 from clients

Paid $4,000 to suppliers

Paid $2,000 in salaries

Net cash = $4,000

2. Indirect Method

- Starts with net income and adjusts for non-cash items.

- Adds back depreciation, subtracts changes in inventory, receivables, and payables.

- Helps reconcile profit with actual cash flow.

- Popular among larger businesses.

- Easier when using accounting software.

Example:

Net income: $5,000

- Depreciation: $1,000

- Increase in inventory: $500

Net cash = $5,500

3. Free Cash Flow (FCF) Analysis

- Shows how much cash remains after covering operating costs and capital expenses.

- Tells you how much is available for dividends or reinvestment.

- A useful tool for investors.

Formula:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

Example:

Operating cash flow = $8,000

Capital expenses = $2,000

Free cash = $6,000

4. Unlevered vs Levered Cash Flow Analysis

Unlevered Cash Flow:

- Cash available before paying debts.

- Shows business performance without financing costs.

Levered Cash Flow:

- Cash after paying interest and loan amounts.

- Shows what is left for shareholders.

Useful for:

- Comparing businesses with different financing methods.

5. Cash Flow Ratio Analysis

- Uses different ratios to measure cash flow health.

- Helps in comparing performance over time or across firms.

Examples:

- Operating Cash Flow Ratio = Operating Cash Flow / Current Liabilities

- Cash Flow Margin = Operating Cash Flow / Net Sales

- Debt Coverage Ratio = Operating Cash Flow / Total Debt

These ratios help spot cash issues early.

6. Rolling Cash Flow Forecast

- A forecast updated regularly (monthly or weekly).

- Helps predict future cash positions.

- Useful for businesses with frequent changes in revenue or expenses.

Benefits:

- Keeps you ready for slow months.

- Supports better financial planning.

7. Cash Flow Break-Even Analysis

- Calculates the point where inflows match outflows.

- Shows the sales volume needed to cover all costs.

- Useful for startups and seasonal businesses.

8. Scenario and Sensitivity Analysis

- Test cash flow under different situations.

- Scenario: Best-case, worst-case, expected-case.

- Sensitivity: What happens if sales fall 10% or costs rise 5%?

- Helps prepare for risks.

Cash Flow Statement Analysis: The Key to Informed Decisions:

The cash flow statement is a crucial financial document for cash flow analysis, detailing inflows

and outflows within a specific period. Operating activities, investing activities, and financing

activities comprise their three main divisions.

Operating activities encompass the day-to-day activities that generate revenue, like sales and

payments to suppliers. Investing activities involve buying or selling assets like property,

equipment, and investments. Financing activities include transactions with the company’s

owners and creditors, such as issuing stock or taking out loans.

Examining the cash flow statement analysis provides a comprehensive financial health

assessment, revealing how money moves within an entity. A positive net cash flow indicates

core operations generating more cash than they use, indicating a positive sign.

You can get in contact with the CPA firm Meru Accounting if you’re looking to hire an accounting firm to manage your cash flow and analyze your financial condition.

Main Types of Cash Flow

To understand what is cash flow analysis, it’s important to know its three main types: operating, investing, and financing cash flow.

1. Operating Cash Flow

- Cash from core business activities like sales or services.

- Shows if the company earns enough to keep going.

2. Investing Cash Flow

- Cash from buying or selling assets like property, equipment, or stocks.

- Shows investment in the business or returns from past investments.

3. Financing Cash Flow

- Cash from taking loans or issuing shares.

- Also includes paying dividends or repaying debts.

Benefits of Cash Flow Analysis

- Maintains Good Cash Levels

Knowing what is cash flow analysis can help maintain strong cash levels for day-to-day needs and emergencies. - Avoids Late Payments and Penalties

It helps track due dates and cash needs, so the business can pay bills on time and avoid extra charges. - Supports Business Planning

Knowing where money comes from and goes helps in making smart business plans. - Builds Investor and Lender Trust

Good cash records show control and care, which builds trust with lenders and investors. - Helps in Setting Goals and Targets

Cash tracking helps set clear, real goals and check progress with facts.

Tools Used in Cash Flow Analysis

- Microsoft Excel

Excel is a top tool for making cash flow charts, tables, and forecasts with built-in math functions. - Google Sheets

Google Sheets lets teams work together in real time on shared cash flow sheets. - QuickBooks

QuickBooks makes cash flow reports easy and links with bank accounts to track real-time cash. - Xero

Xero gives clear cash dashboards and reports to help manage cash in and out. - Zoho Books

Zoho Books helps plan cash use and create easy-to-read reports with less effort. - FreshBooks

FreshBooks helps small firms see where cash goes and makes simple reports fast.

These tools help users save time and avoid mistakes with ready charts and smart cash tracking.

Common Mistakes in Cash Flow Analysis

- Ignoring Small Cash Payments

People often misunderstand what is cash flow analysis and skip small expenses, which can cause errors in the reports. - Not Updating Forecasts Regularly

If you don’t update forecasts often, they may not match your real cash position. - Confusing Profit with Cash

A firm may earn a profit but still lack cash. Cash flow looks at real money, not just paper gains. - Missing Out on Taxes or Interest Payments

Skipping taxes or loan interest in the plan can lead to cash gaps later. - Overestimating Sales Collections

Expecting all clients to pay on time may cause cash issues if they don’t.

Avoiding these mistakes helps make the analysis more clear and useful.

Tips for Better Cash Flow Analysis

- Track Inflows and Outflows Weekly

Check cash in and out each week. This helps spot changes and act fast. - Use Both Direct and Indirect Methods

Using both ways gives a full view of how your cash works. - Keep Reserves for Emergencies

Always have backup cash for slow months or surprise costs. - Update Forecasts Monthly

Update your cash plans each month to stay on track with real figures. - Monitor Spending Closely

Watch what you spend. It helps cut waste and saves cash. - Use Software for Reports and Graphs

Use smart tools to make clean, clear graphs and reports with less work.

Summary Table of Methods

Method | Key Use | Best For |

Direct Method | Tracks actual cash received/paid | Small businesses |

Indirect Method | Adjusts net income to cash flow | Medium to large firms |

Free Cash Flow | Shows extra cash after expenses | Investors, owners |

Levered/Unlevered Cash | Shows cash before/after debts | Business comparison |

Ratio Analysis | Measures financial health | Financial analysts |

Rolling Forecast | Predicts future cash flow | All businesses |

Break-even Analysis | Finds when cash inflows = outflows | Startups, seasonal |

Scenario Analysis | Plans for risks and uncertainty | Strategic planning |

Cash flow is the heart of your business. Without proper cash flow analysis, you may miss risks

or chances to grow. Knowing what is cash flow analysis and using the right method helps you stay in control. From forecasting to ratio analysis, each method has its place. Choose what suits

your needs, and keep your business financially healthy.

FAQs

- What is the purpose of cash flow analysis?

It helps track how money enters and leaves a business across activities like sales, expenses, loans, and asset purchases. - How does direct cash flow analysis work?

It lists all actual cash receipts and payments from income, sales, rent, salaries, and other cash-based items. - Why do businesses use indirect cash flow analysis?

It adjusts net income by including non-cash items like depreciation and changes in working capital to show the real cash impact. - What is included in cash flow ratios?

They compare cash from operations with debts or expenses to show how stable and liquid a business is. - How does working capital change affect cash flow?

A change in receivables or payables affects how much usable cash a company has during a period. - What does a cash flow statement show?

It breaks down cash activities into operations, investing, and financing to reveal where money comes from and where it goes. - Why is a positive net cash flow important?

It means the business creates more cash than it spends, showing healthy performance over that time. - What is the use of the operating cash flow ratio?

It shows if a company can pay its short-term debts using only the cash made from regular operations.