Need Professional Bookkeepers? Partner with Experts Who Keep Your Finances Accurate and Organized

Running a business is hard work as you have to sell your product, talk to your customers, and take care of many small tasks. But one job that many people forget is keeping track of money is called bookkeeping. If your books are not right, you may lose money or get in trouble with taxes. That is why many smart business owners hire Professional Bookkeepers.

Professional Bookkeepers can help you stay calm and focused on growing your business. They make sure your bills are paid on time, your taxes are filed correctly, and your reports are clean and clear. Whether you run a small store, a growing shop, or work from home, hiring Professional Bookkeepers can help a lot.

If you want to save time, stay stress-free, and do things the right way. Let’s learn more about what Professional Bookkeepers do and how they can help.

What Are Professional Bookkeepers?

A Professional Bookkeeper is someone trained to keep track of all the money that comes in and goes out of a business. They use tools and skills to write down sales, costs, and bills in an organized way. They make sure that nothing is missed.

These bookkeepers often use special software to do their work. They check your numbers, update your records, and help you make good choices with your money. The best part is, they do this every day, so they are fast and know what to look for.

Professional Bookkeepers can do many tasks:

- Write down sales and money earned

- Track bills and payments

- Watch over bank accounts

- Prepare tax files

- Send out invoices and help collect money

- Make financial reports

Some business owners try to do all this alone. But it can take a lot of time, and if you make a mistake, it can cost you money. That’s why hiring someone who knows how to do it well is a smart idea.

Why Hire Professional Bookkeepers?

A bookkeeper is someone who helps keep track of your money, what comes in, what goes out, and what’s left. Many business owners hire bookkeepers because it makes their work easier and safer. Here’s how:

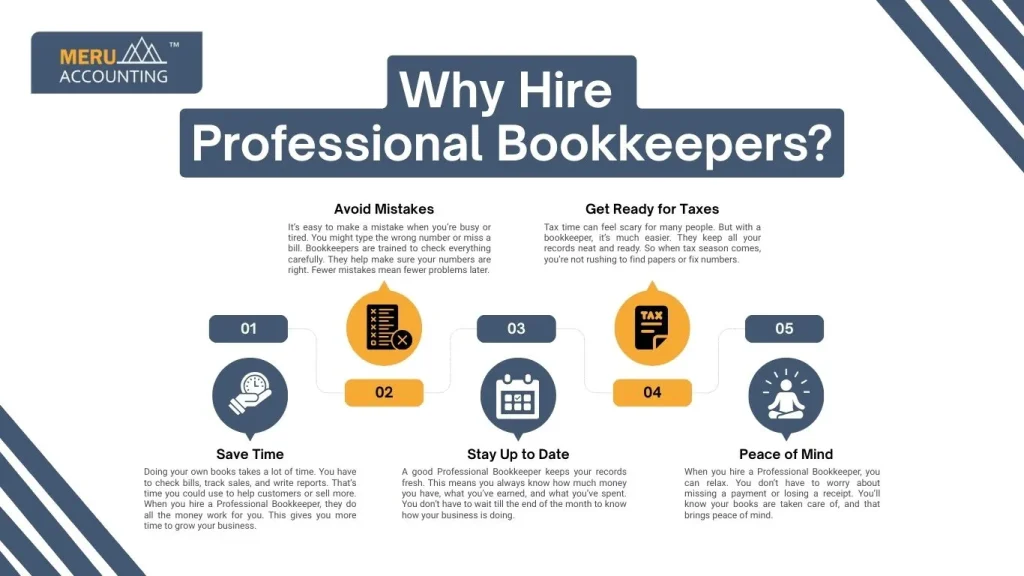

1. Save Time

Doing your own books takes a lot of time. You have to check bills, track sales, and write reports. That’s time you could use to help customers or sell more. When you hire a Professional Bookkeeper, they do all the money work for you. This gives you more time to grow your business.

2. Avoid Mistakes

It’s easy to make a mistake when you’re busy or tired. You might type the wrong number or miss a bill. Bookkeepers are trained to check everything carefully. They help make sure your numbers are right. Fewer mistakes mean fewer problems later.

3. Stay Up to Date

A good Professional Bookkeeper keeps your records fresh. This means you always know how much money you have, what you’ve earned, and what you’ve spent. You don’t have to wait till the end of the month to know how your business is doing.

4. Get Ready for Taxes

Tax time can feel scary for many people. But with a bookkeeper, it’s much easier. They keep all your records neat and ready. So when tax season comes, you’re not rushing to find papers or fix numbers.

5. Peace of Mind

When you hire a Professional Bookkeeper, you can relax. You don’t have to worry about missing a payment or losing a receipt. You’ll know your books are taken care of, and that brings peace of mind.

What Makes a Bookkeeper Professional?

A Professional Bookkeeper has the skills and training to do the job the right way. Here’s what makes them stand out:

1. They Have Experience

A Professional Bookkeeper has worked with other businesses before. They know what to do and how to handle different money tasks.

2. They Use Tools and Software

They don’t just use paper. They use special bookkeeping tools and software to track your money. This makes their work fast and more accurate.

3. They Know Tax Rules

A good bookkeeper understands tax laws. They know what you can write off and how to get ready for tax time.

4. They Work Fast and Carefully

Professional Bookkeepers do their work quickly, but they still check everything. They make fewer mistakes and save you time.

5. They Keep Your Info Private

Your money info is safe with them. A Professional Bookkeeper will not share your details with anyone else.

6. They Are Often Certified

Some bookkeepers go to school or take classes. They may pass tests to show they are trained. This makes them more trusted.

7. They Give Helpful Advice

If you are spending too much or missing chances to save, a Professional Bookkeeper can help. They give advice to make your business stronger.

They may also be certified by a group or school, which means they took classes and passed tests. This shows they are good at what they do. Good bookkeepers also give you advice. If you’re spending too much or missing out on savings, they may help you fix it.

Factors to Consider When Choosing a Bookkeeping Outsourcing Company

Outsourcing bookkeeping can save time and money. But you must choose the right company.

Expertise and Experience

The company should know bookkeeping well. They must handle accounts, payroll, and invoices correctly.

Fit for Your Business

They should understand your business needs. Tasks must match your workflow.

Use of Technology

The firm should work with modern accounting software. This makes work faster and easier.

Data Safety

Your financial data must be secure. The company should protect it from theft or misuse.

Quick Turnaround

Work should finish on time. Fast reporting helps you make smart decisions.

Trustworthiness

They should be accurate and reliable. You must be able to depend on them.

Cost-Effectiveness

Outsourcing should save money compared to hiring staff. Choose a firm with fair pricing.

Can Small Businesses Use Professional Bookkeepers?

And many small businesses really should. Even if your business is tiny or run from home, a bookkeeper can make a big difference. Here’s how:

1. Small Business Owners Are Busy

When you run a small business, you do many jobs. You take care of customers, make products, answer calls, and more. A bookkeeper can help by doing the money part, so you don’t have to worry about it.

2. No Time for Numbers

Money works takes time and care. You have to check bills, count payments, and track what you spend. If you don’t have time for that, a bookkeeper can help keep things in order.

3. They Help with All Kinds of Small Jobs

Bookkeepers don’t just help big shops. They also help people who walk dogs, sell crafts, clean homes, or mow lawns. If you get paid for work, a bookkeeper can help you track that money.

4. You Can Focus on Your Work

Bookkeepers let you focus on what you’re best at. Instead of spending hours looking at bills or taxes, you can do your real work, like baking, building, or selling, while they handle the money.

5. Even Home Businesses Can Use Help

Many people work from home. They sell clothes online, make soaps, or fix bikes. Even small, home-based work needs clear records. A bookkeeper helps keep everything neat and ready for tax time.

Professional Bookkeepers are not just for big companies. They are for anyone who wants to keep track of money, stay safe from tax problems, and grow a strong business. They help save time, avoid mistakes, and make better choices.

With a good bookkeeper, you get peace of mind. And with Meru Accounting, you get great service at a fair price. If you need Professional Bookkeepers, you’ve come to the right place. When you work with Meru Accounting, you don’t just get someone to add numbers; you get a partner who helps you stay strong and smart with money.

FAQs

1. How much does a Professional Bookkeeper cost?

The cost can change depending on how much work you need. Some bookkeepers charge by the hour. Others have a monthly fee. Meru Accounting offers fair and clear prices for all kinds of businesses.

2. Do I need a full-time bookkeeper?

No. Many small businesses hire part-time or online bookkeepers. You don’t need to hire someone full-time.

3. What is the difference between a bookkeeper and an accountant?

Bookkeepers track money daily, like sales, costs, and bills. Accountants look at the big picture and help with taxes and long-term money plans.

4. Can a bookkeeper help with taxes?

Yes! Many bookkeepers help you get your records ready for tax time. Some also work with accountants to file your taxes.

5. How do I know if my bookkeeper is doing a good job?

You should get clear reports each month. Your money should match your bank account. You should feel stress-free. If you ever feel unsure, ask questions. A good bookkeeper like the ones at Meru Accounting, will always be happy to help.