Home » Is NetSuite a good accounting software?

Is NetSuite Accounting Software a Reliable Choice for Managing Your Business Finances?

Managing your business money needs the right tools. NetSuite accounting software is one of the top picks for owners who want to track income, spend, and cash flow in a smart way. The tool helps cut errors, saves time, and gives clear data in real time. It works for both small and large firms, with plans that can grow as your needs grow. With cloud use, you can check your books from any place at any time. Many firms use NetSuite to plan budgets, pay bills, and see profits with ease. Let us explore why it may be the right pick for your business.

What Is NetSuite Accounting Software?

NetSuite accounting software is a cloud-based tool that helps you handle money tasks in one place. It covers areas like billing, reports, budgets, and taxes. Built by Oracle, this software is trusted by many around the world.

Easy to Use for All Sizes

NetSuite fits both small and large companies. It allows you to scale smoothly without switching platforms. You can add users, tools, and features as your business grows without slowing down your process.

Cloud-Based Means Easy Access

NetSuite stores all your accounting data in the cloud. This means you can log in and work from anywhere. It gives flexibility to business owners and teams working from multiple locations.

Main Features of NetSuite That Help You Manage Business Finances

Using NetSuite accounting software gives you helpful tools to simplify your work. Below are some key ones:

Real-Time Dashboard

You get a live dashboard that displays current financial data. It tracks income, expenses, and KPIs. This real-time view helps you make smart choices without waiting for reports.

Strong Financial Reports

NetSuite lets you build reports with ease. You can customize views for profit, cost, or revenue trends. These reports help in business planning and financial forecasting.

Built-In Compliance Tools

NetSuite helps meet tax and audit rules. You can set up rules based on your region. It reduces the risk of errors and penalties during audits or tax filing.

Automated Bookkeeping

You can save time by automating tasks like data entry, billing, and payments. This feature lowers the risk of manual errors and saves your staff hours of work.

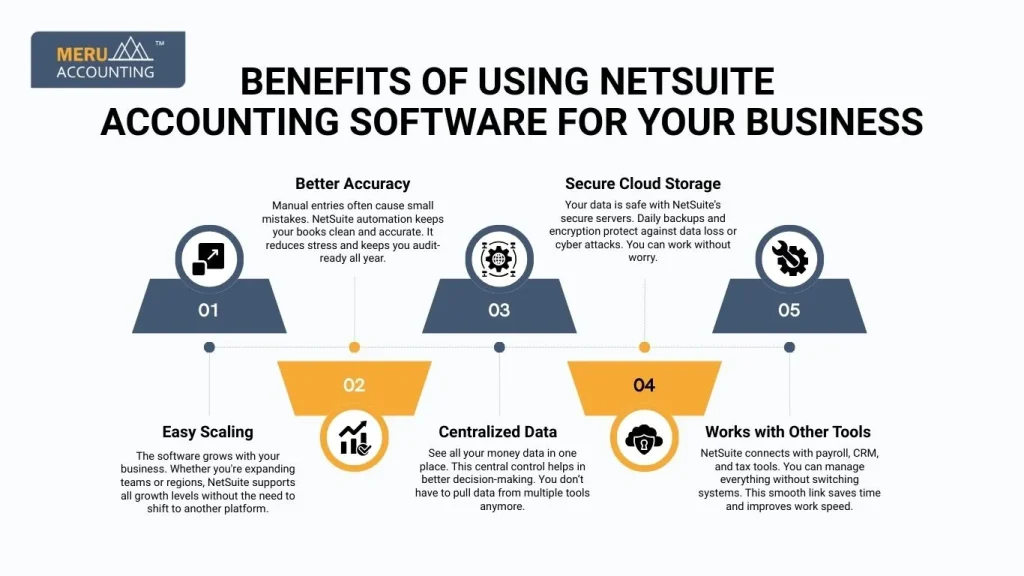

Benefits of Using NetSuite Accounting Software for Your Business

Choosing NetSuite accounting software offers several benefits. It saves time, reduces costs, and boosts efficiency. Here’s what you gain:

Easy Scaling

The software grows with your business. Whether you’re expanding teams or regions, NetSuite supports all growth levels without the need to shift to another platform.

Better Accuracy

Manual entries often cause small mistakes. NetSuite automation keeps your books clean and accurate. It reduces stress and keeps you audit-ready all year.

Centralized Data

See all your money data in one place. This central control helps in better decision-making. You don’t have to pull data from multiple tools anymore.

Secure Cloud Storage

Your data is safe with NetSuite’s secure servers. Daily backups and encryption protect against data loss or cyber attacks. You can work without worry.

Works with Other Tools

NetSuite connects with payroll, CRM, and tax tools. You can manage everything without switching systems. This smooth link saves time and improves work speed.

How NetSuite Bookkeeping Improves Financial Accuracy

Clean books matter to any firm. NetSuite bookkeeping helps you track every dollar without errors.

Real-Time Updates

Each entry posts right away. You always see the latest figures. The system updates all records instantly as transactions occur. This real-time access helps keep your data current and avoids delays in financial decisions.

Auto Checks and Alerts

It shows alerts when things don’t match. You can fix them fast. The system flags any mismatch or skipped entry. You can catch problems early, fix them fast, and avoid confusion during tax season or audits.

Linked Bank Accounts

You can link your banks using NetSuite bookkeeping services. This way, your cash flow is tracked in real-time, giving you a clear financial picture. With live bank feeds, transactions sync daily. It gives a full view of your cash inflow and outflow, helping you manage money better.

Smart Entries

Recurring bills post on their own. This lowers the risk of missing or wrong entries.

You can automate rent, utilities, or loan payments. This reduces errors and keeps your ledgers up to date without needing constant manual work.

Common Challenges Faced While Using NetSuite

Even the best tools have challenges. Here are some common issues when using NetSuite bookkeeping services.

High Setup Cost

NetSuite has a higher start-up cost than some small business tools. This investment often pays off over time, but it may be a barrier at the start.

Learning Curve

It takes time to learn the software. Some training may be needed. New users may find it hard to explore all the features. Proper training and onboarding support make a big difference in success.

Over-Feature Load

Some users feel it has too many tools. Not all may be useful to small teams. While packed with features, some firms may only use a portion of them. Tailoring the dashboard can make use easier and more focused.

Internet Needed

Without internet access, you may not be able to log in or make updates. Plan for backup access during outages to stay on track.

NetSuite Bookkeeping Services: When and Why to Outsource

Letting experts handle your books can save time and stress. In many cases, NetSuite bookkeeping services are the ideal choice.

When You Lack Time

Owners often spend too much time on accounts. Outsourcing saves hours and lets you focus on strategy and growth, not daily bookkeeping chores.

When Errors Keep Happening

Frequent errors can harm your business. Services give you clean, error-free books. Expert services use detailed checks to catch issues. You gain more trust in your reports and feel ready for audits anytime.

When You Need Expert Help

Pros know the full use of NetSuite. These experts understand system tools better than in-house teams. They can offer new ideas for better tracking and smoother work.

When You Grow Fast

Fast growth needs better tracking. Services help keep your numbers in line. With more clients and income, you need clear reports. Outsourced teams scale fast with you, ensuring books stay current.

By using NetSuite bookkeeping services, you gain more trust in your reports and stay ready for audits at any time.

NetSuite vs Other Accounting Software: A Quick Comparison

Let’s see how NetSuite software compares with other tools like Xero or QuickBooks.

Feature Set

NetSuite has more built-in tools than many competitors. Inventory reports give a full view of the business. Others often need add-ons.

For Large Firms

NetSuite is better for growing or large companies. Xero suits small firms. Large firms love the ability to manage global finance, multiple entities, and compliance with ease in NetSuite.

Custom Reports

NetSuite allows in-depth, tailored reports. This helps owners view data that truly matters. Most others have fixed or basic formats.

Price Range

NetSuite costs more but gives more value in return.

It’s not for the smallest budgets but pays off with time saved, errors avoided, and reports that support real growth.

Integration

It links with more tools than many others. You get a full system.

From CRM to payroll to tax apps, NetSuite plays well with others. That makes for smoother, faster processes.

Who Should Use NetSuite? Best Fit for Industries and Business Sizes

Not every firm may need NetSuite, but it fits well with many types.

Growing Startups

If your firm is scaling fast, NetSuite can match your growth. Startups that plan to scale across regions or teams find great value in NetSuite’s built-in global and multi-user tools.

Retail and E-commerce

It tracks stock, orders, and sales in one place.NetSuite links inventory, POS systems, and sales orders. This gives retail teams a full picture of what’s in stock and what’s selling fast.

Service-Based Firms

Handle client billing and time sheets with ease. From time tracking to project-based billing, service teams can invoice clients and track progress inside one tool.

Global Firms

Multi-currency and global tax rules are part of NetSuite. Firms that operate across countries use NetSuite for its strong multi-region, tax, and currency features.

Real-World Use Cases: Success Stories Using NetSuite Accounting Software

Let’s look at firms that got good results using NetSuite software.

A Retail Chain

A chain store used NetSuite to track sales and stock across all shops. It saw 30% fewer errors in billing and 25% faster closing of monthly books.

A Digital Agency

A marketing agency used NetSuite for client billing. It saved 15 hours each week. They now get payments faster and track time spent on each project.

A Tech Startup

This fast-growing team used NetSuite to scale with ease. No need to switch tools every year. Their global team now works with the same data in real time.

How to Get Started with NetSuite for Your Business

Want to use NetSuite? Follow these steps for a smooth start:

Step 1: Plan Your Needs

Know what tasks you want NetSuite to do. Set goals. Look at your current process and list gaps. Define your top priorities so you get a setup that works for your firm.

Step 2: Choose a Partner

Pick a firm to help you set up NetSuite. This saves time. An expert partner helps with setup, data move, and team training. This cuts stress and speeds up your go-live date.

Step 3: Train Your Team

Train key users on how to use the tools. Training helps avoid errors and boosts early success. Make sure your finance team knows how to use key tools and reports.

Step 4: Migrate Data

Move your old books to NetSuite with care. Check the data before and after the move. Make sure numbers match so that you start your new system on a solid base.

Step 5: Go Live

Start using the software with full tracking and support. Have help ready for the first few weeks. Track progress, fix issues fast, and check that your goals are met.

At Meru Accounting, we know how to use NetSuite in the best way. You get clean, fast, and full reports. Our team knows every detail of NetSuite, from setup to custom reports. We use our skills to give you the best service. Our team handles your books. You stay free to grow your business. You can focus on deals, leads, and plans. We take care of the rest and send reports that are clear and on time.

FAQs

1. What is NetSuite accounting software used for?

It helps you track income, handle expenses, manage budgets, and generate reports. It is a full solution for business finance tasks in one cloud-based system.

2. Is NetSuite good for small businesses?

Yes, NetSuite works for small and growing businesses. It lets you scale with ease, manage tasks better, and avoid changing systems as your firm grows.

3. How does NetSuite improve bookkeeping accuracy?

NetSuite bookkeeping tools post entries in real time, auto-check for errors, and link bank feeds. These features cut mistakes and improve record-keeping.

4. Can I use NetSuite with my existing software?

Yes. NetSuite connects well with CRM, payroll, and tax apps. These links help you manage all business tasks without switching between many tools.

5. What are the costs of NetSuite bookkeeping services?

The cost varies based on your business size, features needed, and level of service. Outsourcing with Meru Accounting offers expert help at a fraction of in-house cost.