Benefits of Using Online Bookkeeping Services

Effective management of business accounts is crucial to achieving long-term success. With the rise of digital tools, many companies now prefer online bookkeeping services over traditional methods. This modern way makes tracking money simpler and faster. It also helps business owners focus more on growth rather than paperwork. In this guide, we will review how an Online Bookkeeping Service works and explore the key Benefits of Bookkeeping Services for small and medium firms.

Introduction to Online Bookkeeping Services

Online bookkeeping services are web-based solutions that help track and manage money matters. These services replace the need for manual books and local software. Businesses can log in from anywhere to view records, update data, or share files with accountants. This makes it easier to keep accounts up to date without stress.

What is a Virtual Bookkeeping Service?

A virtual bookkeeping service is a digital tool that keeps all your money records in one secure place. It tracks cash flow, expenses, income, and tax data with ease. Unlike manual methods, it works faster, saves time, and suits both small and large firms.

Key tasks include:

- Recording income and costs

- Managing bills and payments

- Matching bank statements

- Preparing clear reports

- Helping with tax rules and filing

Unlike old bookkeeping, where files sit on paper or local drives, online tools keep data in the cloud. This means you can log in and see your records anytime, from anywhere.

Why Businesses are Moving to Digital Bookkeeping

Firms switch to online bookkeeping because it saves time, space, and effort. It offers quick access to data, fewer errors, and fast reports for smarter decisions.

1. More Time Saved

Digital tools cut manual work and repeat data entry, giving staff more hours to focus on growth.

2. Live Financial Updates

Every transaction is recorded on the spot, so reports and balances stay current at all times.

3. Lower Costs

Online systems reduce the need for in-house bookkeepers and remove paper and storage costs.

4. Smarter Choices

With precise, up-to-date data, owners can act fast, plan well, and grow with confidence.

How Online Bookkeeping Services Work

Online bookkeeping services run on cloud systems. It is fast, safe, and simple. Here’s how it works:

1. Data Upload

You send your bills, receipts, and bank slips to the tool. This keeps all files in one spot, and you can reach them anytime.

2. Auto Sorting

The tool reads your deals and puts them in the right lists. This saves time and cuts errors.

3. Expert Check

A bookkeeper checks the data to make sure it is right and meets all rules.

4. Report Making

You get clear reports on cash flow, profit, and costs. This helps you plan better and make good calls.

5. Ongoing Help

Experts help fix issues, prep tax files, and give tips, making your books clean and up to date.

Key Features of Online Bookkeeping

Cloud Access

Check your books on any device. No need for paper or office files.

Bank Link

Your bank data syncs with the tool, saving time on manual entry.

Live Expense Check

Your spend is logged in real time. This helps you track costs with ease.

Digital Invoices

Send and track bills online. Get paid on time with auto alerts.

Custom Reports

View profit, loss, and cash flow in one click. Use this data to guide your next steps.

Strong Security

Top-level locks and safe servers guard your info at all times.

Cloud vs. Traditional Bookkeeping

Aspect | Traditional Bookkeeping | Cloud-Based Bookkeeping |

Access |

|

|

Security |

|

|

Updates | Data is entered by hand and is often late. Reports are slow to prepare, and you may rely on old numbers that do not show your current business state. |

|

Costs |

|

|

Integration |

|

|

Ping for its flexibility, speed, and reduced chances of errors compared to manual methods.

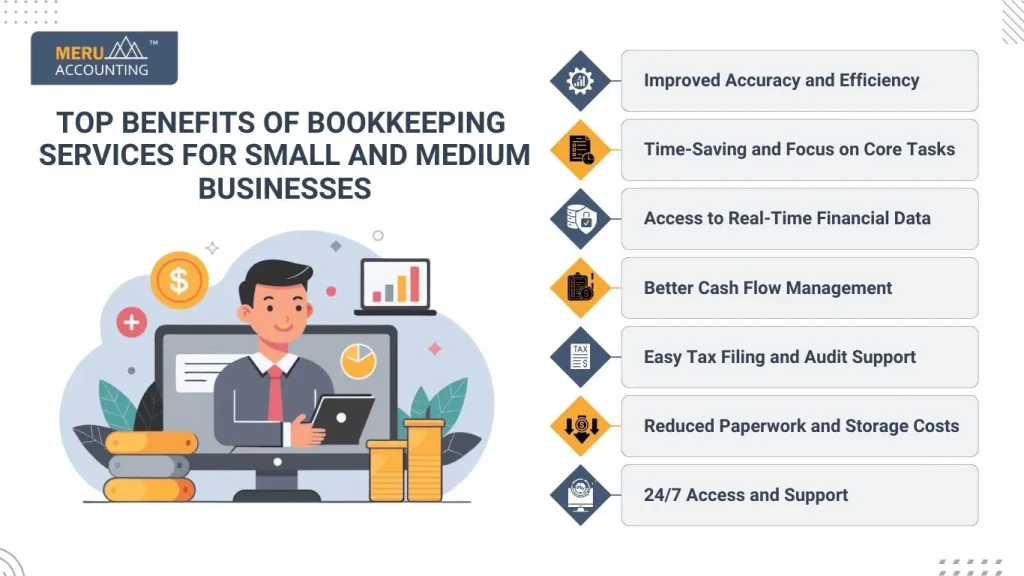

Top Benefits of Bookkeeping Services for Small and Medium Businesses

Running a small or medium-sized business needs clear records and smart money control. The benefits of bookkeeping services go beyond simple data entry. These services help track cash, cut errors, and give quick reports that guide better choices.

Improved Accuracy and Efficiency

Mistakes are common with manual books. A virtual bookkeeping service avoids errors as most tasks are auto-checked and calculated.

Time-Saving and Focus on Core Tasks

Business owners can spend more time on sales and growth while the service manages records. This saves hours every week.

Access to Real-Time Financial Data

Data is updated live, allowing quick insights. This helps in making better decisions without waiting for reports.

Better Cash Flow Management

Online tools give instant data on cash inflow and outflow. This makes it easy to plan spending and avoid shortages.

Easy Tax Filing and Audit Support

Digital records make tax filing smooth and audits stress-free. Reports can be generated quickly when needed.

Reduced Paperwork and Storage Costs

Online systems remove the need for physical files. This cuts office space use and saves on storage expenses.

24/7 Access and Support

Unlike traditional methods, online bookkeeping offers round-the-clock access and help whenever you need it.

Cost-Effectiveness of Using Online Bookkeeping Services

Many businesses choose online bookkeeping services for their cost-saving benefits. These services are generally cheaper than hiring a full-time bookkeeper or accountant.

How Online Solutions Reduce Operational Costs

- No Hiring Costs: Online bookkeeping is cheaper than keeping a full team in-house. You save on pay, training, and hiring fees.

- Faster, Automated Tasks: Auto tools handle data entry, reports, and bank match-ups. This cuts time spent on slow, manual work.

- No Paper Storage: Cloud tools keep all records safe online. You save space and skip the cost of files, cabinets, and storage.

- Plans That Grow With You: Pick a plan that fits your needs. Upgrade only when your business grows, so you don’t spend on extras you don’t use.

Avoiding Errors and Penalties with Accurate Bookkeeping

Errors in bookkeeping can lead to costly penalties and missed tax deductions. Online services minimize errors through:

- Automated transaction matching

- Real-time error detection

- Professional reviews of accounts

- Proper tax categorization

Enhanced Data Security and Compliance

Data breaches and lost records are common risks in traditional bookkeeping. Virtual bookkeeping services provide:

- Encrypted data storage

- Secure login access

- Regular backups

- Compliance with tax and legal requirements

These features protect businesses from financial fraud and legal issues.

At Meru Accounting, we offer top-quality online bookkeeping services for businesses of all sizes. Our team ensures accurate records, secure data, and real-time reports. We deliver all the benefits of bookkeeping services while keeping costs low

FAQ

- Is online bookkeeping safe for my business?

Yes. Most tools use strong locks, safe servers, and backups to keep your money and data safe from leaks and hacks. - Can I check my online bookkeeping records anytime?

Yes. Cloud tools let you sign in from any phone, tablet, or PC with web access. You get 24/7 access to your records. - How much do online bookkeeping services cost?

Costs change based on your needs and firm size. Still, they are often cheaper than hiring a full-time bookkeeper. - Do I still need an accountant if I use online bookkeeping?

Yes. Bookkeeping logs daily deals, while an accountant gives tax tips and big-picture money advice. - What are the main benefits of bookkeeping services for small and medium businesses?

The benefits of bookkeeping services include clear record-keeping, fewer errors, quick tax prep, and real-time cash flow checks. These services save time, cut costs, and help owners make smart money moves. - How do online bookkeeping tools cut errors and fees?

Auto data sync, live updates, and expert checks help stop mistakes and keep you tax-ready at all times. - Can online bookkeeping grow with my business?

Yes. You can start small and scale your plan as your deals and tasks grow, without big added costs.