Home » When should you outsource your accounting?

When should you outsource your accounting?

A business would have experts in the respective products or services they offer. However, they may not have expertise in other essential non-core activities.

Accounting is one such non-core activity that is done in the background and is important for any business.

Many small and medium-sized businesses in the USA struggle to get experts in accounting. They have to bear the heavy cost to hire expert accountants. So, if you outsource your accounting it can be very beneficial.

You get an expert level of services needed for accounting. You can also improve your accounts receivables when you outsource invoicing which can improve the finances of your business. There are many reasons where accounting outsourcing can be beneficial for your business.

Why outsource your accounting?

If you are a US-based business then accounting outsourcing can be beneficial.

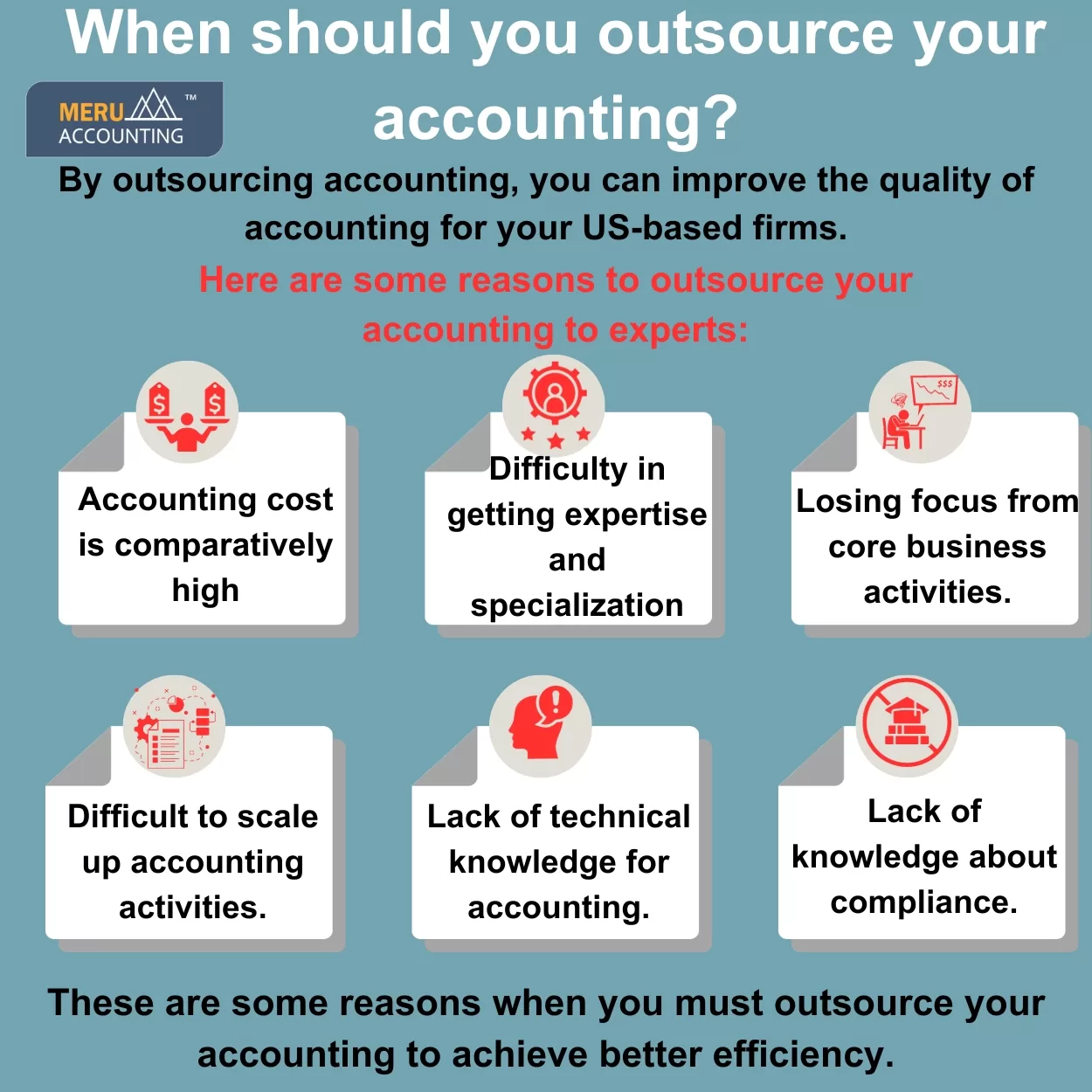

Here are few reasons to outsource your accounting:

1. Accounting cost is high

One of the primary reasons businesses choose to outsource accounting is to reduce costs. Outsourcing eliminates the need to hire and train in-house accounting staff, which can be expensive.

Additionally, outsourcing allows businesses to pay only for the services they need, without incurring overhead costs associated with maintaining an in-house accounting department.

2. Difficult to find expertise and specialization

Accounting outsourcing firms specialize in providing accounting services, which means they have highly skilled professionals with expertise in various accounting areas.

By outsourcing, businesses can tap into this specialized knowledge and benefit from the experience and expertise of professionals who stay updated with the latest industry practices and regulations.

3. Business owners and management losing focus

When you outsource bookkeeping to an expert agency, business owners and managers can focus more on core business activities.

Accounting tasks can be time-consuming and divert attention from key business activities. Outsourcing allows business owners and managers to focus on growing their businesses, improving products or services, and enhancing customer satisfaction.

4. Difficult to scaleup accounting

Outsourcing accounting services provide businesses with the flexibility to scale up or down as needed. During periods of growth or increased workload, outsourcing can accommodate the increased demand without the need to hire additional staff.

Outsourced invoicing can improve the receivables of the business. Similarly, during slower periods, businesses can reduce the outsourced services to match their requirements, avoiding unnecessary costs.

5. Lack technological knowledge in accounting

Accounting outsourcing firms often have access to advanced accounting software and tools that may be costly for individual businesses to acquire and maintain.

By outsourcing, businesses can leverage the latest technology without the need for significant upfront investments. This can lead to improved efficiency, accuracy, and timeliness in financial reporting and analysis.

6. Difficulty in managing compliance

Accounting outsourcing firms are well-versed in accounting regulations, tax laws, and compliance requirements for US-based firms.

They can help ensure that businesses stay compliant with all applicable financial regulations and reporting standards.

By outsourcing, businesses can mitigate the risk of errors, penalties, and non-compliance, as the responsibility for accurate financial reporting lies with the outsourced provider.

These are some reasons that you must outsource your accounting tasks. It can improve your accounting efficiency.

If you are looking to outsource your accounting to experts then Meru Accounting is a better choice. Meru Accounting has experience working with different USA firms.

They have deep knowledge regarding the regulations necessary for accounting for US-based firms. Meru Accounting is a well-known accounting services providing agency across the globe.