Why Accounting Firms Outsourcing Is a Growth Engine for Success

Running an accounting firm isn’t just about numbers. To grow, you need to save time, cut costs, and take on more work. With accounting firms outsourcing, you can handle more work without raising costs. Outsourcing tasks like bookkeeping or payroll gives you more time to focus on your clients and grow your firm. It’s not just a popular idea, but it’s a smart way to grow without extra stress.

Why Growth Matters for Accounting Firms

Growth means more than just making money. It’s about getting new clients, offering better service, and keeping your team happy. Every firm wants to do more without losing control of quality or spending too much.

But when firms grow, the work also grows. Teams work longer hours and feel more stress. To handle this, many CPA firms use outsourcing. They give routine tasks to skilled teams outside. This saves money, lowers stress, and gives space to grow.

What Is Accounting Firms Outsourcing?

Accounting firms outsourcing means hiring outside experts to handle regular or specialized tasks. These teams handle tasks like bookkeeping, payroll, tax filing, and financial reports. They work as an extension of your firm.

Not Just Cost Cutting

Outsourcing helps firms spend less and do more. But it’s more than that. It helps firms grow without adding fixed costs or overhead. You get the work done, but with fewer risks.

Flexible Support

Firms can scale up or down based on workload. During tax season, you can ramp up. When work slows, you can cut back. This keeps your firm lean and ready for growth.

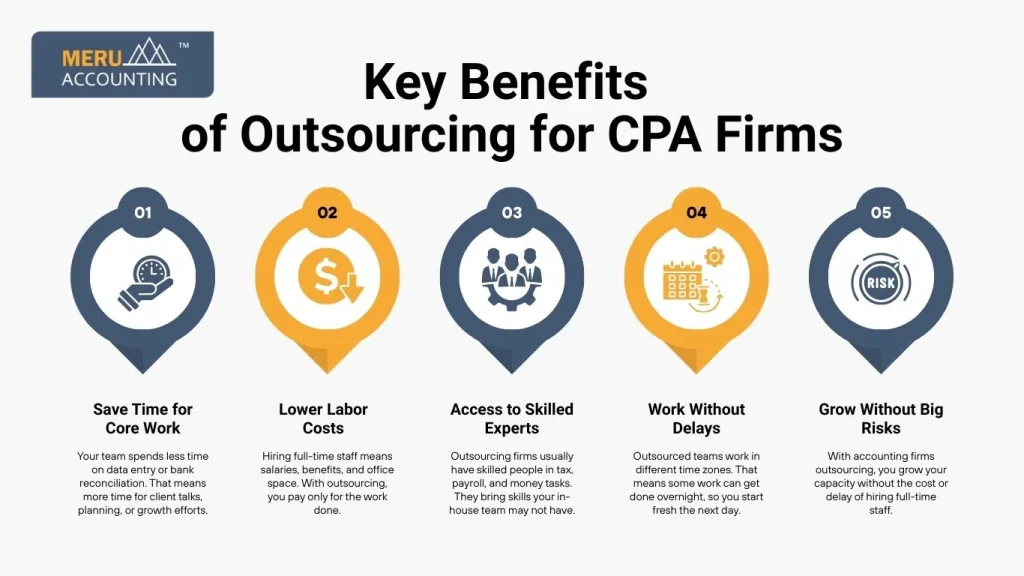

Key Benefits of Outsourcing for CPA Firms

The gains of outsourcing for CPA firms go beyond savings. Let’s look at how it helps in day-to-day work and long-term success.

1. Save Time for Core Work

Your team spends less time on data entry or bank reconciliation. That means more time for client talks, planning, or growth efforts.

2. Lower Labor Costs

Hiring full-time staff means salaries, benefits, and office space. With outsourcing, you pay only for the work done.

3. Access to Skilled Experts

Outsourcing firms usually have skilled people in tax, payroll, and money tasks. They bring skills your in-house team may not have.

4. Work Without Delays

Outsourced teams work in different time zones. That means some work can get done overnight, so you start fresh the next day.

5. Grow Without Big Risks

With accounting firms outsourcing, you grow your capacity without the cost or delay of hiring full-time staff.

Top Tasks Best Suited for Accounting Outsourcing

Not all tasks need to be handled in-house. Some are better done by a trained external team. Here are the top jobs often sent out.

1. Bookkeeping and Data Entry

Daily tasks like bank feeds, invoice entry, and reconciliations are ideal for outsourcing. These take time but not high-level thinking.

2. Tax Return Preparation

The busy season gets hectic. Extra help with return prep lets you meet deadlines without overworking your core team.

3. Payroll Management

Outsourcing payroll avoids errors and delays. It ensures tax filings are done right and on time.

4. Financial Reporting

Reports like profit and loss, balance sheets, and cash flow statements need focus. Let outsourced experts handle it with care.

5. Audit Support Work

Collecting and organizing data for audits is time-consuming. Let your outsourcing team prep the files while your main team handles the client.

How Outsourcing Enhances Efficiency and Reduces Cost

Efficiency and cost control are key to staying strong. Let’s break down how accounting firms’ outsourcing supports both.

1. Cut Overhead Costs

You don’t need more space, tools, or HR when you outsource. That’s instant savings.

2. Avoid Hiring Delays

Finding the right hire can take months. Outsourced teams are ready to start now, saving time and helping with deadlines.

3. Speed Up Workflows

With less work on their team’s desk, they finish tasks quickly. You meet client needs without stress.

4. Reduce Errors

Skilled outsourcing teams follow strict quality checks. That means fewer mistakes, which saves time and rework.

5. Use Time Zones Wisely

Outsourced teams can work when your office is closed. This gives you more output in less time.

Outsourcing vs In-House Teams: What Works Best?

You may wonder if it’s better to hire more staff or outsource. Here’s a quick look at both to help you choose.

Factor | In-House Teams | Outsourced Teams |

Cost | High (salaries, benefits, overhead) | Lower (pay only for tasks done) |

Speed to Hire | Slow (ads, interviews, training) | Fast (ready-to-go team) |

Skill Level | Fixed skill set | Access to a wide range of experts |

Flexibility | Hard to scale up/down | Easy to scale based on demand |

Time Zones | Same zone, limited hours | Global teams can work around the clock |

Focus | More internal work, less client-facing time | Frees team to focus on clients and strategy |

How might CPA Outsourcing propel your company forward?

When it comes to outsourcing, the technology sector is a crucial factor:

Firms with fewer than ten employees may find it challenging to get the capital they need to invest significantly in advanced technology. Maintaining an ever-current set of software tools may indeed become pricey over time.

As a result, it may seem like a burden for CPA firms to constantly modernize their infrastructure. On the other hand, CPA bookkeeping outsourcing companies provide convenient access to top-tier software systems that ensure reliability and consistency.

CPA outsourcing services provider for more efficient use of personnel:

CPA outsourcing services free the in-house staff to focus on client relationships and company growth. You may use it as a tool to attract new customers and reinforce your commitment to retaining existing ones.

When you use a bookkeeping outsourcing firm in your accounting, you join forces with other companies to form a multi-firm network with several potential advantages.

Using the service option boosts your expansion prospects:

Many companies fail to capitalize on growth prospects because they are weighed down with accounting red tape. Hiring a bookkeeping outsourcing company may help alleviate the burden accounting places on your shoulders.

Companies may grow their offerings after receiving assistance from an outsourcing partner that provides them with skilled workers and necessary facilities.

Many customers have needs beyond essential accounting services, providing opportunities for growth in financial advising, financial planning and tax management.

CPA outsourcing might help save costs for your business:

As soon as you bring in more consumers, you may encounter problems due to a lack of infrastructure, workers, systems, Outsourced Bookkeeping Companies, and software. It may become difficult to continue paying for them.

Common Myths About Accounting Firms Outsourcing

Some firms worry about outsourcing, but many of those fears are based on myths. Let’s clear a few of them up.

1. It’s Only for Big Firms

Truth: Small and mid-size firms often gain the most. They save money and free time for key tasks.

2. Quality Drops When You Outsource

Truth: Top outsourcing firms use strong checks. With training and review, quality often improves.

3. Communication Is Hard

Truth: With tools like Zoom, Slack, and email, teams stay in sync even across time zones.

4. It’s Risky and Unsafe

Truth: Reputed outsourcing partners follow strong data rules and security steps to protect client data.

5. It Replaces Your Team

Truth: Outsourcing supports your team — it doesn’t replace them. Your staff can do more value-based work.

Choosing the Right Partner for Outsourcing for CPA Firms

Outsourcing for CPA firms only works well when you have the right partner. The team you pick should match your goals, your tools, and how you work. Here’s how to choose one that fits your firm best.

1. Check Their Focus

Do they serve accounting firms? A focused partner will understand your work better and deliver smarter results.

2. Review Their Process

Ask how they handle tasks, review work, and train their team. A good process means fewer issues later.

3. Ask About Tools Used

Do they work with your tools like QuickBooks, Xero, or Sage? This makes handoffs smooth and stress-free.

4. Look at Data Security

Make sure they use secure tech, backups, and follow privacy rules. Client data must be safe.

5. Start Small

Begin with one task. Test their speed, quality, and service. If it works well, grow the scope.

At Meru Accounting, we help CPA firms save time and grow with ease. We’ve worked with over 300 firms in the US, UK, Canada, Australia, and more. Each country has its own rules and tools, we get that. Our team works the way you do.

FAQs

- What is accounting firms’ outsourcing?

It means hiring outside experts to do tasks like bookkeeping, payroll, or tax work. Firms use this to save time, cut costs, and focus on more important client work.

- Is outsourcing only for large CPA firms?

No. Many small and mid-size firms use outsourcing. It helps them handle more work, meet deadlines, and grow without hiring extra full-time staff.

- Will I lose control over my work?

You stay in charge. The outsourcing team follows your rules and reports to you. You review the work before it goes to clients or gets filed.

- Can I use outsourcing just during busy seasons?

Yes. Many firms use help during tax time or audits. You can scale support up or down based on your needs.