Why Aren’t You Using Outsource Payroll Services Yet?

Handling payroll in-house may seem simple at first. But in reality, it often turns into a stressful and error-prone task. Many businesses face the same issues again and again. These payroll problems not only take time but also put financial and compliance risks on the company. This is why many firms now choose to use an outsourced payroll service. In this article, we will explain what an outsourced payroll service is, how it helps your business.

What is an Outsource Payroll Service?

An outsourced payroll service is when you hire a team outside your company to do payroll work. Instead of doing it yourself, you send the needed data to them.

They do things like:

- Calculate each worker’s pay

- Cut the right taxes

- Make payslips

- Send reports

- Pay taxes to the government.

These services work online or through cloud software. You can send them data using the internet.

Payroll Problems You’ve Seen Before

Handling payroll in-house may seem simple at first. But in reality, it often turns into a stressful and error-prone task. Many businesses face the same issues again and again. These payroll problems not only take time but also put financial and compliance risks on the company. This is why many firms now choose to use an outsourced payroll service.

Below are some of the most common payroll problems companies encounter:

1. Respecting Timetables

- Meeting payroll deadlines is always a big challenge.

- Tracking time-in, time-out, PTO, and benefits is tough when done manually.

- Any delay in payroll processing affects employee trust.

- Many firms now shift to all-in-one systems or outsourcing to make the process smooth.

2. In the Process of Writing Checks

- Printing and sealing checks is time-consuming.

- In-house systems need a check printer and sealer.

- Outsource payroll service providers can process many checks at once.

- They also manage reports and distribute checks across locations.

- This saves time and lets businesses focus on growth.

3. Hopelessness in Direct Deposits

- Handling direct deposits in-house can be a headache.

- Dealing with reversals or ACH file errors is complex.

- Payroll providers handle all ACH transactions.

- They also give employees online access to pay stubs anytime.

- This reduces paper use and cuts costs.

4. Keeping Up with the Rules

- Payroll laws and tax rules change often.

- In-house staff struggle to stay updated.

- An outsourced payroll service ensures experts manage compliance.

- Missing rules can lead to IRS penalties and interest charges.

- Outsourcing reduces this risk by ensuring accurate, on-time filings.

5. Payroll Insurance and Security

- Payroll is a prime target for fraud.

- Whether in-house or outsourced, security must be strong.

- Choosing a trusted payroll provider lowers risks.

- Monthly and yearly reconciliations are also a must.

- Outsourcing helps with ledger reports and exports, making fraud checks easier.

How Does an Outsourced Payroll Service Work?

Outsource payroll service means hiring a team outside your business to pay your workers. This team handles all the steps for you. Here’s how it works:

1. You Pick a Payroll Team

First, you choose a trusted team that knows how to do payroll the right way. You tell them you want help with paying your workers.

2. You Share Worker Details

Next, you send the payroll team some important details like:

- How many hours each worker worked

- How much each worker earns

- The days the worker was on leave.

- Any bonus or extra pay

This helps them know what to pay each worker.

3. They Do the Math

Now, the payroll team starts the math. They:

- Add up each worker’s total pay

- Take out tax and other charges.

- Add in any extra pay.

- Double-check to make sure all numbers are correct

4. They Pay the Workers

The payroll team sends money to each worker’s bank account.

They also give each worker a pay slip, which shows what they earned and what was taken out.

5. They Handle the Taxes

They make sure the tax money is sent to the tax office. They help your business stay safe and follow tax laws.

6. You Get Payroll Reports

You get reports that show:

- How much money was paid

- Which workers got paid

- What taxes were taken out and sent

You can keep these reports for your records.

7. They Keep Information Safe

The payroll team keeps all worker details private. No one else can see this data. It is stored safely. If you don’t understand something, the payroll team will help. They also remind you when it’s time to run payroll again.

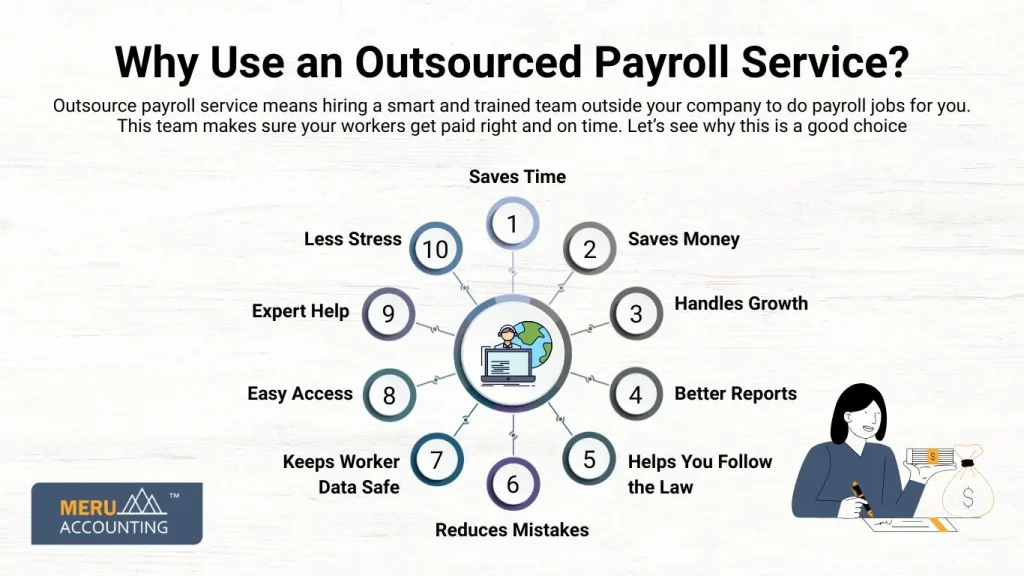

Why Use an Outsourced Payroll Service?

Outsource payroll service means hiring a smart and trained team outside your company to do payroll jobs for you. This team makes sure your workers get paid right and on time. Let’s see why this is a good choice:

1. Saves Time

Doing payroll is not quick. You have to count hours, figure out taxes, and send out pay. This can take many hours each month. A payroll service does all this for you. You get more time to focus on your shop, workers, or new ideas.

2. Saves Money

Hiring a full-time payroll person costs a lot. You might also need to buy payroll software, which can be pricey. A payroll service lets you pay a lower fee while getting expert help. It’s a smart way to keep your money safe.

3. Reduces Mistakes

Payroll mistakes can cause big problems. Your workers might get the wrong pay. You might send the wrong tax. A payroll service knows the laws and checks things twice. This helps avoid trouble and keeps your business safe.

4. Helps You Follow the Law

Tax laws can change and be hard to understand. Every place has different rules. If you break the rules, you may get a fine. A payroll team knows the rules and updates. They help you follow the law and stay out of trouble.

5. Better Reports

Good payroll services give you neat reports. These reports show:

- How much money did you pay

- What taxes were sent

- What each worker earned

These are useful when you plan your money or do taxes at the end of the year.

6. Handles Growth

As your team grows, payroll gets more tricky. You have to keep track of more hours, more taxes, and more records. A payroll service grows with you. They can handle 5 workers or 50 with no problem.

7. Keeps Worker Data Safe

Worker pay and tax info are private. You must keep them safe. Payroll teams use strong tools like locked files and secure apps to protect your data. This keeps your team’s info safe from bad use.

8. Easy Access

You can log in from your phone or computer anytime to check your payroll. You can find past pay slips, tax forms, or reports in one place. This makes life easier and saves you from searching through papers.

9. Expert Help

You don’t have to be a payroll expert. These teams already know everything. They train to stay updated. You get great help without needing to hire a full-time expert in your office.

10. Less Stress

When you use a payroll service, you don’t have to worry about pay dates or tax filing. They do it all for you. You feel calm because you know things are done right and on time.

When Should You Outsource Payroll Services?

Here are some times when using a payroll service is a smart choice:

1. You Have More Than a Few Workers

If your team is growing, it gets hard to pay each one on time. A payroll team can handle many workers at once and not miss a thing.

2. You Don’t Know Payroll Laws

There are rules for taxes, work hours, and pay. If you don’t know them, it’s easy to make a mistake. Payroll experts know all the rules and help you follow them.

3. You Want to Save Time

Counting pay, sending taxes, and making slips takes time. Letting a service do this gives you more time to run your business.

4. You Want to Avoid Tax Mistakes

Mistakes in taxes can cost money. You may have to pay fines. Payroll pros know the tax laws and help you avoid these slip-ups.

5. You Want Reports You Can Trust

It’s hard to track all the numbers alone. Payroll services give you neat and clear reports that show pay, taxes, and more. You can trust these reports.

6. You’re Growing Fast

As your shop or business grows, things get busy. More workers mean more work. A payroll service keeps up with your growth without stress.

7. You’re Tired of Doing It Yourself

Doing payroll by yourself each week or month can feel like too much. If you’re worn out, it’s okay to get help from the professionals.

Using an outsourced payroll service is a smart way to save time, money, and stress. It helps you pay your workers the right way and keeps your taxes in order. You don’t have to worry about rules or math mistakes. The payroll team does all the hard work for you. If your business is growing or you just want help, a good payroll service like Meru Accounting can make things much easier.

That’s why many people use an outsourced payroll service. It saves time, lowers cost, and avoids stress. You get expert help and stay safe from mistakes. If you want payroll to be easy and right, a team like Meru Accounting is ready to help.

FAQs

1. What kind of businesses use outsourced payroll services?

All types, from small shops to big companies. If you pay workers, you can use payroll services.

2. Is it safe to share my worker’s data with a payroll team?

Yes. Trusted services use strong safety tools to keep your data private and safe.

3. Can I still check payroll reports if I outsource?

Yes. Most services give you online tools to see pay slips, tax forms, and reports.

4. What happens if a mistake is made?

Good payroll services fix any mistakes fast. They also help handle problems with tax offices.

5. Can Meru Accounting handle my business in another country?

Yes. Meru Accounting works with global clients and knows payroll laws in many places.