Home » How Secure Are Payable Accounting Solutions for Managing Sensitive Financial Data?

How Secure Are Payable Accounting Solutions for Managing Sensitive Financial Data?

Every company, big or small, needs to handle bills, payments, and records. One way to do this safely is by using payable accounting solutions. These special tools are very helpful as they let you keep the data and records of your business spending and profits. They also protect important money information. Payable accounting solutions help make work easy. They save time, reduce mistakes, and help with money tasks. But when things get easier, we must also be more careful.

The accounts team works with private money data like vendor names, payment records, and bank information. If this data gets stolen, it can cause big problems. A business might lose money or get a bad name.

That’s why we must check how safe payable accounting solutions are. These tools should have strong security rules to stop bad people from stealing or changing money data.

When companies use these tools, they trust them with private data like bank details and bills. So, are payable accounting solutions secure? Let’s learn more about them and how they keep information safe.

What are Payable Accounting Solutions?

Payable accounting solutions are tools, software, or services used by companies to manage money they owe to others. This may include bills, supplier payments, and other costs. These tools help make sure the company pays on time and keeps good records.

Here are some things these solutions do:

- Keep track of unpaid bills

- Send reminders for due dates

- Match the bills with what was ordered and received

- Store important money records

- Protect private money data

Good payable accounting solutions also help companies follow rules and avoid errors. They are very helpful for the finance team.

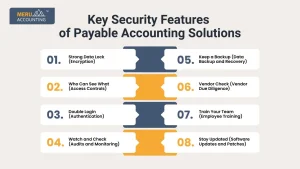

Key Security Features of Payable Accounting Solutions

Payable accounting solutions help keep your business’s money and data safe. They use strong safety tools to stop hackers and mistakes. Let’s look at the most important features that help protect your accounts:

1. Strong Data Lock (Encryption)

Payable accounting solutions use something called encryption. This means the money data is changed into secret code. Even if a hacker gets the file, they won’t understand it. Only someone with the right key can read it. This helps keep your data safe.

2. Who Can See What (Access Controls)

These tools help decide who can see or change things in the system. For example, a worker may only see bills but not send money. This way, only the right people can do important jobs. This helps avoid mistakes and keeps money data private.

3. Double Login (Authentication)

Some payable accounting solutions use two ways to check it’s really you. This could be your password and a code sent to your phone. This makes it very hard for strangers to get into your account.

4. Watch and Check (Audits and Monitoring)

These systems keep watching what’s going on. If something strange happens, like a big payment at night, it gives a warning. This helps teams fix problems before they grow.

5. Keep a Backup (Data Backup and Recovery)

Sometimes systems crash or get attacked. But payable accounting solutions keep a backup, like a saved copy. If anything goes wrong, you can get your important data back fast. This means your work won’t stop.

6. Vendor Check (Vendor Due Diligence)

Before you start using any software, you should check the company that made it. Ask how they protect your data. See if they follow rules like PCI DSS, which help keep data safe. Also, ask other users if they had any problems.

7. Train Your Team (Employee Training)

Sometimes, people make mistakes. A worker might click a fake email or use a weak password. That’s why training is very important. Teach everyone how to spot scams, use strong passwords, and follow safe rules when using payable accounting solutions.

8. Stay Updated (Software Updates and Patches)

Software must be kept up to date. Updates fix holes that hackers may use. When your payable accounting solution gives you an update, install it quickly.

Why Security Is Important in Payable Accounting Solutions?

When we talk about money and records, keeping them safe is a must. If someone breaks into the system, they can steal money, change records, or send fake bills. That can hurt a company and cause big money losses..

1. Save Time

Payable accounting solutions help you finish tasks faster. You don’t have to write or count things by hand. The last-minute work is all handled by the system and it also give you the time to focus on the rest of the work.

2. Reduce Mistakes

If a person enters numbers by hand, they can make a mistake. Payable accounting solutions check the numbers for you. That results in error free work and saves your time.

3. Follow Rules

There are rules businesses must follow when handling money. These tools help you stay in line with those rules by tracking every step and making reports.

4. Keep Data Safe

The biggest job of these tools is to protect your money data. Strong safety tools like passwords, codes, and locks keep your data safe from bad people like hackers.

5. Make Smart Money Choices

With good records, you can see how much you earn and spend. This helps business owners make smart plans with their money and grow their business.

Challenges in Using Payable Accounting Solutions

Even though payable accounting solutions help a lot, there are some challenges to watch for:

Cyber Attacks

Hackers may try to break into systems. If they get in, they can steal money data. That’s why strong safety tools are a must.

Human Mistakes

People may click bad links or share passwords by mistake. These small errors can cause big trouble in payable accounting solutions.

Weak Passwords

Using easy or the same passwords can be risky. Hackers can guess them fast and break into the system.

Outdated Software

If the software is not updated, it may not have new safety tools. Old payable accounting solutions can be easier to hack.

No Training for Staff

If team members don’t know how to use the system safely, they may cause problems without meaning to. Training is very important.

Vendor Risks

Sometimes, the company that makes the payable accounting solutions may not have strong safety rules. Always check their safety history.

Data Loss

If the system breaks or crashes, it can lead to lost data. Good backup tools are needed to save important money records.

Payable accounting solutions are safe when used correctly. They have many layers of protection, like passwords, encryption, and secure storage. They also follow rules and use the latest tools to stop hackers.

If a company wants to manage money and stay safe, these tools are a smart choice. But it is also important to use trusted help. Meru Accounting offers the best support for safe and smart money tools. Our team uses strong payable accounting solutions that protect all your important records. We help companies grow and stay safe at the same time.

So, if you want peace of mind, go with a trusted name. Let Meru Accounting handle your money records in a smart and safe way.

FAQs

1. What are payable accounting solutions used for?

They help track bills, payments, and the money a company owes to others. They also help stay organized and safe.

2. Are these solutions safe for private data?

Yes. Good payable accounting tools use passwords, encryption, and secure storage to keep data safe.

3. Can small businesses use them?

Yes. Many tools are made for small businesses. They are easy to use and protect money data.

4. What happens if the system crashes?

Most tools have backup and restore options. That means your data can be saved and brought back quickly.

5. How can Meru Accounting help?

Meru Accounting uses top tools and smart ways to manage your data. We make sure it’s safe, correct, and easy to use.