Xero Accounting Payroll: Simple Solutions for Easy Payroll Management

Managing payroll is tough for many businesses. Errors can cause unhappy staff, fines, and lost time. Xero accounting payroll helps make the process smooth and accurate. It offers simple and smart payroll solutions that make paying employees easier and more accurate. In this guide, we explore why Xero payroll solutions are ideal for businesses and how you can set them up for smooth payroll management.

What is Xero Accounting Payroll?

Xero accounting payroll is an online tool that makes payroll easy and links with your accounts. It works out taxes on its own, cutting mistakes and extra work. Staff can see their payslips, leave, and tax forms anytime, without asking HR. Managers can approve leave and track hours in Xero, so pay is correct. Being cloud-based, payroll info can be seen on any device, which helps with remote work.

Payroll is more than paying staff. It also covers taxes, benefits, rules, and staff records. Doing this by hand can cause errors, slow work, and cost more. Many firms use Xero payroll to make paying fast, simple, and accurate.

Key Reasons to Use Payroll Software

1. Handling Payroll Beyond Salary Payments

Payroll is not just paying salaries. It includes tax filing, benefits management, and keeping accurate employee records. Manual processes increase mistakes and stress.

2. Cutting Payroll Errors

Payroll mistakes can lead to fines and unhappy staff. Xero payroll solutions handle the math, making sure payments and deductions are always accurate.

3. Saving Time and Money

With Xero accounting payroll, you spend less time on manual work. It saves hours every week and avoids costs caused by wrong or late payments.

4. Staying Legally Compliant

Tax rules often change. Payroll software updates these rules for you, helping you stay compliant and avoid penalties.

5. Boosting Employee Trust

Fast and accurate payments build trust. Clear payslips let staff check their pay details anytime, improving satisfaction and confidence in payroll handling.

6. Providing Scalability for Growth

Xero payroll solutions grow with your team, avoiding the need for extra manual steps or new tools.

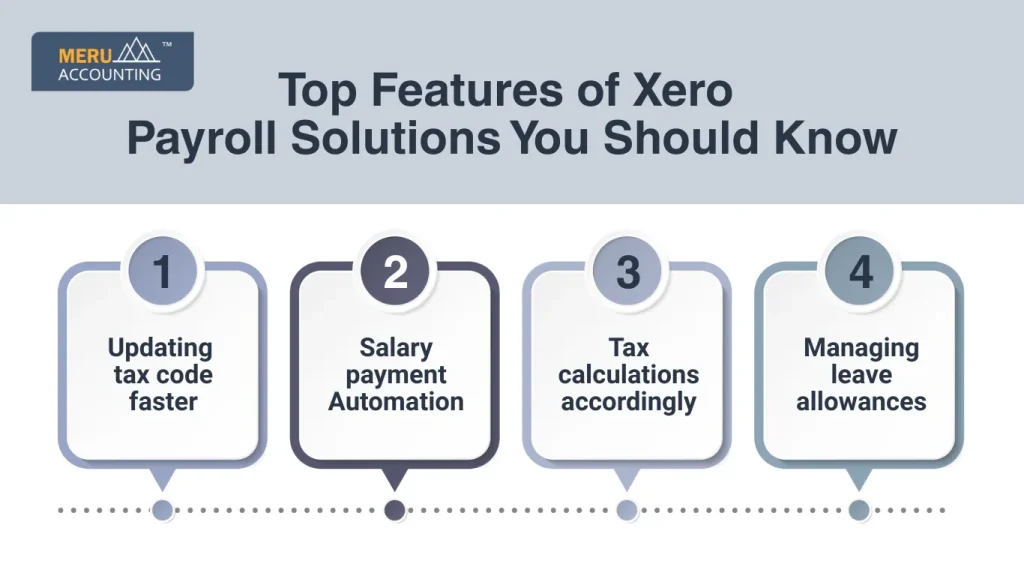

Top Features of Xero Payroll Solutions You Should Know

Xero offers powerful features that make payroll stress-free for business owners.

1. Updating tax code faster

The tax code of the employee changes after some duration. It becomes very difficult for the payroll department in this situation to handle the payroll activities. Late changes to the payroll activity can affect the payroll activity adversely. Xero Payroll can change the necessary tax codes very quickly.

2. Salary payment Automation

On some occasions, different companies could not make the payments on the given date. It mostly happens due to a delay in the payroll calculations.”Xero accounting payroll helps automate employee payments. This software enables you to make all the necessary calculations as decided and make the payments accordingly.

3. Tax calculations accordingly

Tax deduction calculations are one of the important things for any business. Xero accounting software payroll allows you to make the necessary tax deductions of all employees as per the slab they fall it. Salary payments, along with the tax deduction, thus become simpler with the accounting and payroll solutions.

4. Managing leave allowances

As per the leave taken by the employee, the payroll department needs to make provisions for the salary payments. Xero payroll helps to make the calculations of the leave allowances as on the number of holidays.

These are some of the important features of the Xero payroll solutions. It covers most of the areas of payroll management.

Benefits of using Xero payroll:

1. Flexibility in the payments

It becomes tedious to manage the payments on different days as per monthly, weekly, fortnightly, or any other specific type. Xero accounting software payroll allows easy payments as per the decided structure for specific employees.

2. Built-in Employee Timesheet

As per the number of days and number of working hours given by the employee for work, the calculations of the payment need to be made. Xero’s built-in timesheet allows easy calculations of wages and salaries as per the work.

3. Accessing payslips

With Xero payroll, employees can access the e-payslips in a much easier way. It relieves the work pressures from the HR department.

4. Expenses Reimbursement

Reimbursement of the payment takes a lot of time for calculating, checking, and approving. Xero accounting payroll lets you send automated reimbursements to employees without extra fees.

5. Guaranteed Legal Compliance

Tax laws and rules change often. Xero updates these automatically, ensuring every payroll run meets legal standards and you avoid late filings or costly penalties.

6. Enhanced Employee Confidence and Transparency

With Xero payroll, staff can check digital payslips anytime, view leave balances, and see how their pay is calculated. This builds trust, boosts morale, and helps keep employees happy and loyal to the company.

7. Smarter Decisions with Clear Reports

Xero gives detailed payroll reports showing labor costs, overtime hours, and tax amounts. These reports help you plan budgets better, cut extra costs, and make informed business choices.

Step-by-Step Guide to Setting Up Xero Accounting Payroll

1. Create Your Xero Account

Sign up and provide your company details to start using the platform.

2. Configure Payroll Settings

Set payment frequencies, tax preferences, and business details for accurate payroll runs.

3. Add Employees and Their Data

Include names, tax information, salary details, and bank account info for all employees.

4. Connect Payroll to Your Accounting System

Link payroll with other financial records for automatic updates and reconciliations.

5. Test Run the Payroll System

Run a trial payroll cycle to spot and fix errors before the first live run.

6. Finalize and Automate Payroll

Set up recurring schedules to make payroll smooth and hassle-free.

Common Payroll Challenges and How Xero Accounting Payroll Solves Them

1. Tax Calculation Mistakes

Xero automates tax deductions and keeps them error-free.

2. Delayed Payments

Automated schedules ensure employees are always paid on time.

3. Record-Keeping Issues

Digital storage avoids misplaced records and ensures easy access.

4. Remote Worker Payments

Cloud access makes payroll easy for distributed teams worldwide.

5. Complex Benefit Tracking

Xero simplifies benefits and deductions management for each employee.

6. Compliance Errors

Real-time updates keep you aligned with new tax laws and regulations.

Tips to Maximize the Benefits of Xero Payroll Solutions

1. Keep Employee Data Updated

Regularly review employee details to avoid payroll errors.

2. Integrate Time-Tracking Tools

Connect time sheets for accurate pay calculations.

3. Review Payroll Reports Frequently

Spot issues early and make informed business decisions.

4. Automate Recurring Tasks

Reduce manual input by setting up repeating payroll schedules.

5. Train Your Staff on Xero

Make sure your team knows how to use all features efficiently.

Why Xero Payroll Solutions are Ideal for Small and Medium Businesses

1. Affordable Payroll Software

Small businesses get professional payroll tools at a low cost.

2. Easy to Learn and Use

No need for a large HR team to manage payroll with Xero’s simple interface.

3. Scales as Your Business Grows

Add more employees easily without needing new payroll systems.

4. Accessible from Anywhere

Owners and managers can run payroll on the go from any device.

5. Fewer Compliance Risks

Automatic updates ensure you meet all local tax and employment laws.

6. Saves Time for Business Growth

More time is left to focus on growing the business instead of handling payroll manually.

Choosing the Right Xero Accounting Payroll Plan for Your Business

1. Assess Your Payroll Needs

Identify your team size, payment frequency, and required features.

2. Compare Xero Payroll Plans

Review different plans to match your specific requirements and budget.

3. Look for Scalability

Choose a plan that can grow with your business over time.

4. Check Integration Features

Ensure the plan works seamlessly with your current accounting setup.

5. Evaluate Customer Support Options

Pick a plan with responsive support to solve payroll issues quickly.

6. Seek Expert Guidance

Experts can help you pick the right plan and set it up efficiently.

At Meru Accounting, we set up your Xero accounting payroll for smooth and accurate use. We handle everything from data entry to tax filing. Our team customizes payroll settings to fit your needs. Experts are always ready to help you with any payroll issues, anytime.

FAQs

- How does Xero accounting payroll make payroll tasks easier?

Xero does salary calculations, tax deductions, and reporting for you. It cuts down mistakes, saves time, and keeps payroll in line with tax laws. - Is Xero payroll good for small businesses?

Yes, Xero payroll is great for small firms. It is low-cost, easy to set up, and grows as your business grows. It saves time, cuts admin work, and makes sure staff are paid right every time. - Can staff see their payslips and tax info?

Yes, staff can log in at any time to view their payslips, tax forms, and leave details. This reduces HR questions, keeps things clear, and builds trust in the payroll process. - How long does it take to switch to Xero payroll?

Most setups finish in a few hours to one day, based on your data size. Experts make sure the switch is smooth, tested, and error-free before you start using it. - Does Xero update tax rules on its own?

Yes, Xero updates tax rates and deductions by itself. This keeps your payroll legal, avoids fines, and makes sure all numbers stay correct without extra work.