Home » Typical Services Offered by a Personal Tax Accountant.

Key Services Offered by a Personal Tax Accountant

Many people find taxes hard to do as there are many forms, rules, and numbers to think about. That is why many people choose to work with a personal tax accountant. This person knows how to handle taxes and can help make things simple. When you have someone to help, it saves time, lowers stress, and helps you not miss money you should get back.

A personal tax accountant is someone who helps people, not businesses, with their taxes. They know the rules and laws about taxes. They make sure you pay the right amount. Not too much, not too little.

They do more than just fill out tax forms. They give advice, help you save money, and keep you out of trouble. They work for you and make sure everything is done right.

Some people think you only need a tax accountant if you are rich. That is not true. Anyone can get help from a personal accountant. Even if you have one job and simple money, they can still help you save and feel safe. In this guide, we will talk about what a personal tax accountant does. We will also explain how they help you and why hiring one is a smart idea. This guide uses easy words, so it is simple to follow, even if you are not good with taxes.

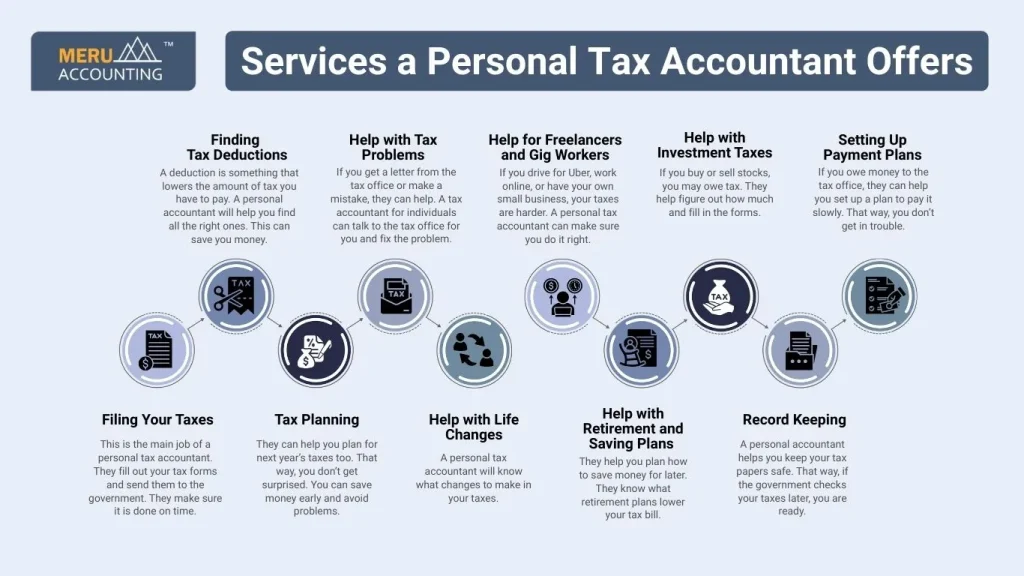

Services a Personal Tax Accountant Offers

Here are the main things a tax accountant for individuals can do for you:

Filing Your Taxes

This is the main job of a personal tax accountant. They fill out your tax forms and send them to the government. They make sure it is done on time.

Finding Tax Deductions

A deduction is something that lowers the amount of tax you have to pay. A personal accountant will help you find all the right ones. This can save you money.

Tax Planning

They can help you plan for next year’s taxes too. That way, you don’t get surprised. You can save money early and avoid problems.

Help with Tax Problems

If you get a letter from the tax office or make a mistake, they can help. A tax accountant for individuals can talk to the tax office for you and fix the problem.

Help with Life Changes

A personal tax accountant will know what changes to make in your taxes.

Help for Freelancers and Gig Workers

If you drive for Uber, work online, or have your own small business, your taxes are harder. A personal tax accountant can make sure you do it right.

Help with Retirement and Saving Plans

They help you plan how to save money for later. They know what retirement plans lower your tax bill.

Help with Investment Taxes

If you buy or sell stocks, you may owe tax. They help figure out how much and fill in the forms.

Record Keeping

A personal accountant helps you keep your tax papers safe. That way, if the government checks your taxes later, you are ready.

Setting Up Payment Plans

If you owe money to the tax office, they can help you set up a plan to pay it slowly. That way, you don’t get in trouble.

Benefits of Hiring a Personal Tax Accountant

1. Saves Time and Cuts Stress

Filing taxes can feel hard and take a lot of time. A personal tax accountant handles the forms and numbers, so you can focus on other tasks and stress less.

2. Ensures Accurate Tax Filing

Mistakes on tax returns can bring fines or audits. A personal accountant makes sure your taxes are done right, keeping you in line with the rules.

3. Finds Deductions and Credits

A tax accountant knows which deductions and credits you can claim. They help lower your taxes and make sure you don’t miss any savings.

4. Guides on Complex Tax Situations

If you earn from rentals, self-employment, or investments, tax rules can get tricky. A personal accountant gives advice that fits your situation.

5. Advises on Investments and Retirement

Taxes are not just about filing forms. A personal accountant can suggest ways to invest and plan for retirement while lowering your tax bills.

6. Avoids Fines and Legal Trouble

Late or wrong filings can cost you. A personal tax accountant meets all deadlines and follows the rules to keep you safe from penalties.

7. Helps with Tax Planning

A personal accountant can plan for your future taxes. They show ways to save money and reduce taxes year after year.

5 Common Mistakes Avoided by Hiring a Personal Accountant

1. Filing Wrong Forms or Missing Deadlines

Filing the wrong forms or missing deadlines can cost you fines. A personal accountant checks all forms and files them on time.

2. Overlooking Deductions or Credits

Missing deductions or credits can raise your tax bill. A personal accountant finds all the savings you can claim.

3. Misreporting Income or Investments

Errors in reporting income or investments can lead to audits. A personal accountant makes sure your numbers are correct.

4. Not Planning for Taxes on Bonuses or Gains

Extra income, like bonuses or gains, can raise taxes if not planned. A personal accountant shows you how to handle them smartly.

5. Failing to Keep Filings Accurate and Legal

A tax accountant for individuals makes sure your filings follow all rules, stay correct, and avoid penalties.

Technology in Personal Tax Accounting

1. Faster and More Accurate Work

Modern personal tax accountants use technology to work fast and correctly.

2. Online Portals for Documents

Clients can upload documents online, saving time and reducing errors.

3. Software to Track Deductions and Credits

Tax software tracks deductions and credits automatically, so nothing is missed.

4. Electronic Filing for Quick Refunds

E-filing speeds up tax submissions and helps clients get refunds faster.

5. Secure Cloud Storage

Tax records are stored safely in the cloud for easy access and long-term security.

6. Efficient Client Service

Technology allows accountants to serve clients faster and with less hassle.

Tax Considerations for Special Situations

1. Rental Property Owners or Real Estate Investors

Taxes on rental income or real estate can be complex. A tax accountant ensures correct filings.

2. Freelancers or Gig Workers

Irregular income makes taxes tricky. Accountants help track earnings and pay the right amount.

3. Individuals with Foreign Income or Multiple Accounts

Foreign income and multiple accounts require careful reporting. An accountant ensures compliance.

4. Major Life Events

Marriage, divorce, or inheritance can change your taxes. Accountants guide clients to save more and follow the law.

5. Specialized Guidance

For unique situations, a personal tax accountant gives advice that fits your needs and avoids costly mistakes.

How Personal Accountants Save Money

1. Maximize Deductions and Credits

A personal accountant finds all deductions and credits you can claim. This lowers your tax bill.

2. Reduce Taxes Legally

They show ways to pay less tax while staying within the law.

3. Avoid Penalties

Late or wrong filings can cost you. A personal accountant makes sure all forms are correct and on time.

4. Advise on Tax-Efficient Investments and Retirement

Accountants guide you on investments and retirement plans that cut taxes and grow your money.

5. Smart Financial Choice

Hiring a personal tax accountant saves money, cuts stress, and makes your finances easier to manage.

A personal tax accountant offers many services that make managing taxes easier. From planning to filing, audits, investments, and ongoing advice, a tax accountant for individuals helps you stay organized, legal, and stress-free. Hiring a personal accountant is an investment in financial peace and better tax outcomes.

Partnering with Meru Accounting ensures you get expert guidance from experienced professionals. Our team of personal tax accountants and personal accountants helps you plan, file, and optimize your taxes with ease. We provide tailored solutions, minimize stress, and help you maximize savings. With Meru Accounting, your financial peace of mind is our priority.

FAQs

- What’s the difference between a personal tax accountant and a business accountant?

A personal tax accountant helps people with their personal taxes. A business accountant helps companies and firms.

- How much does a personal accountant cost?

It depends on how hard your taxes are. Simple returns cost less. You can ask Meru Accounting for a price.

- Can a personal tax accountant help me if I’m late filing taxes?

Yes! They help you file even if it’s late. They can also talk to the tax office to fix problems.

- Do I need to meet a tax accountant in person?

No, many accountants help you online or by phone. You send your papers, and they do the rest.

- Is hiring a personal accountant better than using tax software?

Tax software is good, but a person can understand their life better. A personal tax accountant finds things the software might miss.