7 Key Responsibilities of Financial Planning and Analysis Teams

Every growing business relies on Financial Planning and Analysis (FP&A) to make informed decisions and drive growth. Strong FP&A teams help guide money decisions, growth plans, and track results. Without a proper plan, companies may face money issues and miss growth opportunities. This blog explains the main tasks of FP&A teams, their value to a business.

What is Financial Planning and Analysis, and Why Is It Important

Financial Planning and Analysis is the process of looking at past money data, planning for the future, and guiding leaders with useful reports. FP&A teams help set budgets, study trends, and support key choices. With the right FP&A team, a business can:

- Track where money comes and goes.

- Plan future costs and growth goals.

- Avoid risks by acting on real data.

- Make smart, quick decisions for success.

Role of FP&A Teams in Driving Business Growth

A strong FP&A team does more than crunch numbers. They shape the future of the company by:

- Finding where profits can grow.

- Managing cash flow better.

- Giving leaders the data they need to act fast.

- Spotting risks before they harm the business.

In short, FP&A teams keep the company on track and help it grow faster.

Essential Skills and Tools for Effective Financial Planning and Analysis

Strong Financial Planning and Analysis skills and tools help teams provide clear, timely, and reliable insights for planned growth.

Data Understanding

FP&A teams must read and understand large sets of numbers. Clear data reading gives leaders strong insights for better actions.

Forecasting Ability

Teams predict future trends using current and past data. This skill helps plan costs, growth, and risks with high accuracy.

Problem-Solving Skills

Quick and smart solutions are needed to face sudden financial challenges. FP&A teams give real-time advice to avoid losses.

Clear Reporting

Reports must be simple and direct. They help leaders make the right calls fast without confusion.

Strategic Thinking

FP&A teams guide the company toward long-term goals. They create plans that fit both market trends and company vision.

Right Tools

Software and data apps help FP&A work faster and with fewer mistakes. The right tools turn raw data into useful actions.

FP&A teams with strong skills and tools make safe plans, reduce risks, and support growth with clear insights.

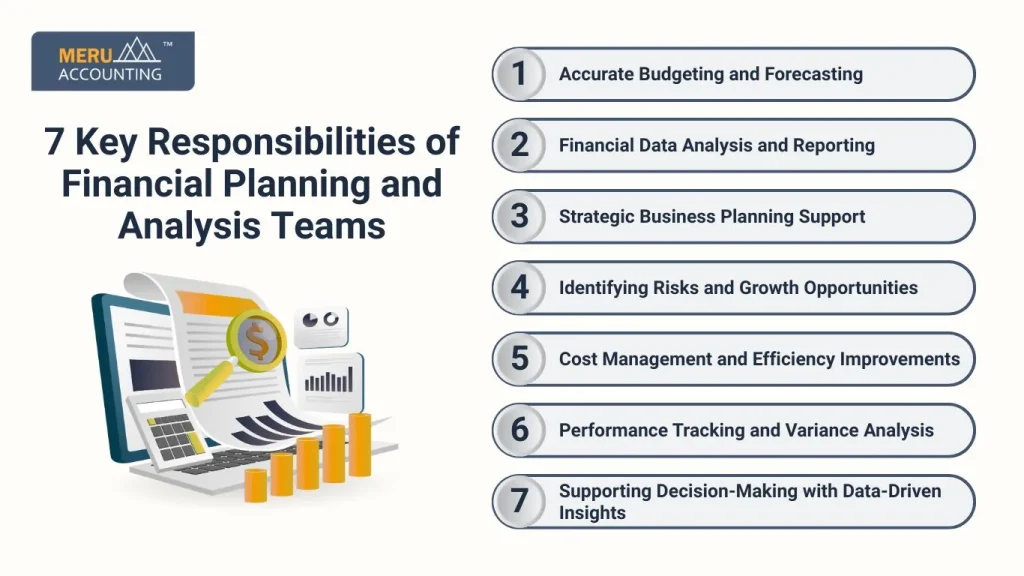

7 Key Responsibilities of Financial Planning and Analysis Teams

FP&A has many roles that help keep a company’s growth safe and steady. These duties make sure money is spent right and profits increase.

1. Accurate Budgeting and Forecasting

FP&A teams set clear budgets that match company goals. They predict future revenue and costs to avoid money gaps or waste.

2. Financial Data Analysis and Reporting

Teams study numbers to see what works and what fails. They build reports with facts and trends for faster, better choices.

3. Strategic Business Planning Support

Leaders get support with clear data and ideas from FP&A teams. This helps create safe, long-term business growth paths.

4. Identifying Risks and Growth Opportunities

FP&A experts watch markets and warn about risks early. They point out new profit areas that help the company stay ahead.

5. Cost Management and Efficiency Improvements

The team looks for ways to cut waste and manage spending better. This adds more value without reducing quality or growth.

6. Performance Tracking and Variance Analysis

Results are checked against plans. Gaps are fixed quickly, helping the company stay focused on reaching set goals.

7. Supporting Decision-Making with Data-Driven Insights

FP&A teams turn data into clear advice for leaders. Smart data use leads to safe and planned growth steps.

These FP&A tasks keep a company strong by guiding budgets, reducing waste, and making safe, smart growth choices.

Challenges Faced by FP&A Teams and How to Overcome Them

Challenges are part of every FP&A process. Overcoming them helps companies make safe choices and build strong financial plans. Below are key hurdles and ways to solve them.

Poor Data Quality

Bad data leads to wrong choices that hurt growth. FP&A teams must use strong tools, clean databases often, and double-check figures. Clear, updated data keeps every plan safe and reliable.

Sudden Market Shifts

Markets change fast, creating risks and delays. FP&A teams need real-time monitoring, early alerts, and backup plans. Quick action prevents losses and keeps business performance on track.

Limited Tools

Old or slow tools cause delays and errors in reports. Upgrading to modern, automated software saves time, improves accuracy, and allows FP&A teams to give faster and stronger advice.

Lack of Clear Goals

Unclear goals make plans weak and waste money. FP&A teams should set measurable, realistic targets, review progress, and adjust steps often to match actual market and company needs.

Weak Communication

Poor info flow leads to mistakes and slow action. FP&A teams must share clear reports, hold regular talks, and align with other teams to ensure decisions are quick and safe.

Short Time Frames

Tight deadlines cause errors and stress. Automation tools, planned schedules, and early data checks help teams deliver reports on time without losing quality or accuracy.

With these fixes, FP&A teams can handle common hurdles and give stronger, safer advice for smart growth.

Key Skills Needed in Financial Planning and Analysis Teams

Strong Knowledge of Accounting and Finance

A good FP&A team needs a solid base in accounting and finance. This helps them track cash, read balance sheets, and make smart calls on spend and growth.

Ability to Work with Data Tools and Reports

FP&A teams use data tools to make clear reports. They must know Excel, BI tools, and models to check trends and risks.

Clear Communication Skills

Teams must share numbers and facts in a way that all can grasp. Good talk and write skills help bridge the gap with non-finance staff.

Problem-Solving and Critical Thinking

FP&A staff must think fast and spot root issues. They should test many views before giving advice.

Teamwork Across Departments

Strong FP&A teams link with sales, ops, HR, and more. This helps them build a full view of costs, income, and goals.

Strategic Planning Skills

They must plan for the long run. This means linking daily data with the firm’s main aim and growth track.

Attention to Detail

Small errors in numbers can cause big loss. FP&A pros must check data with care and make sure reports are true.

Adaptability to Change

Markets and rules shift fast. FP&A teams need to adapt and stay quick with new tools and trends.

Best Practices to Strengthen Financial Planning and Analysis in Your Company

Good FP&A work keeps business growth steady. Best practices improve forecasts, reduce risks, and guide smart steps for long-term results.

Keep Data Clean

Updated and checked data avoids wrong advice. FP&A teams must clean records, remove errors, and ensure figures are always fresh to give true insights for smart business choices.

Involve Every Team

Sharing input across sales, operations, and finance gives a full picture of the company’s money state. It leads to stronger forecasts and better growth plans for long-term success.

Review and Adjust Often

Markets and costs change fast. FP&A teams should review plans often, compare them with results, and adjust steps to stay safe and seize new chances quickly.

Use Simple Reports

Clear, short reports help leaders act fast. Avoiding complex terms and making data visual ensures every decision is easy, fast, and based on true figures.

Invest in Tools

Modern tools cut time and errors. Automated dashboards, fast report builders, and trend trackers help FP&A teams plan better and give timely, strong insights to leaders.

Train Teams Well

Regular training builds skills and speed. FP&A experts learn new tools, refine analysis skills, and give accurate advice that keeps growth safe and reduces costly mistakes.

These best practices help FP&A teams guide companies toward safe, planned, and steady progress.

Meru Accounting offers full Financial Planning and Analysis support for your business needs. We help you set smart budgets, plan future moves, track results in real time, control costs, and prepare simple reports for quick decisions. Our team studies your data, finds risks and new growth paths, and gives clear advice for every money choice. With expert forecasting and planning, you can grow safely and steadily without extra cost or delays.

FAQs

- What is the main role of FP&A in a company?

FP&A teams guide money plans, track performance, and help leaders make safe, smart growth decisions using data-based insights and clear reports.

- How does FP&A support business growth?

By planning budgets, forecasting revenues, spotting risks, and giving timely advice, FP&A ensures strong steps toward growth without waste or missed chances.

- What tools are most useful for FP&A teams?

Modern dashboards, real-time trackers, and automated reporting tools help FP&A teams work faster, improve accuracy, and give better advice to leaders.

- What challenges do FP&A teams face most often?

Common issues include poor data, unclear goals, sudden market shifts, old tools, weak communication, and short time frames that risk poor decisions.

- How often should FP&A plans be reviewed?

Plans should be reviewed monthly or quarterly to keep them aligned with market changes and real results, ensuring smart and secure growth choices.

- Why is clean data important for FP&A work?

Bad data causes wrong advice. Clean, updated data keeps forecasts true, guides safe decisions, and builds trust in FP&A team insights.

- How do FP&A services save costs for a company?

By spotting waste, planning safe investments, and improving forecasts, FP&A services prevent losses and guide steady, cost-effective growth for the long term.