QuickBooks Printing Checks vs. Manual Check Writing: What You Need to Know

Managing business payments is a critical task for every business owner. Choosing the right method to write and issue checks can save time, reduce errors, and improve overall efficiency. In this blog, we will discuss QuickBooks Printing Checks and how it compares to traditional manual check writing. We will cover the benefits, challenges, and reasons why QuickBooks can be an innovative move for your business finances.

What is QuickBooks Printing Checks?

QuickBooks Printing Checks is a feature in QuickBooks accounting software that allows businesses to print checks directly from the system.

- You can print checks for vendors, suppliers, and employees.

- It automatically fills in details like payee name, date, and amount.

- It reduces the chances of manual errors.

QuickBooks Printing Checks makes check management faster and more organized than manual methods.

What is Manual Check Writing?

Manual check writing is the traditional method of writing checks by hand.

- You write the payee name, amount, and date on a physical check.

- Manual checks require careful handling and record-keeping.

- It is time-consuming, especially for businesses with many transactions.

While manual checks are simple, they have limitations in accuracy and efficiency.

Benefits of QuickBooks Printing Checks

Using QuickBooks Printing Checks has many advantages over manual writing.

1. Time-Saving

- QuickBooks allows you to print multiple checks in minutes.

- No need to write each check individually.

- Reduces administrative workload.

2. Accuracy

- Auto-fills payee and amount details.

- Minimizes human errors like wrong amounts or misspelled names.

- Keeps your accounts accurate and organized.

3. Professional Appearance

- Printed checks look neat and professional.

- Helps maintain a professional image with vendors and employees.

- Reduces the chances of a rejected or bounced check.

4. Record Keeping

- QuickBooks automatically records all checks in the system.

- Easy to track payment history.

- Simplifies accounting and reporting.

5. Security

- Printed checks reduce the risk of fraud compared to handwritten checks.

- QuickBooks can use secure check stock and MICR technology.

Benefits of Manual Check Writing

Manual checks have some benefits, but they are limited.

1. No Software Needed

- You don’t need any accounting software.

- Can be done anywhere with a checkbook.

2. Simple for Small Payments

- Works well for very few transactions.

- Easy for home-based or micro businesses.

3. Personal Touch

- Handwritten checks may feel more personal for small vendors or clients.

However, manual checks are slow, prone to mistakes, and hard to track.

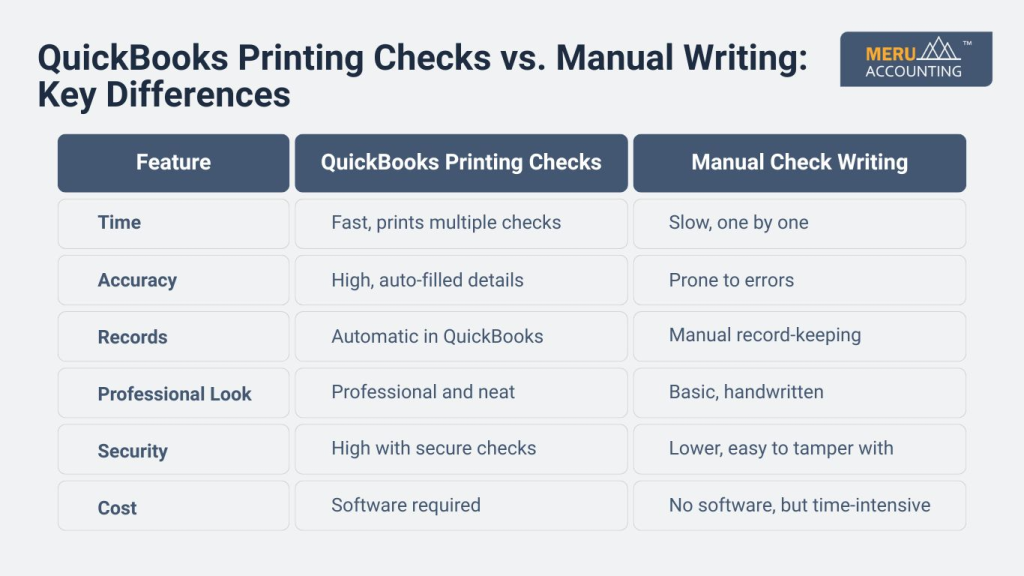

QuickBooks Printing Checks vs. Manual Writing: Key Differences

Feature | QuickBooks Printing Checks | Manual Check Writing |

Time | Fast, prints multiple checks | Slow, one by one |

Accuracy | High, auto-filled details | Prone to errors |

Records | Automatic in QuickBooks | Manual record-keeping |

Professional Look | Professional and neat | Basic, handwritten |

Security | High with secure checks | Lower, easy to tamper with |

Cost | Software required | No software, but time-intensive |

How QuickBooks Printing Checks Works

Using QuickBooks to print checks is simple and efficient.

- Set Up Bank Account

- Connect your bank account in QuickBooks.

- Ensure your account is ready for printing checks.

- Connect your bank account in QuickBooks.

- Enter Payee Information

- Add vendor or employee details in QuickBooks.

- Include address and payment preferences.

- Add vendor or employee details in QuickBooks.

- Create Checks

- Choose the payee and enter the payment amount.

- QuickBooks fills in the date and memo automatically.

- Choose the payee and enter the payment amount.

- Print Checks

- Use pre-printed check stock.

- QuickBooks aligns the details correctly for printing.

- Use pre-printed check stock.

- Record Payment

- The system automatically updates your accounts.

- Payment history is saved for easy tracking.

- The system automatically updates your accounts.

Tips for QuickBooks Printing Checks

1. Use Compatible Check Stock

Always use QuickBooks-approved check stock for correct printing. Wrong stock may cause misalignment or unreadable checks.

2. Reconcile Bank Accounts Often

Check your bank account in QuickBooks to catch errors. Make sure all printed checks match your bank records.

3. Verify Payee Details

Check names, addresses, and amounts before printing. QuickBooks lets you edit details before batch printing.

4. Keep Software Updated

Update QuickBooks for better security, bug fixes, and new features. Old software may cause printing errors.

5. Batch Printing Saves Time

Print many checks at once. This reduces repetitive work and cuts down on mistakes.

6. Use QuickBooks Reports

Reports show check activity, unpaid checks, and payment history. This helps track payments and keep records clear.

7. Set User Permissions

Allow only trusted staff to print checks. QuickBooks can limit who can print to reduce fraud risk.

8. Keep Data Backups

Back up QuickBooks files before printing. This keeps data safe from crashes or errors.

Challenges of QuickBooks Printing Checks

1. Setup Can Take Time

New users may spend time setting up printers, accounts, and templates.

2. Software Cost

QuickBooks fees can be high for small businesses that print a few checks.

3. Printing Issues

Misaligned checks, smudges, or wrong toner can cause problems.

4. Need Basic Software Skills

Users must know QuickBooks basics to avoid mistakes and keep accurate records.

5. Need a Computer and a Printer

Check printing needs a computer and printer, which may limit off-site use.

Challenges of Manual Check Writing

1. Time-Consuming

Writing checks by hand is slow, especially with many payments.

2. High Error Risk

Manual checks may have wrong amounts, misspellings, or missing info.

3. Hard to Track Records

Manual records make it tough to track checks or match them with bank statements.

4. Higher Fraud Risk

Manual checks can be lost, stolen, or altered.

5. Weak Audit Trail

It is hard to track past payments for audits with manual checks.

6. Labor-Intensive

Writing many checks takes time and staff effort.

QuickBooks Printing Checks: Best Practices

1. Keep Payee Info Updated

Update names, addresses, and bank info to prevent errors.

2. Print Checks in Batches

Print several checks at once to save time.

3. Use Secure Check Stock

MICR printers and secure stock help prevent fraud and ensure bank acceptance.

4. Reconcile Often

Check printed checks against bank statements to find mistakes early.

5. Maintain Backups

Keep digital backups to avoid data loss.

6. Limit User Access

Give check printing rights only to trusted staff.

Manual Check Writing: Best Practices

1. Write Clearly

Check names, amounts, and dates to avoid mistakes.

2. Keep a Logbook

Record all checks with date, payee, and purpose.

3. Avoid Blank Spaces

Blank spaces can be filled in by fraudsters.

4. Store Checks Safely

Keep checkbooks locked in a secure place.

5. Reconcile Often

Match manual records with bank statements.

6. Limit Who Can Write Checks

Set rules for staff to prevent misuse.

QuickBooks Printing Checks: Who Should Use It?

1. Businesses with Many Payments

Ideal for companies with lots of monthly payments.

2. Companies Seeking Efficiency

QuickBooks saves time and keeps automatic records.

3. Organizations Needing Professional Checks

Printed checks look neat and bank-ready.

4. Businesses Wanting Security

MICR printing, secure stock, and limited access reduce fraud.

5. Firms Needing Audit Trails

QuickBooks records make audits simple.

Manual Check Writing: Who Should Use It?

1. Small Businesses

Good for small firms with few payments.

2. Home or Personal Use

Use when software is not available.

3. Personal Touch Needed

Handwritten checks can feel more personal.

4. Temporary Use

Useful before QuickBooks setup is complete.

QuickBooks Printing Checks: Cost Considerations

1. Software Fee

A QuickBooks subscription is needed to print checks.

2. Check Stock Cost

Use QuickBooks-approved stock and toner.

3. Save Time and Labor

Efficiency may offset software costs for high-volume payments.

4. Long-Term Value

Fewer errors and automatic records save money over time.

5. Lower Bank Fees

Correct printing helps avoid bounced checks and penalties.

Manual Check Writing: Cost Considerations

1. Low Setup Cost

Only need checkbooks, pens, and a logbook.

2. High Labor Cost

Frequent checks take more time and staff effort.

3. Mistakes Can Cost Money

Errors can lead to fees, penalties, or reissued checks.

4. Risk of Loss

Fraud or lost checks can hurt cash flow.

5. Not Scalable

Manual checks get harder and costlier as business grows.

Small QuickBooks Tips on Printing Checks with a Separate Name

- Update Vendor Details

- Go to Vendors under the Expenses menu.

- Select the vendor and click Edit.

- Untick the box labeled “Print on check as”.

- Enter the payee name on which you want to draw the check.

- Handle Third-Party Payments

- Useful when a vendor raises a bill in their name, but payment must go to a third party due to an agreement.

- Ensures the check is correctly issued without changing vendor records.

- Maintain 1099 Compliance

- You can still generate the 1099 form in the vendor’s name at year-end.

- Keeps all tax and accounting records accurate and compliant.

- Simplify Accounting and Reconciliation

- Payments remain clear, traceable, and easy to track.

- Helps avoid confusion in accounting records and speeds up bank reconciliations.

Choosing between QuickBooks Printing Checks and manual check writing depends on your business size, payment volume, and need for accuracy. QuickBooks Printing Checks saves time, cuts errors, and provides a professional way to manage payments. It works best for businesses that want clear records, fewer mistakes, and secure payments. Manual checks may suit very small or home-based businesses, but they can be slow, error-prone, and hard to track. For growing businesses, QuickBooks Printing Checks is a smart way to boost efficiency, save time, and keep finances in check.

At Meru Accounting, we help businesses set up QuickBooks with ease. Our team guides you through setup, best practices, and ongoing support, so your check printing is fast, safe, and well-organized. Partner with us to simplify payments and focus on growing your business.

FAQs: QuickBooks Printing Checks vs. Manual Check Writing

- Can QuickBooks Printing Checks save time?

Yes, it prints multiple checks in minutes, saving hours of manual work. - Is manual check writing prone to errors?

Yes, handwriting mistakes and wrong amounts are common. - Do I need a printer for QuickBooks Printing Checks?

Yes, a printer and compatible check stock are required. - Can small businesses use QuickBooks Printing Checks?

Yes, even small businesses benefit from accuracy and professional checks. - Are manual checks secure?

Not as much; they can be lost, stolen, or altered easily. - Does QuickBooks record all printed checks?

Yes, every check is automatically saved in the accounting system. - Which method is cheaper for very small businesses?

Manual check writing may be cheaper initially, but less efficient in the long run.