Home » The Benefits of Using Professional Bookkeepers for CPA Firms.

The Benefits of Using Professional Bookkeepers for CPA Firms

Managing clients, taxes, audits, and deadlines is a lot for CPA firms. To grow and stay ahead, they often need expert help. Bookkeepers for CPA firms handle daily records and keep books clear and correct. This support lets CPAs focus on higher-level work. In this blog, we show how bookkeepers make a real impact. They cut errors, save time, and help with rule checks. With strong bookkeeping, CPAs give better advice and smart plans. This teamwork boosts speed, trust, and client care.

Why CPA Firms Need Dedicated Bookkeeping Support

CPA Workload Is Already Heavy

CPA firms handle many things like taxes, audits, planning, and advice. Tracking every invoice or bank entry can slow them down. CPA firms take over this work and lighten the load.

Clients Expect Speed

Today’s clients want fast answers. If a CPA spends time on basic records, client service may slow. Bookkeepers let CPAs give better support without delay.

Accuracy Matters

Bad books lead to bad results. Professional bookkeepers keep everything correct and clean. This helps CPAs avoid audit errors and client issues.

Staff Shortages Hurt Workflow

Not every CPA firm can afford to hire more full-time staff. Bookkeepers fill this gap with less cost and more skill.

Growth Demands Support

When firms grow, the books grow too. Without help, things fall through the cracks. Bookkeepers help keep growth on track.

What Do Professional Bookkeepers for CPA Firms Do?

Organize Daily Records

Bookkeepers log income and expenses daily. This keeps books current, neat, and ready for review. CPAs benefit from quick access to accurate financial data when advising clients.

Manage Bank Reconciliations

They reconcile bank statements with firm records. This prevents errors, builds trust, and keeps accounts aligned. With bookkeepers for CPA support, both firms and clients rely on consistent, verified financial accuracy.

Handle Payroll and Bills

Bookkeepers process payroll and manage bills. Payments go out on time, keeping staff and vendors satisfied. This avoids late fees and protects the firm’s credibility with employees and clients.

Support for Tax Prep

Clean records mean fast, accurate tax filing. Bookkeepers prepare detailed reports, allowing CPAs to file returns smoothly. This reduces last-minute stress and helps meet every client deadline with ease.

Build Custom Reports

Bookkeepers create tailored reports for CPA firms. These highlight cash flow, costs, and trends. CPAs can then present clear insights to clients, showing firm value while strengthening client relationships and trust.

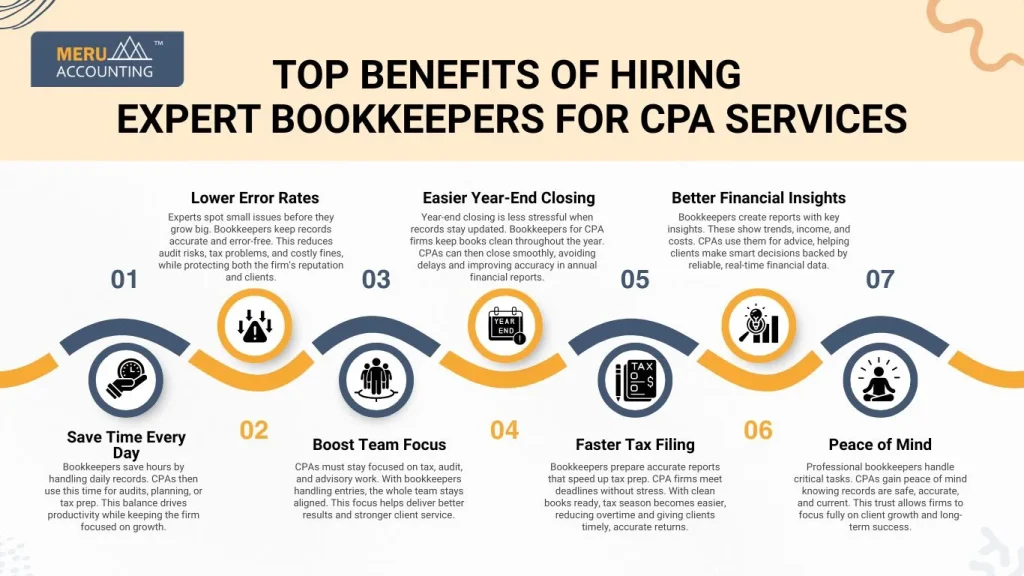

Top Benefits of Hiring Expert Bookkeepers for CPA Services

Save Time Every Day

Bookkeepers save hours by handling daily records. CPAs then use this time for audits, planning, or tax prep. This balance drives productivity while keeping the firm focused on growth.

Lower Error Rates

Experts spot small issues before they grow big. Bookkeepers keep records accurate and error-free. This reduces audit risks, tax problems, and costly fines, while protecting both the firm’s reputation and clients.

Boost Team Focus

CPAs must stay focused on tax, audit, and advisory work. With bookkeepers handling entries, the whole team stays aligned. This focus helps deliver better results and stronger client service.

Easier Year-End Closing

Year-end closing is less stressful when records stay updated. Bookkeepers for CPA firms keep books clean throughout the year. CPAs can then close smoothly, avoiding delays and improving accuracy in annual financial reports.

Faster Tax Filing

Bookkeepers prepare accurate reports that speed up tax prep. CPA firms meet deadlines without stress. With clean books ready, tax season becomes easier, reducing overtime and giving clients timely, accurate returns.

Better Financial Insights

Bookkeepers create reports with key insights. These show trends, income, and costs. CPAs use them for advice, helping clients make smart decisions backed by reliable, real-time financial data.

Peace of Mind

Professional bookkeepers handle critical tasks. CPAs gain peace of mind knowing records are safe, accurate, and current. This trust allows firms to focus fully on client growth and long-term success.

How Professional Bookkeepers Help Improve Client Relationships

Quick Report Access

Clients expect fast answers. Bookkeepers for CPA firms prepare accurate reports quickly. CPAs deliver updates on time, which boosts client confidence and improves the firm’s reputation for responsiveness and reliable financial support.

Clearer Cash Flow

Cash flow questions are common for clients. Bookkeepers for CPA firms track inflows and outflows daily. CPAs then share accurate insights, helping clients plan better and trust their advisors with key decisions.

Better Advice, Backed by Data

Timely records help CPAs give stronger advice. Bookkeepers ensure data is accurate, letting CPAs guide clients with confidence. This makes every client meeting valuable, backed by trusted financial information.

Less Waiting Time

Bookkeepers reduce delays by managing books fast. Clients get invoices, reports, and answers without long waits. CPA firms then improve client service and strengthen their reputation for efficiency and reliability.

Organized Client Files

Bookkeepers keep files neat and complete. Clients no longer face missing records or gaps. This organized approach improves trust and makes every financial review clear, simple, and professional.

Higher Trust

Smooth, error-free operations build client trust. Bookkeepers ensure this by keeping records accurate. Clients notice the reliability, leading to stronger relationships and long-term loyalty toward the CPA firm.

Cost and Time Savings with CPA Firms

No Need to Hire Full-Time Staff

Hiring staff full-time is costly. Bookkeepers deliver expert support without contracts. This flexibility reduces costs while giving firms reliable, skilled bookkeeping service whenever it’s needed.

Pay for What You Use

With bookkeepers, you only pay for the required work. Services scale up during busy tax periods or scale down later. This cost control helps firms stay lean and efficient.

Avoid Late Fees

Missing payments hurts cash flow. Bookkeepers monitor due dates, ensuring bills go out on time. This avoids late fees, protects vendor ties, and keeps the firm’s finances steady.

Cut Tech Costs

Some bookkeepers bring advanced software. CPA firms avoid extra tech costs and training fees. With expert tools included, bookkeepers improve accuracy, speed, and reporting without added expenses.

Reduce Workload for Senior CPAs

Top CPAs should focus on audits, advice, and tax strategy. Bookkeepers handle routine records, freeing senior staff for high-value work. This improves efficiency while raising the firm’s ability to serve clients.

Save on Tax Season Overtime

During tax season, overtime is common. Bookkeepers for CPA firms prepare records early, reducing extra hours. This saves money, prevents staff burnout, and makes the busiest season smoother for the whole team.

Common Mistakes CPA Firms Avoid with Professional Bookkeepers

Mixing Business and Personal Expenses

Bookkeepers separate personal and business expenses. This makes tax returns simpler, helps audits go smoothly, and keeps financial reports more reliable.

Skipping Regular Reviews

Bookkeepers perform frequent checks to catch problems early. CPA firms avoid major errors and stay ahead of issues before they grow bigger.

Poor Invoice Tracking

Unpaid invoices slow cash flow. Bookkeepers follow up on receivables, helping CPA firms maintain income and track due payments efficiently.

Missing Deductions

Bookkeepers log every eligible business expense. CPAs then find all deductions, reducing tax bills and helping clients save more.

Late Payroll Runs

Bookkeepers run payroll on schedule. This avoids staff complaints, builds trust, and ensures legal compliance with labor laws.

Wrong Account Codes

Coding errors cause confusion. Bookkeepers assign correct codes so financial statements remain clear, clean, and easy to read.

How to Choose the Right Bookkeeping Partner for a CPA Firm

Check Their CPA Experience

Choose bookkeepers who’ve worked with CPA firms. Their insight into audits, tax timelines, and firm structure means smoother collaboration.

Ask About Tools

Top bookkeepers use software like Xero, QuickBooks, and others. These tools improve accuracy, speed, and reporting for your firm.

Look for Flexibility

CPA workloads change each month. Choose bookkeepers who can adjust services based on busy seasons and slower periods.

Request Sample Work

Ask for examples of previous reports or work summaries. This shows the quality, clarity, and accuracy you can expect from your bookkeeping partner.

Ask About Data Safety

Client data must stay safe. Choose bookkeepers who follow secure practices like encryption and cloud backups to avoid breaches or data loss.

Choose a Clear Price Plan

Avoid surprise invoices. Pick bookkeepers with flat-rate or transparent pricing, so your firm can budget easily and predict monthly costs.

At Meru Accounting, we offer expert bookkeeping support that fits the needs of modern CPA firms. With deep knowledge of accounting tools and tax needs, our team makes sure your books stay clean and current. You focus on clients, we handle the rest.

FAQs

1. Why do CPA firms need bookkeepers?

CPA firms need bookkeepers to handle daily records and tasks. This frees up CPAs to focus on audits, tax filings, and client work.

2. Can outsourced bookkeepers use the tools my firm already has?

Yes. Most outsourced bookkeepers are skilled in many tools like QuickBooks, Xero, and cloud platforms.

3. Are bookkeepers for CPA firms cost-effective?

Yes. They reduce the need for full-time hires and help avoid costly errors or late fees.

4. How does bookkeeping improve tax filing?

Bookkeepers keep records current and clean. This helps CPAs prepare tax files faster and with fewer issues.

5. Is my firm’s data safe with an outsourced bookkeeper?

Good bookkeeping firms use secure, cloud-based tools to keep your data safe.

6. Will I still have control over my finances?

Absolutely. Bookkeepers manage records, but you stay in charge of decisions and oversight.