Which QuickBooks Features Are Essential for Efficient Virtual Bookkeeping Services?

QuickBooks is a strong tool for handling finances. For virtual bookkeeping, it has many built-in features that help save time, boost accuracy, and improve teamwork. These tools make it easier for virtual bookkeepers and clients to work together. Below, we look at the key QuickBooks features that help make remote bookkeeping smooth, and we touch on QuickBooks bookkeeping costs and how a virtual bookkeeper can help your business.

Why Choose QuickBooks for Virtual Bookkeeping?

- Easy to use for both bookkeepers and business owners.

- Cloud-based access from anywhere.

- Secure and real-time financial data.

- Good value compared to other software.

- Supports most accounting needs.

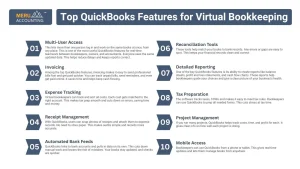

Top QuickBooks Features for Virtual Bookkeeping

- Multi-User Access

This lets more than one person log in and work on the same books at once, from any place. This is one of the most useful QuickBooks features for real-time teamwork between bookkeepers, owners, and accountants. Everyone sees the same updated data. This helps reduce delays and keeps reports correct. - Invoicing

Among the top QuickBooks features, invoicing makes it easy to send professional bills fast and get paid quicker. You can track unpaid bills, send reminders, and even get paid online. It saves time and helps keep cash flowing. - Expense Tracking

Virtual bookkeepers can track and sort all costs. Each cost gets matched to the right account. This makes tax prep smooth and cuts down on errors, saving time and money. - Receipt Management

With QuickBooks, users can snap photos of receipts and attach them to expense records. No need to store paper. This makes audits simple and records more accurate. - Automated Bank Feeds

QuickBooks links to bank accounts and pulls in data on its own. This cuts down manual work and lowers the risk of mistakes. Your books stay updated, and checks are quicker. - Reconciliation Tools

These tools help match your books to bank records. Any errors or gaps are easy to spot. This keeps your financial records clean and correct. - Detailed Reporting

One of the key QuickBooks features is its ability to create reports like balance sheets, profit and loss statements, and cash flow charts. These reports help bookkeepers guide your choices and give a clear picture of your business’s health. - Tax Preparation

The software tracks taxes, 1099s and makes it easy to meet tax rules. Bookkeepers can use QuickBooks to prep all needed forms. This cuts stress at tax time. - Project Management

If you run many projects, QuickBooks helps track costs, time, and profit for each. It gives clear info on how well each project is doing. - Mobile Access

Bookkeepers can use QuickBooks from a phone or tablet. This gives real-time updates and lets them manage books from anywhere.

Smart Ways to Lower QuickBooks Bookkeeping Costs

If you’re hiring a virtual bookkeeper to manage QuickBooks, use these tips to reduce your QuickBooks bookkeeping costs without sacrificing quality.

- Know What You Need

Think about your books. How many transactions? How complex? This helps avoid paying for extras. - Pick the Right Plan

QuickBooks and bookkeepers offer plans with different levels. Don’t overpay—choose what fits your size. - Understand the Fees

Some charge by the hour, others by the month. Know your options before you commit. - Use Automation

Use all built-in tools like auto-imports and rules. Less manual work means lower fees. - Check In Often

Make sure the work matches what you pay. Don’t let costs creep up without results. - Ask for Custom Plans

Need only some services? Ask for a plan made just for you. Tailored services can cut waste. - Check the ROI

A good bookkeeper helps you avoid fines and gives advice that grows your business. That’s value beyond the fee. - Negotiate

Rates aren’t set in stone. Talk to your bookkeeper. You might get a discount or a better plan.

Choosing the Right QuickBooks Plan

Plan | Best For | Key Features |

Simple Start | Solopreneurs | Invoicing, expenses |

Essentials | Small Teams | Bills, time tracking |

Plus | Growing Businesses | Projects, inventory |

Advanced | Larger Firms | Custom reporting, analytics |

How to Get Started with Virtual Bookkeeping

- Pick the Right Plan for You

Before you start virtual bookkeeping, check your business size, needs, and goals. Whether you run a one-person shop, a new startup, or a big business, there are plans made just for you. Look for plans that fit your budget—hourly, monthly, or by project—and include key things like reports, account checks, and software links. - Set Up Your Accounts List

Your accounts list is the base of your money system. It groups your money moves into clear parts like sales, costs, things you own, debts, and owner’s shares. A good accounts list helps you make clear reports and smart choices. Your bookkeeper can help set this up to match your business type. - Link Your Bank and Card Accounts

One big plus of virtual bookkeeping is that your data updates fast. Connect your bank, credit cards, and pay sites like PayPal or Stripe to cut down on typing and mistakes. This helps your bookkeeper check your money moves fast. Programs like QuickBooks, Xero, and Zoho Books make this easy and safe. - Add Your Virtual Bookkeeper

Once your money systems are ready, invite your bookkeeper in. Give them safe access to your software and data. Set clear roles and how often you want reports. Good talk at the start helps your bookkeeper keep your books right and keep you in the loop. - Track and Manage Your Money

Now you can track sales, costs, bills, pay, and more. Regular checks and monthly reports show you how your cash flows, if you make a profit, and trends in your business. Your bookkeeper will help you stay neat, legal, and ready for audits.

Why Virtual Bookkeeping is the Future

1. Saves Time and Space

- Old-school bookkeeping means paper files, face-to-face meetings, and lots of typing. Virtual bookkeeping cuts these out.It saves office space and trims your QuickBooks bookkeeping costs, giving you more time to grow your business.

2. Find Top Help from Anywhere

- You don’t have to hire nearby. Virtual bookkeeping lets you find skilled pros worldwide—often cheaper. Need someone who knows U.S. tax law or global rules? They’re just a click away.

3. Uses Tools Like QuickBooks for Speed

- Apps like QuickBooks, packed with smart QuickBooks features, help complete tasks quickly and accurately. They make invoices, pay bills, check banks, and write reports with a few clicks. These tools cut mistakes and give you quick views of your money, so you can act fast.

4. Cuts Errors and Keeps You Legal

- Virtual bookkeepers use good methods and software that guard your data. This cuts errors and wrong entries. Plus, cloud tools give updates and alerts to keep you on time with taxes and filings.

How QuickBooks Saves Time and Money

1. Cuts Down Manual Entry

- QuickBooks saves time by cutting down manual data entry. With features like automatic bank feeds, linked payment tools, and receipt capture, you don’t have to type in every transaction. This cuts errors and saves many hours, especially if you have lots of transactions.

2. Automates Routine Work

- QuickBooks does many tasks on its own, like sending invoices, paying bills, handling payroll, and sending reminders. You can set up repeat invoices for regular clients or schedule payroll at set times. This means less work for you and more steady money handling.

3. Lowers Need for In-House Staff

- By automating tasks, QuickBooks lets you need fewer full-time staff. You can use virtual bookkeepers or part-time pros instead. This cuts labor costs but keeps your records right and your business legal.

4. Helps Cut QuickBooks Bookkeeping Costs

- Virtual bookkeeping with QuickBooks costs less because it uses cloud tech and automation for fast, correct work. With fewer mistakes and smooth steps, your QuickBooks bookkeeping costs go down each month. Picking the right QuickBooks plan stops you from paying for features you don’t need.

Tips to Get the Most from QuickBooks for Virtual Bookkeeping

1. Check Bank Feeds Every Day

- Look at your bank feeds daily to match and sort transactions fast. This keeps your books fresh and helps spot mistakes early. It’s an easy habit that saves time later.

2. Set Up Recurring Invoices

- For clients you bill often, set up repeat invoices in QuickBooks. This keeps things steady and stops you from making new invoices by hand. You can also set reminders and late fees to help get paid on time.

3. Schedule Regular Reports

- QuickBooks can send you reports on profit, cash flow, and more. Set them to come weekly or monthly right to your inbox. These QuickBooks features help you see how your business is doing and plan well for future growth.

4. Use Mobile Apps for Work on the Go

- The QuickBooks app lets you send invoices, track costs, snap receipts, and check reports anywhere. This is great if you travel or run more than one spot. It gives you fast access to your books.

5. Learn the Dashboard for Quick Views

- The dashboard shows your money info at a glance. Spend time learning what each part means—income, costs, overdue bills, and more. This helps you make smart moves without deep dives.

Common Mistakes to Avoid

1. Not Setting User Rights Right

If you don’t set user access well, you risk security issues or wrong data changes. QuickBooks lets you give users only the rights they need. This keeps your data safe and neat.

2. Skipping Monthly Reconciliations

Reconciliation means matching QuickBooks to bank and card statements. Missing this step can cause unseen errors, wrong reports, and tax issues. Make sure to reconcile all accounts at least once a month.

3. Not Backing Up Desktop Data

If you use QuickBooks Desktop and don’t back up your files, you risk losing data from crashes or file problems. Set up automatic backups or use cloud storage to keep your data safe.

4. Not Checking Reports Often

Many skip QuickBooks’ reports, but these tools help you track cash flow, costs, and odd trends. Regular checks keep you ready for tax time and money plans.

5. Not Using App Integrations

QuickBooks works with many apps—payment tools, CRM, stock control, and payroll. Missing these links means more manual work and fewer chances to save time.

QuickBooks has many tools that make online bookkeeping fast and smart. With bank feeds, real-time reports, invoice tools, and mobile apps, you can manage your books with ease.

If you’re a freelancer, a small firm, or just getting started, knowing QuickBooks tools can help you cut costs and avoid mistakes. And with manageable QuickBooks bookkeeping costs, it’s a smart pick for any business, big or small. Meru Accounting, a trusted QuickBooks ProAdvisor, helps businesses get the most from these tools.

Their team offers setup, support, and full-service bookkeeping using QuickBooks.

With Meru’s help, your books stay clean, on time, and ready for smart business choices.

They serve global clients with a focus on quality, speed, and cost control.

FAQs

- What are the top QuickBooks tools for online bookkeeping?

Bank feeds, invoices, cost tracking, and live reports are key tools. - Is QuickBooks good for small firms?

Yes. It’s easy to use and has plans made for small firms. - What do QuickBooks bookkeeping costs start at?

Plans start at about $25/month for the app alone. - Can a remote bookkeeper use my QuickBooks?

Yes. You can add them as a user with limits. - Is QuickBooks safe for money data?

Yes. It uses strong security and cloud storage. - Can I track more than one firm in QuickBooks?

No. You’ll need one plan per firm. - Does QuickBooks work on phones?

Yes. It has an app for both iPhone and Android.