How a QuickBooks Virtual Assistant Can Cut Your Bookkeeping Costs

Bookkeeping costs are going up. Small business owners feel the pressure. Staff, software, and taxes make it worse. One smart way to lower costs is by hiring a QuickBooks virtual assistant. They are trained to use QuickBooks and handle books without full-time hours. They work from anywhere and save both time and money.

More business owners now pick virtual help, not full-time hires.. This smart move lowers costs, reduces errors, and gives more control over tasks. In this blog, we will show how a virtual assistant expert can help.

Who Is a QuickBooks Virtual Assistant?

A QuickBooks virtual assistant expert works from home or a remote office, helping businesses manage their books. They use QuickBooks to manage daily money tasks. They enter sales, handle bills, and send out reports. These experts do the job well without costing as much as an in-house worker.

What Makes Them Different?

They are skilled, work only when needed, and cost less than full-time bookkeepers. You also don’t need to give them space or buy them tools. They charge based on tasks or time worked. This helps you get the support you need without spending more.

Top Benefits of Working with a QuickBooks Virtual Assistant

Hiring a QuickBooks virtual assistant offers several key benefits. Here are the main ones:

Lower Staff Costs

You pay only for time worked. No need for fixed salaries or office expenses. This helps small firms cut their spending while still getting expert support from a trusted virtual assistant.

No Setup Expenses

You skip the cost of office gear, software, and tools. Your virtual assistant already has what they need. That means less money spent to start and faster results for your business.

Skilled and Ready Help

Virtual assistants for QB come trained and ready to go. You won’t waste time on setup or training. They get started quickly and manage your records with skill and care.

Flexible Work Plans

Hire help only when needed: hourly, weekly, or monthly. This saves money and gives you better control. Virtual assistants fit your needs without long-term costs or fixed shifts.

Fewer Mistakes

Mistakes cost time and money. Virtual assistants avoid errors by using the best methods. Your records stay clean, and you save money by not fixing past mistakes or missing key details.

Fast Financial Reports

Get clear reports whenever you need them. Virtual assistants for QuickBooks provide timely updates on profits, expenses, and taxes. These reports help you plan and prevent cash flow issues before they grow.

Easy to Scale

As your workload grows, bring in more help. During slow periods, scale back. Virtual assistants give you that flexibility, no long-term contracts or hiring stress when things change.

A virtual assistant helps you save more and do more. You won’t need to waste time or worry about mistakes. It gives you peace of mind while keeping your records clean.

They also bring outside views and fresh ideas to your workflow.

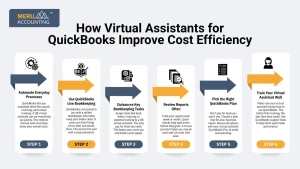

How Virtual Assistants for QuickBooks Improve Cost Efficiency

Virtual assistants for QuickBooks help you reduce costs in practical, effective ways. Here’s how:

Outsource Key Bookkeeping Tasks

Assign tasks like bank feeds, invoicing, or expense tracking to a QB virtual assistant. You only pay for what you need. This keeps your costs low and boosts work speed.

Use QuickBooks Live Bookkeeping

QuickBooks Live connects you with a skilled bookkeeper who helps keep your books clean. It saves you from fixing errors later and avoids fines. The service fits well with virtual assistants.

Automate Everyday Processes

QuickBooks lets you automate tasks like payroll, invoicing, and receipt tracking. A QB virtual assistant can set everything up quickly. This reduces manual work and helps lower your overall costs.

Review Reports Often

Track your reports each week or month. Quick checks help spot errors before they grow. A virtual assistant helps you stay on track and cut costs with ease.

Pick the Right QuickBooks Plan

Don’t pay for tools you won’t use. Choose a plan that fits your business needs. Review all options with your virtual assistant, QuickBooks Pro, to avoid overspending.

Train Your Virtual Assistant Well

Make sure your virtual assistant knows how to use QuickBooks. The better their training, the less time they waste. Use QuickBooks support tools to help them work faster and smarter.

Top Tasks Managed by a QuickBooks Virtual Assistant Specialist

An expert can do many jobs for your books. Some of the top tasks include:

Invoicing and Billing

They send invoices fast, track payments, and remind clients. This speeds up cash flow and avoids missed income.

Payment Tracking

They check for payments daily and log them on time. This keeps your books clean and your income accurate.

Bank Reconciliation

They match your bank entries with book records. This helps avoid balance errors and missing data.

Expense Management

They track costs, label them, and file them right. This helps control spending and cut waste.

Tax Records Support

They sort your tax data in neat files. This makes year-end filing smooth and stress-free.

Payroll Assistance

They prepare timesheets, wages, and payment slips. This keeps your team happy and payroll right.

Monthly Reports

They send reports on profits, cash flow, and costs. This shows you where money comes and goes.

They also manage records, follow up on unpaid bills, and keep your cash flow healthy. With less stress about money, you can focus on growth.

Industries That Benefit Most from Virtual Assistants for QuickBooks

Many types of businesses benefit from virtual assistants for QuickBooks. Let’s look at the top ones:

Online Stores

They track stock, returns, and daily sales. E-commerce moves fast, and a virtual assistant keeps records in sync.

Law and Health Offices

They keep clean books and handle payroll. Service-based firms need reliable support for billing and taxes.

Property Firms

They manage rent, fees, and costs. They also track payments, repair fees, and deposit returns.

Nonprofit Groups

They sort gifts and stay tax-ready. Nonprofits often have limited staff and need outside help.

Solo Workers and Startups

They need smart help at a low cost. A virtual assistant helps new businesses keep costs low while staying on track.

What to Look for When Hiring a QuickBooks Virtual Assistant

Choosing the best virtual assistant, QuickBooks Pro, is key. Follow these steps:

Check QuickBooks Skills

Make sure they know both QuickBooks Online and Desktop versions.

Review Their Work

Ask for examples or references. Make sure they’ve done this kind of job before.

Match Your Business Type

Find someone who knows your line of work, whether retail, services, or real estate.

Talk Before You Hire

Have a video or phone chat. Ask questions and check if you feel at ease.

Ask About Data Safety

Your data must stay safe. Ask how they protect files and systems.

Match Time Zones

Find someone who works when you need them. Time gaps can cause delays.

Start Small, Then Grow

Try a short task first. If they do well, give them more jobs. This helps build trust and ensures they fit your needs.

Ask for samples, test tasks, or a trial week. This is a safe way to start the work and test their skills.

Common Mistakes to Avoid While Outsourcing QuickBooks Tasks

Outsourcing QuickBooks can work great, but don’t make these common mistakes:

No Task List

Be clear on what needs to be done. Write tasks down to avoid confusion.

Picking on Price Alone

Low price might mean poor work. Focus on value and skill.

No Trial Period

Always test their skills first. A trial saves time and avoids risk.

Not Checking Safety Steps

Make sure your data is safe. Ask what tools they use and how they store files.

No Clear Chat

Talk often and ask for updates. Use tools like email or chat to stay in touch.

At Meru Accounting, we give expert QuickBooks virtual assistant support to help your business save more and do better. Our skilled team knows QuickBooks inside out and uses that to cut your costs, reduce mistakes, and improve how you handle books. We build plans that match your needs. Whether you want help by the hour, the week, or full-time, we offer support that fits just right.

FAQs

- What is a QuickBooks virtual assistant?

It is a trained expert who handles bookkeeping tasks using QuickBooks. They work online and help you manage records, invoices, reports, and more. - In What Ways Does a QB Virtual Assistant Save You Money?

They work part-time or task-based, so you avoid full-time wages. You also save on office costs, software, and staff training, making them a cost-effective choice. - Can virtual assistants for QuickBooks work with any business?

Yes. They help all types of firms, like retail, real estate, healthcare, and e-commerce. They can also support startups, nonprofits, and solo business owners. - Is my business data safe with a QB virtual assistant?

Yes, if you hire the right one. Trusted assistants use secure tools, strong passwords, and cloud-based systems to keep your data safe and private. - What tasks can a QB virtual assistant handle?

They manage invoices, track payments, sort expenses, handle payroll, and give reports. They also help with tax prep and daily bookkeeping jobs.