QuickBooks for Personal Finances: Easy Steps to Track Your Money

Handling your money can feel tricky, but QuickBooks for personal finances makes it simple. With the right setup, you can track what you earn, watch what you spend, and plan. QuickBooks helps you build better money habits by giving a clear view of income and expenses in one place. You can set budgets, track savings goals, and avoid overspending with timely insights. Whether you are planning for daily costs or long-term savings, using QuickBooks for personal finances brings clarity and confidence to every decision. This guide shows how to use QuickBooks to stay in charge of your funds and make wise calls.

Why QuickBooks is Ideal for Personal Finances?

Keeping track of cash is key to a calm life. Many find it hard to track bills, save funds, and note spends. QuickBooks for personal use gives a clear way to track each cent. It helps you see where funds go and keeps your records neat.

Benefits of Using QuickBooks

- Easy track of what you earn and spend

- Plan budgets and set goals

- Clear financial reports for smarter choices

- Mobile access for updates anywhere

QuickBooks is not just for businesses. It works well for personal money, too. By using it regularly, you can save time, reduce errors, and plan for a secure future.

Why Use QuickBooks for Personal Finances?

Using QuickBooks for your funds is not just about logging sums. It helps you make wise cash moves. Here’s why you should try it:

- One place for all accounts – Link bank, card, and even investment accounts.

- Clear spend views – See where most of your cash goes.

- Custom spend plans – Set month or year plans that fit your life.

- Live cash views – Get fresh info on your cash flow.

- Easy tax prep – Store all cost files in one place to make tax time smooth.

In short, QuickBooks for home funds helps you stay in charge and plan well for the days ahead.

Getting Started with QuickBooks for Personal Finances

Pick the right plan first. QuickBooks has both web and desktop plans. For most home use, QuickBooks Online is best. It is easy to use, works on your phone, and stays fresh on its own.

Steps to Start:

- Sign up for QuickBooks Online – Pick the plan that fits your budget and needs.

- Set up your profile – Add your name, email, and other info.

- Add your accounts – Link bank and card accounts for live cash views.

Once you are set up, you can move to the actual money management steps.

Key Features of QuickBooks for Personal Finances

Managing money is easier when you have the right tools. QuickBooks for personal finances gives you a clear way to track income, plan budgets, and stay on top of bills.

- Track What You Earn and Spend – See all cash in and out at a glance. Log bills, pay, and side jobs. Sort each deal to keep facts right and help with plans.

- Make Budgets – Set monthly caps for rent, bills, food, and fun. Track use on its own and change caps to match your cash flow for better control.

- Set Goals – Plan for savings, clear debt, or grow an emergency fund. QuickBooks tracks gains, shows graphs, and keeps you on course each month.

- View Reports – Get clear views of what you earn, spend, and save. Reports help spot high spend spots and guide your budget.

- Link Accounts – Link all bank, card, and app accounts. Sync deals on their own to keep your data fresh without handwork.

- Use on Any Device – Run your accounts from phone, tablet, or PC. Check your money from home, work, or while you travel.

- Get Alerts – Get notes for due bills, low funds, or high spends. These keep you on track and help you dodge late fees.

- Stay Safe – Keep your data safe with locks and auto saves. Your money facts stay safe from loss or fraud.

By using these tools, QuickBooks gives you a full view of your money and makes it easy to stay in charge.

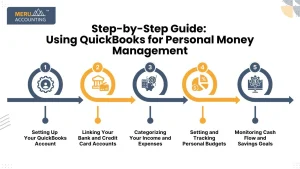

Step-by-Step Guide: Using QuickBooks for Personal Money Management

Tracking your money requires simple steps. Follow them to set up accounts, categorize transactions, and stay on budget.

Setting Up Your QuickBooks Account

After you log in, set your base currency, time zone, and account type. This makes your reports accurate. You can also customize categories like “Groceries”, “Bills”, “Travel”, etc.

Linking Your Bank and Credit Card Accounts

This step saves time. When you connect your accounts, QuickBooks automatically pulls in your transactions. You don’t have to add them one by one.

Categorizing Your Income and Expenses

This is key for clean reports. QuickBooks lets you tag transactions as “Income” or “Expense” and assign them to categories. For example:

- Salary → Income

- Netflix subscription → Entertainment

- Grocery shopping → Food

Setting and Tracking Personal Budgets

Go to the “Budgeting” section and set spending limits for each category. For example:

- Groceries → $300/month

- Dining Out → $100/month

QuickBooks will show if you are going over budget.

Monitoring Cash Flow and Savings Goals

The dashboard shows your monthly cash flow – how much money comes in and how much goes out. You can also create saving goals, like setting aside $500 for a trip.

Best Practices for Managing Personal Finances in QuickBooks

To make the most of QuickBooks, follow these tips:

- Check it weekly – Spend 10–15 minutes every week to review your accounts.

- Use clear categories – Don’t make too many confusing categories.

- Update budgets – Adjust budgets when your income or expenses change.

- Add notes – For big expenses, add a short note to remember why you spent it.

With these habits, QuickBooks for personal finances becomes more than a tracking tool; it becomes your money coach.

Common Mistakes to Avoid in Personal Money Care

Even with QuickBooks, some slips can hurt your flow. Steer clear of these traps:

Mixing Work and Personal Funds

- Keep work and home funds in their own accounts.

- If you mix them, it leads to a mess, wrong facts, and bad reports.

Skipping Account Checks

- Match bank and card notes each month.

- Make sure QuickBooks shows the same as your real cash.

Missing Repeat Deals

- Add repeat bills and pay in QuickBooks.

- This stops late payments and keeps cash flow smooth.

Not Adding Deals on Time

- Log deals often to keep your true cash view.

- If you wait, your view is wrong, and plans can fail.

Not Changing the Budget

- Check your spending plan each month to fit your cash.

- Change caps when your pay or costs shift.

Not Using Reports

- Read your earn and spend reports often.

- They show where you waste and where you can save.

Tips to Maximize QuickBooks for Personal Finances

QuickBooks can do more than just record money. Follow these tips to gain the most from it:

Using Alerts and Reminders

- Set alerts for bill payments or low balances.

- Get notified before deadlines to avoid fees or late payments.

Utilizing Mobile and Multi-Platform Access

- Use QuickBooks on your phone, tablet, or PC.

- Update transactions immediately for real-time tracking.

Customizing Reports for Clear Insights

- Choose the data points you want in your reports.

- Make reports easy to read and relevant to your goals.

How QuickBooks Helps Save Money

Track Every Expense

Know where every dollar goes and cut unnecessary spending.

Avoid Late Fees

Use reminders and automated payments.

Plan for Emergencies

Set aside money for emergencies and unexpected bills.

Reduce Errors

Automation reduces mistakes in records and reports.

Make Smarter Investments

Use financial insights to plan savings, stocks, or retirement funds.

Improve Credit Management

Track debts, payments, and credit card balances accurately.

See Long-Term Trends

QuickBooks helps spot patterns to plan for bigger goals.

QuickBooks for Personal Finances vs. Other Personal Finance Tools

There are many personal finance tools, like Mint, YNAB, and Excel sheets. Here’s why QuickBooks stands out:

Feature | QuickBooks | Mint | Excel |

Bank sync | Yes | Yes | Manual |

Budget tracking | Yes | Yes | Manual |

Reports & charts | Yes | Limited | Limited |

Tax-ready data | Yes | No | No |

Mobile app | Yes | Yes | No |

QuickBooks combines automation, budgeting, and tax features in one platform, making it ideal for personal finance management.

At Meru Accounting, we know that keeping track of your money can be as important as managing a business. While QuickBooks for personal finances is a great tool, the real value comes when your books are accurate and up to date.

Our team gives professional help with books, taxes, and pay tasks to help you get the most from QuickBooks. We log and sort each deal, make clear reports, and keep your tax files set when you need them.

FAQs

- Can I use QuickBooks only for personal money?

Yes. QuickBooks works well to track cash in, cash out, and savings for home use. - Is QuickBooks hard to learn for home funds?

No. It is easy to use. Start with the base tools and add more as you grow. - Do I need a work plan to use QuickBooks for home funds?

No. You can pick a plan that fits your home or your own use. - Can QuickBooks link with my bank?

Yes. You can link most banks and cards to see all your spending and income in one place. - How does QuickBooks help with budgets?

You can set a spending limit for each type of cost. It will show if you go over. - Is QuickBooks safe for my data?

Yes. QuickBooks uses high-grade data safety tools to protect your info. - Can QuickBooks help me with taxes?

Yes. It keeps all spending and income in one file to make tax time easy.