What Factors Influence the Cost of QuickBooks Bookkeeping Services?

Software is now commonly used in bookkeeping, simplifying many related processes. Among the various options available, QuickBooks stands out as a preferred choice for many businesses. QuickBooks bookkeeping has significantly improved efficiency in managing financial records, making it easier for companies to handle their day-to-day accounting needs. However, the cost of QuickBooks bookkeeping services can vary widely in the USA, influenced by several factors.

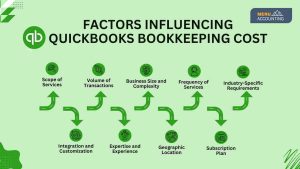

Factors Influencing QuickBooks Bookkeeping Cost

- Scope of Services

- Basic vs. Full-Service: Basic bookkeeping services include payroll management, expense tracking, and bank reconciliation. On the other hand, full-service bookkeeping includes more advanced tasks like financial statement preparation, analysis, and forecasting. The broader the service scope, the higher the QuickBooks bookkeeping cost.

- Additional Services: Businesses may require extra services like tax preparation, payroll processing, or financial consulting, which can further raise the overall cost.

- Volume of Transactions

- Transaction Frequency: The volume of transactions a business processes directly impacts the time and effort required for bookkeeping. High transaction volumes mean more data entry and reconciliation work, leading to a higher QuickBooks bookkeeping cost.

- Business Size and Complexity

- Number of Employees: Businesses with more employees generally have more complex financial requirements, such as payroll management, which adds to the bookkeeping workload.

- Revenue and Expenses: A higher volume of revenue and a diverse range of expenses can make bookkeeping more challenging and increase costs.

- Frequency of Services

- Monthly vs. Quarterly: The frequency of bookkeeping services also significantly determines the QuickBooks bookkeeping cost. Monthly services are more expensive than quarterly or annual services due to the increased workload.

- Monthly vs. Quarterly: The frequency of bookkeeping services also significantly determines the QuickBooks bookkeeping cost. Monthly services are more expensive than quarterly or annual services due to the increased workload.

- Industry-Specific Requirements

- Regulatory Compliance: Certain industries, such as healthcare or finance, have specific regulatory and reporting requirements that can add complexity to bookkeeping, influencing costs.

- Integration and Customization

- Software Integration: Customizing QuickBooks to work with other business systems or requiring specialized reporting can increase the service cost. Integrations that streamline operations are beneficial but may add to the overall QuickBooks bookkeeping cost.

- Customization Needs: Tailoring services to meet unique business needs, such as specific financial reports or dashboards, also affects pricing.

- Expertise and Experience

- Professional Qualifications: Bookkeepers with specialized certifications or extensive experience in the field often charge higher rates. The expertise of a QuickBooks virtual bookkeeper can add value but at a premium cost.

- Reputation and Reviews: Established firms known for their high-quality service may command higher fees due to their reputation and client trust.

- Geographic Location

- Cost of Living: Bookkeeping services are typically more expensive in high-cost living areas, such as major metropolitan cities, affecting the QuickBooks bookkeeping cost.

- Subscription Plan

- QuickBooks Plan: The QuickBooks subscription plan chosen also plays a significant role in the overall cost. More advanced plans with added features will cost more compared to basic plans.

Conclusion

Understanding the factors that affect QuickBooks bookkeeping cost helps businesses make informed decisions when selecting bookkeeping services. Opting for the right plan and frequency can ensure you get the most value from QuickBooks virtual bookkeeper services. For personalized support, consider Meru Accounting, a trusted provider that offers reliable QuickBooks virtual bookkeeper solutions tailored to your business needs. By leveraging their expertise, you can efficiently manage your bookkeeping while keeping costs under control. Choosing the right QuickBooks bookkeeping service can streamline your financial processes, save time, and ultimately help your business thrive.

FAQs

- What factors raise the cost of QuickBooks bookkeeping?

Service range, business size, and how often you need updates can raise the cost of QuickBooks bookkeeping.

- How does full-service QuickBooks bookkeeping differ from basic plans?

Full-service includes reports, analysis, and forecasts. Basic plans cover payroll, expenses, and bank checks.

- Why does a high number of transactions increase QuickBooks costs?

More transactions mean more entries, checks, and time, which makes the service cost more.

- Does business size affect QuickBooks bookkeeping prices?

Yes. More staff, higher sales, and more spending make the books harder to manage and cost more.

- Is monthly QuickBooks bookkeeping more costly than yearly plans?

Monthly plans need more work and updates, so they cost more than plans with less frequent service.

- Why do some fields pay more for QuickBooks bookkeeping?

Fields like health or finance have strict rules. This adds steps, which raise the total cost.

- How do custom reports impact QuickBooks bookkeeping fees?

Custom reports take more setup and checks. This adds to the time and cost of the service.

- Do skilled QuickBooks bookkeepers charge more?

Yes. Bookkeepers with proof of skill or long years of work charge more for their time.