Why Are Accounts Receivable Management Services a Game Changer for Improving Cash Flow?

Accounts Receivable (AR) Management Services improve cash flow by streamlining payment collection, reducing late payments, and ensuring timely revenue realization. They help businesses manage accounts efficiently, accelerate collections, minimize bad debts, and enhance overall cash flow, allowing companies to maintain financial stability and focus on growth.

Table of Contents

- Accounts Receivable Management Services for Improving Cash Flow

- Why Are Accounts Receivable Management Services a Game Changer for Improving Cash Flow?

- Integration of Accounts Receivable Management with Cash Flow Analytics

- Frequently Asked Questions (FAQs)

- Conclusion

- Summary

Accounts Receivable Management Services for Improving Cash Flow

Accounts Receivable (AR) Management Services play a vital role in improving cash flow by optimizing the process of collecting payments. These services handle invoicing, payment tracking, and follow-ups, ensuring timely collections and reducing the chances of late payments. By streamlining the AR process, businesses can shorten the time it takes to convert sales into cash, which is crucial for maintaining liquidity and supporting day-to-day operations.

Moreover, AR management services help businesses reduce the risk of bad debts by proactively managing customer accounts and identifying potential payment issues early. This leads to more predictable cash inflows, allowing businesses to focus on growth and financial stability.

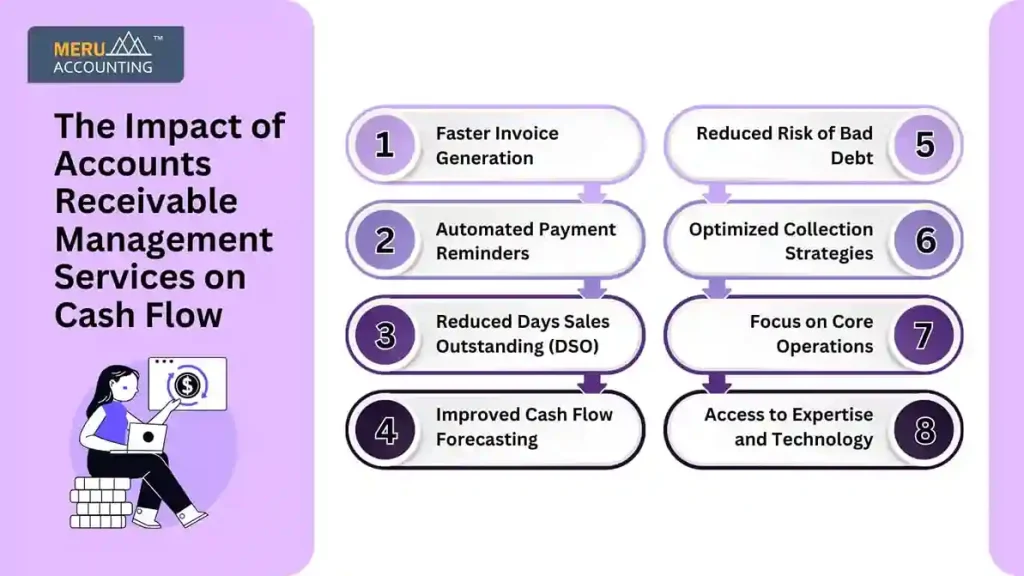

The Impact of Accounts Receivable Management Services on Cash Flow

- Faster Invoice Generation

Accounts receivable management services ensure timely and accurate invoice generation. By reducing delays in invoicing, businesses can accelerate the payment cycle, leading to quicker cash inflows. - Automated Payment Reminders

These services automated payment reminders and follow-ups, ensuring that customers are regularly notified about upcoming or overdue payments. This reduces the likelihood of missed payments and speeds up collections. - Reduced Days Sales Outstanding (DSO)

Effective management of receivables lowers Days Sales Outstanding (DSO), the average time it takes to collect payment after a sale. A lower DSO means faster access to cash, improving a business’s liquidity. - Improved Cash Flow Forecasting

Accounts receivable services provide accurate tracking of outstanding invoices, allowing businesses to forecast their cash flow more accurately. This enables better financial planning and ensures the business has enough cash to meet obligations. - Reduced Risk of Bad Debt

These services monitor customer payment habits and identify high-risk clients. Proactive actions, such as credit checks and early follow-ups, help reduce bad debt and minimize the impact of non-paying customers. - Optimized Collection Strategies

Accounts receivable management services implement efficient collection strategies tailored to each customer, ensuring that businesses receive payment promptly without harming customer relationships. - Focus on Core Operations

By outsourcing receivables management, businesses can focus on their core operations like sales and production, rather than spending valuable time on collections. This boosts overall productivity and business growth. - Access to Expertise and Technology

Professional services offer expertise and advanced tools for efficient receivables tracking, helping businesses optimize their cash flow management and reduce operational costs.

Integration of Accounts Receivable Management with Cash Flow Analytics

- Improved Cash Flow Forecasting: Integrating AR data with cash flow analytics enables more accurate cash flow forecasting by predicting future inflows based on outstanding invoices and payment trends.

- Real-Time Financial Visibility: The integration provides real-time access to both receivables and cash flow data, offering a comprehensive view of the business’s financial health and cash position.

- Identify Cash Shortages and Surpluses: Businesses can quickly identify potential cash shortages or surpluses, allowing for proactive adjustments to spending or investment strategies.

- Optimize Working Capital: By combining AR and cash flow data, businesses can optimize working capital, ensuring that funds are available for operations without overextending credit.

- Track Payment Trends: The integration helps track customer payment behaviors, enabling businesses to spot delays early and adjust collection strategies to maintain healthy cash flow.

- Data-Driven Decision Making: Businesses can make informed decisions about collections, expenses, and investments based on the insights provided by integrating AR management with cash flow analytics.

- Enhanced Liquidity Management: By monitoring both receivables and cash flow together, businesses can better manage liquidity, reducing the risk of a cash flow crisis.

- Prioritize Collections: The integration allows businesses to focus collection efforts on customers with overdue payments, improving overall cash inflow.

Frequently Asked Questions (FAQs)

- What is Accounts Receivable Management?

Ans. AR Management tracks and collects payments from customers to ensure timely cash flow. - How does AR management improve cash flow?

Ans. AR management speeds up collections, reduces bad debts, and enhances liquidity. - What are the benefits of outsourcing AR services?

Ans. Outsourcing reduces administrative tasks, improves collections, and allows focus on core business. - How can AR management reduce bad debts?

Ans. AR management monitors accounts, identifies risks, and prevents payment delays. - What role does data analytics play in AR management?

Ans. Data analytics helps identify payment trends, forecast cash flow, and optimize collections.

Conclusion

At Meru Accounting, our Accounts Receivable Management services play a vital role in improving cash flow for businesses by streamlining collections, reducing bad debts, and enhancing operational efficiency. Through timely follow-ups, data analytics, and proactive risk management, we help businesses optimize their financial health and ensure steady cash inflows.

By outsourcing AR functions to Meru Accounting, companies can focus on their growth while leaving the complexities of receivables management to our experts. Our services not only support better cash flow but also contribute to financial stability, empowering businesses to make informed, strategic decisions for long-term success.