How to Reconcile QuickBooks Self-Employed: A Simple Guide

If you run your own business, you know it’s key to keep track of your cash. One way is to check your QuickBooks Self-Employed often. Reconcile means to match the QuickBooks records with your bank and card statements to be sure all is right. This helps you find mistakes, avoid tax-time shocks, and see your cash well. In this blog, we will show you how to reconcile QuickBooks Self-Employed step by step. We will also share tips, common problems, and how these tips make your books easy to manage.

Introduction to QB Self-Employed

QB Self-Employed is a tool made for freelancers, small biz owners, and sole traders. It tracks cash in, cash out, miles, and tax all in one spot. But even with this tool, it’s key to reconcile QuickBooks Self-Employed on a set plan to keep your books clear and right.

Reconcile means the numbers in QuickBooks match your bank’s records. If you skip this, your reports could be wrong, and tax filing can be tough. So, let’s start by learning what reconcile means here.

Understanding the Reconcile QuickBooks Self-Employed Process

Reconciliation means comparing your QuickBooks transactions to your actual bank and credit card statements. The goal is to make sure all the transactions are recorded correctly, no amounts are missing, and nothing is duplicated.

QB Self-Employed connects to your bank accounts and pulls in transactions automatically. But sometimes, transactions can be miscategorized or missed. Reconciliation lets you find and fix these issues early.

Why Reconciliation Matters

- It helps spot mistakes before they cause bigger problems.

- It prevents fraud by showing any unusual activity.

- It gives you confidence that your financial reports are correct.

- It makes tax time easier by having accurate income and expenses.

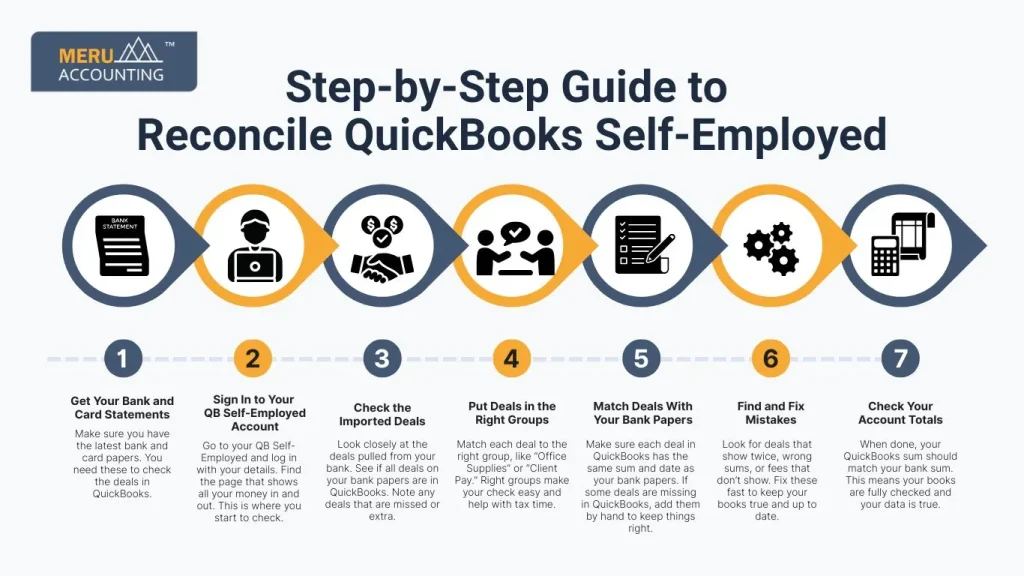

Step-by-Step Guide to Reconcile QuickBooks Self-Employed

Knowing how to reconcile QuickBooks Self-Employed helps you keep your financial records correct. Though it may seem tough at first, these clear steps will guide you through the process with ease.

1: Get Your Bank and Card Statements

Make sure you have the latest bank and card papers. You need these to check the deals in QuickBooks.

2: Sign In to Your QB Self-Employed Account

Go to your QB Self-Employed and log in with your details. Find the page that shows all your money in and out. This is where you start to check.

3: Check the Imported Deals

Look closely at the deals pulled from your bank. See if all deals on your bank papers are in QuickBooks. Note any deals that are missed or extra.

4: Put Deals in the Right Groups

Match each deal to the right group, like “Office Supplies” or “Client Pay.” Right groups make your check easy and help with tax time.

5: Match Deals With Your Bank Papers

Make sure each deal in QuickBooks has the same sum and date as your bank papers. If some deals are missing in QuickBooks, add them by hand to keep things right.

6: Find and Fix Mistakes

Look for deals that show twice, wrong sums, or fees that don’t show. Fix these fast to keep your books true and up to date.

7: Check Your Account Totals

When done, your QuickBooks sum should match your bank sum. This means your books are fully checked and your data is true.

How to Link Your Bank and Card Accounts in QuickBooks Self-Employed

Before you start to check your books, it’s key to link your bank and card accounts right to QB Self-Employed. This helps to pull deals fast and right.

Steps to Link Your Accounts:

Before you check, link your bank and card accounts well. This helps QuickBooks get your deals on its own and keep your books fresh.

1: Open the Banking Tab: Sign in to QB Self-Employed and click on the Banking tab. This is where all your linked accounts live.

2: Click “Add Account”: Hit the “Add Account” button to start linking a new bank or card account.

3: Pick Your Bank: From the list, pick your bank. If it’s not there, try to find it or add your deals by hand.

4: Put In Your Safe Login Info: Type your bank username and pass. QuickBooks uses a safe link to keep your info secure.

5: Start Syncing Deals: Once linked, QuickBooks starts to pull deals by itself. This saves time and cuts mistakes.

6: Check Sync Speed: QuickBooks updates your deals each day. Keep syncing to stay up to date and keep checks smooth.

Tips for Sorting Deals Before Checking

Good sorting makes checking books fast and clear. Use these tips to keep your deals neat.

1: Be the Same Every Time: Put like deals in the same group. This keeps your reports clean and easy to read.

2: Keep Personal and Work Deals Apart: Make sure personal deals don’t mix with work ones. This is key for the right books and taxes.

3: Check Unsorted Deals Weekly: Look at and sort any unsorted deals each week. This stops a pile-up that makes checks hard.

4: Use QuickBooks Rules to Sort: Set rules in QuickBooks to sort deals that come up a lot. This saves time and cuts errors.

5: Keep Groups Simple: Don’t make too many groups. Use broad, clear groups for easy work.

6: Check Groups Before You Check Books: Look at your groups before you start your book check to find and fix mistakes fast.

Good sorting helps you cut mistakes when you check your books in QB Self-Employed.

Common Challenges When Reconciling QB Self-Employed

Reconciliation can be tricky if you don’t know what to watch for. Here are common problems users face:

Duplicate Transactions

Sometimes the same transaction appears twice. Always check for duplicates and remove the extras before reconciling.

Missing Transactions

Your bank feed may miss some transactions. Look for gaps and enter any missing entries manually.

Incorrect Categorization

Wrongly categorized transactions distort your financial reports. Double-check categories to keep reports reliable.

Timing Differences

Transactions may show up in QuickBooks before or after your bank statement date. Keep track of these timing gaps to avoid confusion.

Bank Fees or Interest Charges

Bank fees or interest may appear only on your bank statement. Add these to QuickBooks to match balances.

Manual Entry Mistakes

If you enter transactions manually, watch out for typos or wrong amounts that can throw off reconciliation.

By knowing these challenges, you can handle them better and keep your books accurate.

Benefits of Regularly Reconciling QB Self-Employed

Here are the benefits that make it worth your effort.

- Clear Financial Picture: Know exactly where your cash stands at all times. This helps you plan well and make smart choices.

- Catch Mistakes Early: Find and fix errors before they cause big trouble. Small fixes now save you time and cash later.

- Simplify Tax Time: Clean and right books make tax work quick and easy. You will have less stress when tax day comes.

- Prevent Fraud: Spot strange deals fast and keep your money safe. Early checks help stop fraud from growing.

- Save Money: Avoid bank fees or lost tax breaks by keeping tabs on your cash. Good records help you claim all you should.

Regular reconciliation is a simple habit with big payoffs.

Using Reports to Verify Your Reconciliation in QuickBooks Self-Employed

After reconciling, use reports to confirm your work and keep track of finances.

Transaction Report

Shows a list of all income and expenses. Review it to verify your transactions.

Profit and Loss Report

Summarizes your earnings and expenses over a period. Use it to check your business health.

Expense by Category Report

Breaks down spending by category. Spot any unusual or high expenses that need attention.

Bank Reconciliation Report

Shows your reconciled transactions and differences. This helps confirm that accounts match your bank.

Cash Flow Report

Tracks money coming in and going out. Useful for managing daily operations.

Tax Summary Report

Summarizes taxable income and deductible expenses. Helpful for tax preparation.

Use these reports to verify your accounts and make decisions based on accurate data.

At Meru Accounting, our team knows QB Self-Employed well. We make sure your books are right, neat, and ready for tax time. Whether you are a freelancer, sole trader, or small business owner, we tailor our help to you.

FAQs

- What does it mean to reconcile QuickBooks Self-Employed?

Reconcile means you check that QuickBooks deals match your bank and card statements. It helps keep your books right and full. - How often should I reconcile my QB Self-Employed account?

It’s best to do this each month. Checks on a set plan catch mistakes fast and keep your cash clear. - Can QB Self-Employed do reconciliation on its own?

QuickBooks brings in deals by itself, but you still need to check and match them by hand to keep things right. - What do I do if I see deals twice in QuickBooks?

If deals show twice, delete the extras to stop mistakes in your money reports. - How do I fix missing transactions during reconciliation?

Check your bank statements carefully. If some transactions are missing in QuickBooks, add them manually.

- Why are some transactions not matching the bank statement dates?

Timing differences happen because some transactions post on different days in your bank and QuickBooks. Make notes of these and review regularly.