Why Hiring Remote Bookkeeping Services is the Best Strategy for CPA Firms?

Keeping books and records in order is a big part of the work for CPA firms. But as work grows and deadlines get close, it gets hard to stay on top of day-to-day tasks. Hiring a full-time staff can cost more and take time to manage. That’s why more CPA firms now choose remote bookkeeping to ease their load.

With remote accounting services, firms can pass simple tasks to skilled workers who work from anywhere. These pros handle data entry, checks, monthly reports, and payroll help. A remote bookkeeper brings speed, skill, and saves space and money.

This plan helps CPA firms focus more on audits, tax help, and other key tasks. It boosts output, cuts costs, and keeps the books clean and ready. In this blog, we will see why remote bookkeeping is a smart move for CPA firms.

What is Remote Bookkeeping?

Remote bookkeeping is the process of tracking a firm’s financial tasks from a different place, often online, without being at the office. Unlike full-time accountants, bookkeepers focus on day-to-day records. They handle payments, create and send invoices, collect dues, and log entries in the firm’s books.

They may also track stock, manage petty cash, and ensure all transactions are in order. Many bookkeepers now work from home, making remote accounting services ideal for startups and small firms. In big companies, bookkeeping teams often report to the Chief Finance Officer.

What is the Importance of Bookkeeping for CPA Firms?

Bookkeeping is the base of every CPA firm. It keeps the money side of things in check. Without it, tax work, planning, and audits can go wrong. A strong bookkeeping system helps CPA firms do their job with less risk and more trust.

Here are the top reasons why bookkeeping is so important:

1. Accurate Financial Records

- Tracks all money that comes in and goes out.

- Keeps records neat, correct, and up-to-date.

- Helps find errors early and fix them fast.

- Gives a full view of where the business stands.

2. Smooth Tax Filing

- Makes tax time simple and stress-free.

- All needed records are ready in one place.

- Avoids mistakes that may lead to fines or delays.

- CPA firms can file taxes fast and with full confidence.

3. Better Client Service

- Clean books help CPAs give smart advice.

- Clients trust advice that is based on good data.

- Shows clients that the firm is skilled and on time.

- Makes it easy to spot problems and fix them early.

4. Saves Time During Audits

- Well-kept books are easy to check and verify.

- Reduces time spent digging for lost data.

- Makes audits faster and more smooth.

- Gives proof of good work and clean money records.

5. Helps with Planning

- Good records show trends in income and costs.

- Helps build smart budgets and set money goals.

- Firms can guide clients to make wise choices.

- Makes it easy to plan for tax, growth, and cuts.

6. Legal Compliance

- Laws need records to be clear and stored well.

- Bookkeeping helps CPA firms meet all rules.

- Keeps records ready for audits or checks by law.

- Avoids fines, tax issues, or other legal risks.

7. Supports Business Growth

- Gives facts that guide smart growth steps.

- Shows what parts of the firm make the most gain.

- Helps firms spot new chances to earn more.

- Strong records build a strong base to grow from.

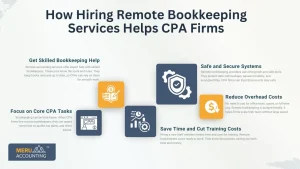

How Hiring Remote Bookkeeping Services Helps CPA Firms

Outsourcing bookkeeping through remote accounting services can help CPA firms grow and work better.

1. Focus on Core CPA Tasks

Bookkeeping can be time-heavy. When CPA firms hire remote bookkeepers, they can spend more time on audits, tax plans, and client advice.

2. Get Skilled Bookkeeping Help

Remote accounting services offer expert help with skilled bookkeepers. These pros know the tools and rules. They keep books neat and up to date, so CPAs can rely on them for smooth work.

3. Save Time and Cut Training Costs

Hiring a new staff member means time and cost for training. Remote bookkeepers come ready to work. They know the process, saving you both time and money.

4. Safe and Secure Systems

Remote bookkeeping providers use strong tech and safe tools. They protect data with backups, password safety, and encrypted files. CPA firms can trust that records stay safe.

5. Reduce Overhead Costs

No need to pay for office tools, space, or full-time pay. Remote bookkeeping is budget-friendly. It helps firms scale their team without large spend.

Skills Needed for Remote Bookkeeping Jobs

To do well in remote bookkeeping jobs, one must have both soft and technical skills. A good remote bookkeeper should be able to work alone, handle data with care, and stay on top of tasks.

Here are the key skills needed:

Strong Focus and Care for Details

- A small mistake in a book can lead to big problems.

- Remote bookkeepers must check every entry with care.

- Double-checking helps avoid errors and keeps records clean.

Good Use of Tools like QuickBooks, Xero, or Zoho

- Bookkeepers must know how to use cloud tools well.

- Tools like QuickBooks, Xero, and Zoho make the work fast and easy.

- These tools help with tracking, reports, and data sharing.

Ability to Meet Deadlines

- Bookkeeping tasks must be done on time, every time.

- Late work can delay tax filing or audits.

- A good remote bookkeeper knows how to plan and meet deadlines.

Knowledge of Tax Rules and Compliance

- Understanding tax laws is key for clean books.

- A bookkeeper must follow the rules in the client’s state or country.

- This helps CPA firms stay compliant and avoid legal issues.

Good Talk and Writing Skills

- Clear talk helps when sharing updates or asking for data.

- Remote teams rely on emails, calls, or chat tools.

- A bookkeeper must explain reports and data in simple words.

High Level of Trust and Ethics

- Bookkeepers handle private money data.

- A remote bookkeeper must keep all info safe and private.

- Trust and honesty are key parts of this job.

Common Duties of a Remote Bookkeeper

Remote bookkeepers work on many key tasks. These include:

Data Entry

Log bills, receipts, invoices, and track costs or stock if needed.

Payroll

Track hours, process wages, and update tax data or paid leave.

Payables and Debts

Keep vendor bills up to date, manage due payments, and record outflows.

Receivables

Track money that comes in, post receipts, and update accounts.

Bank Reconciliations

Match records with bank data and flag errors or gaps.

Why CPA Firms Choose Remote Bookkeeping?

1. Reduces Costs

- No office space or full-time salaries needed.

- You only pay for services you use.

2. Increases Efficiency

- Bookkeeping through remote accounting services is handled by experts who know CPA workflows.

- CPA firms save time and avoid errors.

3. Access to Skilled Remote Bookkeepers

- You can hire the best talent from anywhere.

- Many have years of experience with CPA workflows.

Benefits of Remote Bookkeeping for CPA Firms

1. Lower Overhead Expenses

- No need to buy office tools or furniture.

- Save on insurance and other employee costs.

2. Scalable Services

- Add or reduce bookkeeping tasks anytime.

- Ideal for both small and large CPA firms.

3. Improved Focus on Core Services

- CPA firms can focus more on tax planning and audits.

- Leave daily financial entries to the remote bookkeeper.

4. Round-the-Clock Service

- Get support in different time zones.

- Your books can be updated even after your office closes.

5. Easy Integration with Cloud Tools

- Most remote accounting services use tools like QuickBooks, Xero, Zoho, etc.

- CPA firms get real-time access to financial data.

How Remote Bookkeepers Improve Workflow

1. Timely Updates

- Transactions are recorded daily or weekly.

- No backlog of work at tax time.

2. Organized Records

- Everything is in proper order and easy to access.

- Reduces time spent during audits or reviews.

3. Better Communication

- Email, calls, or cloud chat tools make it easy to connect.

- Clear updates and reports are shared regularly.

Hiring remote bookkeeping services is a smart move for CPA firms. It brings skill, saves cost, and helps teams stay lean and focused. Firms can reduce admin work, boost data safety, and give clients faster service.

At Meru Accounting, we offer trusted remote accounting services and high-quality bookkeeping for CPA firms. Our skilled team uses top tools and gives strong support, so you can focus on what you do best. Let us help you scale with peace of mind and expert care.

FAQs

Q1. What is remote bookkeeping?

It is managing books from a distance using cloud tools.

Q2. Is a remote bookkeeper as good as an in-house one?

Yes, and often more efficient and affordable.

Q3. Can remote accounting services handle tax season?

Yes, they prepare reports and records on time for filing.

Q4. Are my financial records safe with a remote bookkeeper?

Yes, they use secure systems and encryption.

Q5. What tools do remote bookkeepers use?

They use tools like QuickBooks, Xero, and Zoho Books.

Q6. How do I talk to my remote bookkeeper?

You can call, email, or chat using online tools.

Q7. Can CPA firms scale up services with remote bookkeeping?

Yes, you can increase or decrease work as needed.