Home » Tax Planning Strategies for US Small Businesses in 2023.

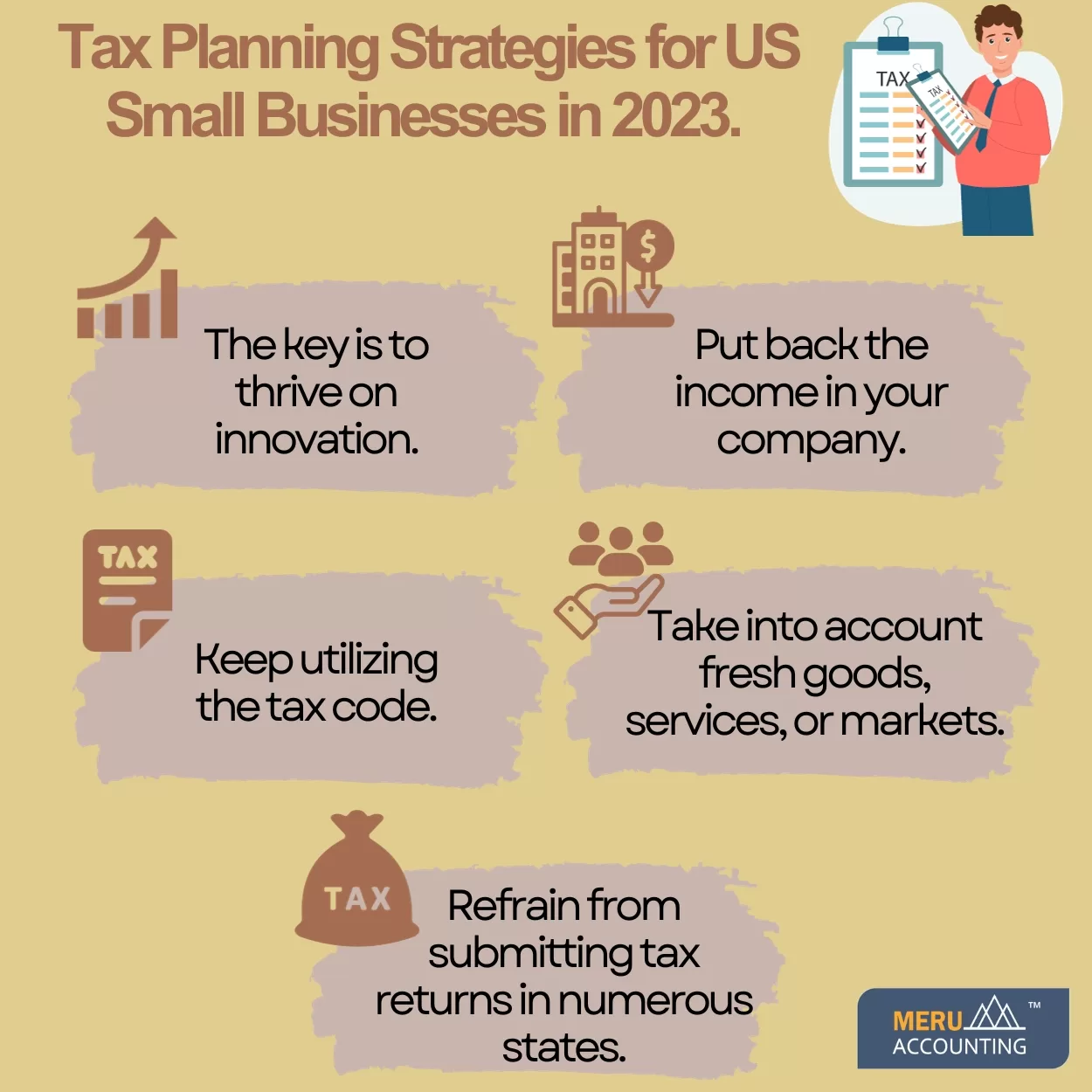

Tax Planning Strategies for US Small Businesses in 2023.

When it comes to preparing for small businesses, the tax code is the most potent instrument available to the country. You’ll be able to expand your business and ensure that you’re not passing up any chances for growth or profitability by being aware of how the tax law can be employed by business owners. In this In this guide , we will discuss about the different tax strategies for small business owners.1. Thrive on Innovation.

The secret to effective tax planning for small business is innovation. It’s an ongoing process that entails coming up with new goods, services, and markets as well as fresh approaches to old problems. You must be able to: in order to compete on a level of innovation.- Improve your product or service (for instance, create a better mousetrap).

- Develop new markets for it (ex., offer it exclusively online).

2. Put income back into your company.

Reinvesting your income back into your company is a terrific method to increase profits and expand your enterprise. Reinvesting involves taking gains from one year and investing them in the next so that they will be larger the following year when they are once again available for reinvestment. We hope this part is helpful if this sounds like something you might want to do or if it sounds like something that might benefit any tax planning for small businesses read this blog!3. Effectively use the tax code as a tax strategy for small business.

You must understand how the tax system functions in order to benefit from it. Although education and experience are the best routes to take, they are not an option if you are short on time or money. Fortunately, there are many online resources that can instruct you on taxes in 2023 and beyond—one of them might be appropriate for your company!4. Take into account fresh goods, services, or markets.

Adding new items to your line of business can help you diversify it and increase its profitability. By offering special incentives that distinguish you from rivals, you may also use them to draw in new clients or boost sales. People who want healthier options without having to pay more for them at the grocery store or department store may be drawn to your natural personal care products, for instance. Many business owners underestimate how much money they spend on tax preparation services each year, but accounting services help small businesses remain on top of their finances so they don’t run into difficulties when things become tight.5. Refrain from submitting tax returns in numerous states.

You must always bear in mind that taxes are only one aspect of running a small business. The tax code is very intricate and complex; if you don’t know what you’re doing, it might be used against you. Moving your company within the state or between states is the greatest method to avoid this. When filing taxes each year, all of your employees would be based in one place as opposed to several. What if they reside other than your home office? When compared to other taxes paid by businesses in addition to their salaries (like property taxes), they will pay more in rent but less overall. Looking for an effective tax strategy for small business? Meru Accounting is here to help create effective tax strategies for small business owners that will allow them to save a lot of money on taxes.