Why Bookkeeping for Trading Firms Is Essential?

Like all businesses, trading firms must keep accurate bookkeeping and financial records. However, trading is not the same as service or manufacturing. The core parts of trading are merchandise, stock, and inventory. These elements need a more tailored bookkeeping method. While general accounting rules apply, bookkeeping for trading firms needs a more focused approach. In the U.S., trading firms must follow strict tax laws and accounting rules. Without strong bookkeeping, they may face compliance issues, missed deductions, or tax fines. Inaccurate records can also cause trouble during tax filing. To avoid these issues, many firms hire experts in bookkeeping for trades.

What Is Bookkeeping for Trading Firms?

- Bookkeeping is the process of recording all business transactions.

- For trading firms, it includes trade logs, stock purchases, sales, profits, and losses.

- It also tracks tax payments, fees, and other costs.

- Bookkeeping for trading firms helps show the full picture of a firm’s cash flow.

- These records help make better decisions based on facts.

Key Considerations in Bookkeeping for Trading Firms

Here are the main areas trading firms should focus on for proper bookkeeping:

1. Sales and Purchase Management

- Record all sales and purchase entries with care.

- Reconcile these entries often to avoid errors.

- Track goods sold or bought by item or batch.

- Calculate profits or losses by batch or sales agent.

- Group sales by agent for easier reporting.

This helps firms report profits and file taxes more accurately.

2. Using Accounting Software

Modern software makes bookkeeping faster and easier. Firms should:

- Use tools like QuickBooks, Xero, Zoho Books, or FreshBooks.

- Record each transaction in real time.

- Create reports that suit their needs.

- Set reports to go to the Federal Tax Authority.

- Design invoice formats and use batch invoicing.

- Prepare monthly, quarterly, and yearly reports.

Using software cuts down on errors and saves time.

3. Cost and Expense Analysis

Firms must track costs to control spending. They should:

- Assign item-wise costs for better pricing.

- Track salaries, overheads, and other fixed costs.

- Divide shipping costs by product category.

- Calculate agent commissions correctly.

- Record marketing and promotion expenses.

Smart cost tracking improves budget control and profits.

4. Order and Inventory Management

Inventory is a key part of any trading firm. To manage it well, firms must:

- Follow global accounting rules for stock tracking.

- Match inventory reports with actual stock each month.

- Record free or promotional items the right way.

- Keep separate records for in-house and retail stock.

Good inventory tracking keeps stock steady and cash flow strong.

5. Tax Management

Tax rules for trading firms in the U.S. can be complex. Firms must:

- Use the right tax rates for each product group.

- Record all taxed transactions properly.

- Follow both federal and state tax laws.

Proper bookkeeping for trading firms helps avoid tax errors and late filings.

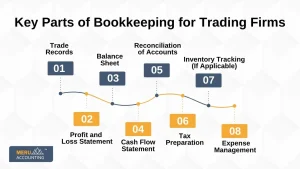

Key Parts of Bookkeeping for Trading Firms

1. Trade Records

- Every buy or sell must be recorded.

- Include date, time, value, and trade type.

2. Profit and Loss Statement

- Shows if your firm is gaining or losing money.

- Helps you check if your trading methods work.

3. Balance Sheet

- Shows what your firm owns and owes.

- Helps track total assets, cash, and liabilities.

4. Cash Flow Statement

- Records all cash that enters or leaves the business.

- Helps in managing liquidity.

5. Reconciliation of Accounts

- Compares firm records with bank records.

- Ensures there are no missing or wrong entries.

6. Inventory Tracking (If Applicable)

- Useful for trading goods and not just securities.

- Helps maintain proper stock levels.

7. Expense Management

- All business costs should be tracked.

- Includes rent, utilities, software fees, broker charges, etc.

8. Tax Preparation

- Proper records make filing taxes simple.

- Reduces last-minute stress and errors.

Tools Used in Bookkeeping for Trading Firms

1. Accounting Software

- Tools like QuickBooks, Xero, or Zoho Books are helpful.

- They reduce manual work and improve accuracy.

2. Spreadsheets

- Small firms may start with Excel or Google Sheets.

- Spreadsheets help with trade records and cash flow.

3. Inventory Software

- Helps in managing goods if you trade products.

- Integrates with accounting systems.

4. CRM and Trading Platforms

- Some tools can connect trading platforms to accounting systems.

- This helps with real-time data entry.

Common Mistakes in Bookkeeping for Trades

1. Not Recording Small Transactions

- Every transaction, big or small, matters.

- Skipping entries can lead to errors.

2. Mixing Personal and Business Funds

- Always keep separate accounts.

- This avoids confusion during tax filing.

3. Delayed Entry of Records

- Enter data regularly, not just at month-end.

- Delays lead to missed or wrong data.

4. Not Backing Up Records

- Always have a backup of your financial data.

- Use cloud storage or external drives.

5. Ignoring Trading Fees

- Many traders forget to log commission or platform fees.

- These affect your actual profit margins.

Benefits of Hiring a Professional Bookkeeper

1. Saves Time

- Letting experts handle bookkeeping frees your time for trading.

2. Reduces Errors

- Professionals avoid common financial mistakes.

3. Better Reports

- You get cleaner, detailed reports for decision-making.

4. Tax Savings

- Experts know what deductions you can claim.

5. Peace of Mind

- You’ll feel more secure knowing your books are in order.

How Often Should You Update Your Books?

1. Daily or Weekly Updates

- Update your books each day or week.

- It helps catch mistakes fast and saves time later.

- Track sales, costs, and payments in real time.

- Avoid a backlog of unrecorded tasks.

2. Monthly Reviews

- Check your books at the end of each month.

- Spot trends and changes in income or spending.

- Fix any errors or missed entries.

- Prepare reports to guide your business.

3. Quarterly Checks

- Review full data each quarter.

- Compare goals to what was earned or spent.

- Plan taxes, bills, and growth.

- Look at profits, losses, and cash flow.

4. Year-End Updates

- At year-end, close all books.

- Get records ready for taxes and audits.

- Check that all data is full and right.

- Make final reports to wrap up the year.

Tips to Improve Bookkeeping for Trading Firms

1. Use Cloud-Based Tools

- They are secure, easy to use, and accessible anywhere.

2. Automate Repetitive Tasks

- Use software that auto-syncs with your trading accounts.

3. Review Your Reports Monthly

- Look at cash flow, profit/loss, and balance sheet regularly.

4. Stay Updated on Tax Rules

- Rules change often, especially in trading.

- Be aware of what’s new to avoid penalties.

5. Take Expert Help When Needed

- Don’t try to do everything on your own.

- Bookkeeping services are often affordable and reliable.

Role of Bookkeeping in Risk Management

1. Identifies Loss Patterns

- Bookkeeping for trades helps spot repeated losses in specific trades or sectors.

- Firms can change or stop strategies that don’t work.

2. Tracks Leverage and Margin Use

- Bookkeeping for trading firms records margin use.

- This helps avoid over-leveraging and margin calls.

3. Controls Budget and Capital Use

- Keeps track of how much money is being risked daily.

- Prevents overspending or exceeding trading limits

Legal and Regulatory Importance of Bookkeeping

1. Fulfills Legal Obligations

- Trading firms must maintain clear records to meet tax and legal rules.

- Missing data can lead to legal actions or audits.

2. Helps in the Case of an Audit

- Clean records make audits less stressful.

- Auditors can easily see proof of income and expenses.

3. Meets Broker or Exchange Requirements

- Many exchanges require firms to show capital and cash flow.

- Bookkeeping supports compliance.

Bookkeeping for trading firms is not just about keeping records. It’s about running your business the right way. With proper bookkeeping for trades, you can track money, follow rules, and grow your business with confidence.

It may feel like extra work, but it saves you from big issues later. Whether you trade stocks, goods, or crypto, good books help you stay on track. Doing your own books can be hard for trading firms. Small errors can lead to money loss, tax fines, or legal trouble. When you hire pros, your books stay clean and follow the rules. It also saves time, cuts stress, and gives you clear money reports.

Meru Accounting offers skilled bookkeeping for trades and has served many U.S.-based trading firms. Our team knows the tax and accounting rules that apply to the trading industry.

We help your firm stay compliant, organized, and ready to grow.

FAQs

1. What is bookkeeping for trades?

Bookkeeping for trades means tracking all money in and out of a trading firm. This includes buys, sells, gains, losses, and fees.

2. Why is bookkeeping important for trading firms?

It helps you track gains, manage costs, and avoid tax trouble. Good records also show how your trades perform over time.

3. Can I do bookkeeping by myself?

Yes. But a skilled bookkeeper can save you time, cut down on errors, and help with reports.

4. Which software is best for a trading firm’s bookkeeping?

QuickBooks, Xero, and Zoho Books are top picks. They are easy to use and suit many firm sizes.

5. How often should I update my books?

Update your books each week. Then, do a full review once a month to stay on track.

6. Does bookkeeping help with taxes?

Yes. Clean books make tax filing fast, easy, and correct. You may also spot ways to save.

7. What happens if I don’t keep good records?

You might pay fines, miss tax dates, or make bad calls. Poor records can also hurt trust and growth.