Trucking Industry Accounting Trends and How They Affect Your Finances

The trucking field, along with strong trucking industry accounting, is one of the most important parts of the U.S. economy. Trucks move over 70% of all freight across the country. They help keep shelves stocked, factories running, and goods moving. The work truckers do supports jobs in trade, retail, farming, and beyond.

But in 2024, the trucking world is facing changes. New trends are shaping how truckers earn, spend, and plan their money. From fuel costs to tech tools, each shift has an impact. That’s why truckers, fleet owners, and logistics firms are turning to truck driver accountants and trucking industry accounting experts to guide their money plans.

This guide explores the most important trends in trucking, what they mean for your wallet, and how smart accounting helps you stay ahead.

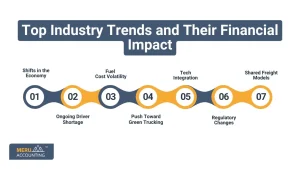

Top Industry Trends and Their Financial Impact

1. Shifts in the Economy

The U.S. economy plays a huge role in the health of the trucking sector. When the economy grows, more freight needs to move. That means more jobs and income for truckers. But when the market slows down, freight demand drops, leading to fewer runs and lower pay.

Inflation also affects the cost of running trucks. Prices for parts, gear, fuel, and even meals on the road have gone up. This makes it harder to stay within budget. That’s where the trucking industry accounting plays an important role in building better plans and helps manage rising costs.

Financial Impact:

- Up-and-down income streams

- Rising costs for repairs, parts, and supplies

- Higher need for strong budgeting and financial planning

How Trucking Accountants Help:

They build flexible plans, help you prepare for cash flow dips, and track rising costs to avoid going over budget.

2. Ongoing Driver Shortage

The driver shortage isn’t new, but it’s still a huge challenge. The industry needs over 80,000 new drivers to meet demand. More truckers are retiring, and fewer young people are joining the field. Because of this, companies must raise wages to keep the drivers they have.

Small fleets and single-owner operators are hit the hardest. That’s where truck driver accountants play a key role as they help plan pay, review costs, and keep budgets tight for owner-operators. They must match higher wage demands or risk losing good drivers to bigger fleets.

Financial Impact:

- Higher pay for drivers and staff

- Increased cost of hiring and training

- Slimmer profit margins for small operators

How Trucker Accountants Help:

They keep wage records clean, help plan pay raises, and ensure the company can afford staffing costs long-term.

3. Fuel Cost Volatility

Fuel is one of the biggest expenses in trucking. Diesel prices can shift fast due to world events, oil supply, or seasonal changes. Even a small jump in fuel costs can wipe out profits, especially for independent drivers.

Financial Impact:

- Sharp fuel price increases = lower profit

- Harder to predict weekly/monthly costs

How Trucker Accountants Help:

They track fuel spending, create cost control plans, and help you claim fuel-related tax deductions or credits. These are core parts of trucking industry accounting, built to keep profits stable even when prices rise. These services are vital parts of trucking industry accounting, especially when fuel costs swing fast.

4. Push Toward Green Trucking

To reduce carbon emissions, many firms are shifting to green tech—electric trucks, solar-powered rigs, and better fuel systems. While these upgrades may save money in the long term, they are not cheap to start.

Also, new laws from states like California require cleaner fleets, pushing companies to update sooner than planned.

Financial Impact:

- High up-front costs for new gear

- Long-term cost savings (if well planned)

- Risk of fines if you don’t comply with clean air rules

How Transportation Accounting Helps:

Accountants help secure tax credits, grants, and write-offs related to green upgrades. They also spread costs across years to ease the financial hit. Accountants for truck drivers also make sure every upgrade meets rules and offers the best return through credits and grants.

5. Tech Integration

Tech is changing trucking fast. From GPS and fuel trackers to smart logbooks and route software, these tools boost speed, save fuel, and reduce errors. Larger firms use AI and data tools to find the best loads and routes.

But buying and setting up this tech costs money. Small firms may not have the funds to invest.

Financial Impact:

- Start-up costs for tech upgrades

- Savings on fuel, repairs, and errors in the long term

How Trucker Accountants Help:

They assess the return on tech spending and help plan the cost across months or years. With smart trucking bookkeeping tips, they help merge your tools, like routing apps and billing, into your books for smooth tracking. They also help link accounting tools with route and fleet software to save time.

6. Regulatory Changes

State and federal laws change often. One key law is California’s AB 5, which affects how truckers are labeled—contractor vs. employee. If you’re now seen as an employee, your taxes, benefits, and pay structure may change.

Other rules—like ELD mandates or emissions laws—add costs and paperwork.

Financial Impact:

- Costly legal or tax changes

- Risk of audit or fine if rules are ignored

How Transportation Accountants Help:

They make sure your setup matches the latest laws. They help with tax changes and even support you during IRS audits. Truck driver accountants help you switch from contractor to employee status without losing track of taxes or deductions.

7. Shared Freight Models

More firms now use shared freight—two or more companies share a trailer or route. This reduces waste, saves fuel, and cuts down on “empty miles.”

But shared models can also mean complex billing and revenue splits.

Financial Impact:

- Lower fuel and trip costs

- Complex load and income tracking

How Trucker Accountants Help:

They help set up systems for shared loads, split income fairly, and record each trip with clarity for tax and reports. These systems use trucking bookkeeping tips to keep every mile, load, and payout well-organized and audit-ready.

How Trucker Accountants Save You Money

Beyond trends, daily finances can be hard to handle when you’re on the road. Missed deductions, bad records, or late payments all cost you. A trucker-focused accountant helps reduce these risks and keeps your books clean.

Here’s how they add value:

Maximize Tax Deductions

Truckers qualify for many tax write-offs. But if you don’t track them well, you miss out.

Top Deductions Include:

- Fuel, Repairs, and Insurance: These day-to-day costs are all tax-deductible.

- Per Diem Rates: Flat rates for meals and expenses make record-keeping simple.

- Lodging and Meals: If you travel overnight, you can claim room and food costs.

- Truck Depreciation: Over time, you can write off the cost of your truck.

A trucking accountant ensures you claim every cent allowed by law. They bring trucking industry accounting know-how to catch all write-offs from tires to tolls.

Strategic Tax Planning

Smart planning is key to saving big.

Key Tips:

- Pay Quarterly: Avoid late fees by staying on top of tax deadlines.

- Use Retirement Accounts: Save for your future and cut your tax bill at once.

- Plan for Growth: Want to add a truck or hire help? Your accountant helps plan for it without cash strain. Using smart trucking bookkeeping tips, you’ll know the best time to grow without risking your cash flow.

Track Expenses and Income with Precision

Without strong records, you risk fines or missed savings.

Smart Record-Keeping Includes:

- Mileage logs

- Load receipts

- Fuel bills

- Maintenance costs

- Tolls and scale fees

Truck driver accountants offer systems (or link with apps) that make this easy and match the best trucking bookkeeping tips for smooth reports.

Stay Audit-Ready

IRS audits are rare, but when they hit, they hit hard. Many audits happen due to:

- Missed income reporting

- Wrong deduction amounts

- Late filings

Accountants Help You:

- File on time

- Keep clean books

- Back up all claims with proof

- Guide and speak for you if the IRS comes calling. This is where accountants for truck drivers play an important role, as they know how to keep audits smooth and error-free.

Provide Industry-Specific Expertise

A general accountant may not know trucking rules. A trucking accountant knows the forms, laws, and hidden savings most others miss. They stay on top of:

- DOT rules

- FMCSA guidelines

- State-specific tax breaks

- Fuel tax filings (like IFTA)

- Lease vs. own pros and cons

This knowledge helps truckers save more and sleep better.

Financial Tips from Trucker Accountants

Want to get started on better money management today? Follow these expert tips:

1. Stay Organized

Track every cost. Use a spreadsheet, app, or software to log:

- Fuel

- Meals

- Repairs

- Tools

- Load fees

You’ll be glad you did at tax time.

2. Save for Taxes

Set aside 25%–30% of income for taxes. Open a separate savings account if needed.

3. Monitor Cash Flow

Don’t just look at revenue—watch your full money flow. Know how much you bring in and how much goes out each month.

4. Plan for Repairs

Trucks break down. It’s not “if,” it’s “when.” Set aside funds for:

- Tires

- Oil and filters

- Brake systems

- Emergency towing

5. Invest in Tools that Pay Off

Spend money on:

- Fuel tracking apps

- Load planning software

- Expense record tools

- GPS systems

These boost income, save fuel, and cut mistakes.

6. Know the Rules

Stay updated on:

- Tax law changes

- Freight rates

- Truck laws in your state

- New deductions or grants

A good accountant or bookkeeper keeps you in the loop.

7. Don’t Go It Alone

When in doubt, ask for help. A skilled trucker accountant gives peace of mind, fewer errors, and more savings.

The trucking world moves fast. From fuel swings to new tools, each change hits your earnings. Truckers need more than hard work; they need sharp money skills. That’s why a trucker accountant or transport accounting expert is key.

By tracking income, cutting taxes, and keeping clean records, these pros help truckers and fleets stay on the road and stay in the black.

Fuel costs, tech shifts, and rules change often. Each trend hits your wallet, but with smart trucking industry accounting and the right truck driver accountants, you can stay ahead.

Use smart trucking industry accounting, hire top truck driver accountants, follow proven trucking bookkeeping tips, and get more from each mile.

At Meru Accounting, we know the road you drive. We bring expert trucking industry accounting to help drivers and fleets stay in control. Our truck driver accountants keep your records right, help you save on taxes, and give you the tools to grow. We also offer proven trucking bookkeeping tips and full support tailored for truckers and fleets. With clear trucking bookkeeping tips, we help you boost profit and avoid stress. Let Meru Accounting steer your money right, mile after mile.

FAQs

Q1: Why do truckers need accountants?

To manage taxes, track income, and handle deductions the right way.

Q2: What expenses can truck drivers deduct?

Fuel, repairs, meals, lodging, and insurance are all common.

Q3: How often should truckers update their books?

At least weekly. Daily updates are even better.

Q4: Can I do trucking accounting myself?

Yes, but hiring accountants for truck drivers saves time and avoids errors.

Q5: What’s the best accounting software for truckers?

QuickBooks and TruckingOffice are popular choices.

Q6: Should I get a business bank account?

Yes, to keep personal and business money separate.

Q7: What if I fall behind on taxes?

Call a truck driver accountant right away to avoid penalties.