Home » Types of Taxes in USA for employees to fill.

Types of Taxes in the USA for employees to file

Understanding the types of taxes in the USA is very important for employees. Whether you are new to a job or have been working for years, knowing what taxes in the USA you need to file helps you stay compliant and avoid fines. Many employees are not sure which taxes apply to them. This guide will help you learn about the main types of taxes in the USA, how they work, and what you need to do.

The tax system in the USA is very complicated, as per the Internal Revenue Service (IRS) system. If you are an employer where you are paying the employees, then you need to understand the different types of taxes in the USA. The business owner must pay the employment taxes on behalf of employees to the respective authorities. However, you need an expert tax consultant to understand and implement different types of taxes in the USA for employees. Failing to pay the relevant taxes in the USA can lead to severe penalties. So, to help you understand the several tax types in the USA, we have put here some of its important highlights.

Why Employees Must File Taxes in the USA

Filing taxes is not just a rule; it also brings many gains. Here’s why it matters:

1. Helps Fund Public Needs

- Tax money helps pay for things like roads, schools, health care, and safety.

2. It’s the Law

- Most workers must file taxes. If you don’t, you could face fines or legal trouble.

3. You Could Get Money Back

- If you paid too much tax, filing lets you ask the IRS for a refund.

4. You Get Credits and Deductions

- Some tax breaks, like credits or write-offs, are only given if you file a return.

5. Keeps Your IRS Record Clear

- Filing on time shows the IRS you follow the rules. It helps you stay safe from tax issues.

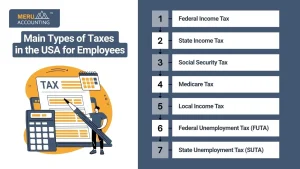

Main Types of Taxes in the USA for Employees

Let’s look at the most common types of taxes in the USA that employees must file:

1. Federal Income Tax

- This is the largest tax for most workers.

- It is based on how much you earn.

- Your employer takes it from your paycheck.

- You must file it every year using Form 1040.

- Tax brackets decide how much you pay.

- You can lower it with deductions and credits.

2. State Income Tax

- Many U.S. states charge income tax.

- The rate depends on the state you live in.

- Some states, like Texas and Florida, have no income tax.

- You must file a state return if your state requires it.

- The form and rules vary by state.

3. Social Security Tax

- It helps fund the Social Security program.

- You pay 6.2% of your income.

- Your employer matches this amount.

- You don’t file it, but it shows on your W-2.

- It helps you get retirement and disability benefits.

4. Medicare Tax

- It funds the Medicare health system.

- You pay 1.45% of your wages.

- Your employer also pays 1.45%.

- High earners pay an extra 0.9%.

- Like Social Security tax, it’s automatically deducted.

5. Local Income Tax

- Some cities or counties have their own taxes.

- Not all areas charge this.

- Rates are usually low.

- You may need to file a local return.

- Check with your local tax office.

6. Federal Unemployment Tax (FUTA)

- This tax is paid by employers.

- It does not come from your paycheck.

- It funds unemployment benefits.

- You don’t file this, but it’s good to know.

7. State Unemployment Tax (SUTA)

- Like FUTA, this is paid by your employer.

- Some states require a small part from employees.

- It also funds jobless benefits.

Understanding Your W-2 Form

- The W-2 is a form you get from your employer.

- It shows how much tax you paid all year.

- You need it to file your tax return.

- It includes federal, state, and other tax details.

- You get it by January 31 each year.

Common Deductions for Employees

Deductions help lower your taxable income. Some common ones are:

- Standard Deduction (most people use this)

- Student loan interest

- Retirement plan contributions

- Medical expenses (if very high)

- State and local taxes paid

Tax Credits Employees Can Claim

Credits reduce your tax amount. Some helpful ones are:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Saver’s Credit

- American Opportunity Tax Credit (education)

- Lifetime Learning Credit

How to File Your Taxes

Filing taxes is easy if you follow these steps:

- Collect Income Forms

Get all your forms, like W-2s, 1099s, or any papers that show how much you earned. - Pick How to File

You can file by hand, use tax software, or ask a tax expert to help you. - Fill Out Form 1040

Use IRS Form 1040 for your federal tax return. Be sure all info is true and full. - File State and Local Taxes

If your state or town asks for a tax form, make sure to file those too. - Meet the Due Date

File your taxes by April 15. If you need more time, ask the IRS for more days. - Pay or Wait for Refund

If you owe tax, pay on time. If not, the IRS will send you a refund.

When Are Taxes in the USA Due?

- Federal tax return: April 15 (unless extended)

- State tax return: Same or different dates (check your state)

- You can file early, starting in late January

- Always file on time to avoid penalties

How to Pay Less Tax Legally

Here are ways to reduce your tax bill:

- Use tax deductions and credits.

- Contribute to retirement plans (401(k), IRA).

- Use Health Savings Accounts (HSA).

- Track work-from-home expenses (if allowed).

- Adjust your W-4 form to match your income.

Tax Filing Tools for Employees

These tools make tax filing easier:

- TurboTax: Easy to use

- H&R Block: Great for in-person and online

- Free File: IRS offers it for low-income earners

- TaxAct: Affordable and user-friendly

Mistakes to Avoid While Filing Taxes in the USA

Avoid these common errors:

- Filing late or missing the deadline

- Entering the wrong Social Security number

- Forgetting to sign your return

- Not reporting all income

- Skipping state tax filing

- Not checking for tax credits

What Happens If You Don’t File Taxes?

- You may get a penalty or a fine.

- You could miss out on refunds.

- The IRS may take legal action.

- It affects your credit and record.

- Always file, even if you can’t pay now.

Tax Tips for First-Time Employees

- Fill out your W-4 form correctly when starting.

- Save a copy of your W-2 and tax returns.

- Learn about the taxes in USA before filing.

- Ask a tax pro if you’re not sure.

- Start early to avoid rush and errors.

Filing Taxes in the USA as a Remote or Freelance Worker

- You may get a 1099 form instead of a W-2.

- You are responsible for paying all your taxes.

- You may need to pay quarterly taxes.

- Use Schedule C to report income.

- Save at least 25-30% of your earnings for taxes.

Filing Jointly or Separately?

If you are married, you can:

- File jointly to get better tax rates and higher credits.

- File separately if one of you has large deductions or debts.

- Always compare both to see which is better.

Summary of All Types of Taxes in the USA for Employees

Tax Type | Who Pays | Filing Needed |

Federal Income Tax | Employee | Yes |

State Income Tax | Employee | Yes (if applicable) |

Social Security Tax | Employee & Employer | Auto-deducted |

Medicare Tax | Employee & Employer | Auto-deducted |

Local Income Tax | Employee | Yes (if applicable) |

Federal Unemployment Tax | Employer | No |

State Unemployment Tax | Employer (sometimes Employee) | No |

Knowing the types of taxes in the USA helps employees file correctly and avoid issues. From federal to local taxes, each one plays a role in your finances. Keep your records ready, understand your deductions and credits, and file on time. Stay informed and stay ahead — that’s the smart way to handle taxes in the USA. At Meru Accounting, we help you with all kinds of taxes in the USA. Our team makes sure your tax forms are right, your claims are fair, and you file on time. Be it federal, state, or local tax, we take care of it for you. Trust Meru for simple, low-cost, and smart tax help.

FAQs

- Do all employees have to file taxes in the USA?

Yes, if you earn above a certain amount, you must file. - When should I file my tax return?

You must file by April 15 each year. - What form do employees use to file taxes?

Most employees use Form 1040 to file federal taxes. - Can I file taxes in the USA online?

Yes, you can use tax software or IRS Free File. - What if I made a mistake on my return?

You can fix it by filing an amended return using Form 1040-X. - Do I need to file taxes if I earned very little?

Maybe not, but it’s good to file to get refunds or credits. - What happens if I file late?

You may pay a penalty and interest, and delay your refund.