What Are the Real Benefits of Virtual Accounting Services for Startups?

For startups aiming to scale quickly and efficiently, financial management is critical. Combining the flexibility of outsourced bookkeeping with advanced technology, virtual accounting services provide startups with the tools and expertise they need to focus on growth. By outsourcing bookkeeping and accounting tasks to virtual professionals, startups can save valuable time and reduce the overhead costs of hiring in-house staff. Virtual accounting services also utilize advanced technology, such as cloud-based accounting software, to ensure accurate and up-to-date financial records. These tools make it easier to track expenses, manage cash flow, and generate essential reports for decision-making.

Table of Contents

- What Are Virtual Accounting Services?

- Key Benefits of Virtual Accounting Services for Startups

- Overcoming Common Challenges

- Frequently Asked Questions (FAQs)

- Conclusion

What Are Virtual Accounting Services?

Virtual accounting services allow businesses to manage their financial operations remotely. By utilizing cloud-based tools and professional expertise, startups can streamline processes like bookkeeping, financial reporting, and compliance without hiring an in-house team. With the burden of financial management lifted, startups can focus their energy on growth, innovation, and achieving their business goals.

Outsourced bookkeeping is a component of virtual accounting services that focuses specifically on maintaining accurate financial records, tracking transactions, and reconciling accounts.

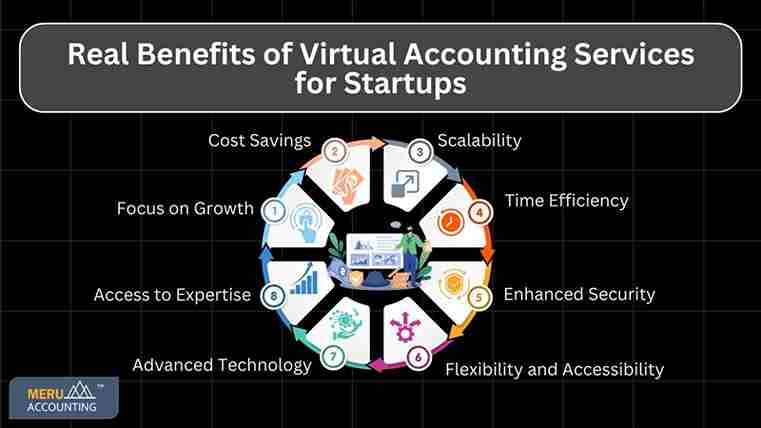

Key Benefits of Virtual Accounting Services for Startups

For startups, managing finances effectively is a critical part of building a strong foundation. Virtual accounting services, including outsourced bookkeeping, provide a practical and efficient way to handle financial tasks without overwhelming limited resources. Here’s a detailed look at how these services can help:

- Cost Savings

Hiring an in-house accounting team can be expensive, with costs for salaries, office space, equipment, and software adding up quickly. Virtual accounting services eliminate these overhead expenses, offering startups affordable options that still provide high-quality financial management.

- Access to Expertise

Startups often lack the resources to hire a team of experienced accountants. Virtual accounting services solve this problem by giving access to skilled professionals with expertise in bookkeeping, tax compliance, financial analysis, and more. These experts provide valuable insights that can help startups make smarter financial decisions.

- Scalability

As startups grow, their financial needs change. Virtual accounting services are highly flexible and can scale up to meet increasing demands. Whether it’s managing larger budgets, handling more complex transactions, or supporting international operations, these services adapt as the business evolves.

- Time Efficiency

Handling bookkeeping and accounting tasks in-house can consume a lot of time, especially for startups with small teams. Virtual accountants take care of these tasks efficiently, freeing up valuable time for founders and team members to focus on core business areas like product development, marketing, and customer acquisition.

- Advanced Technology

Virtual accounting often utilizes innovative accounting software and automation tools. These provide real-time financial updates, detailed reports, and accurate data. Startups can leverage this technology to monitor their cash flow, track expenses, and make data-driven decisions without additional effort.

- Flexibility and Accessibility

One of the greatest advantages of virtual accounting is the ability to access financial data from anywhere. Whether you’re in the office, at home, or traveling, cloud-based systems allow you to stay connected to your accounts and stay informed about your financial status.

- Enhanced Security

Reputable virtual accounting providers prioritize data security, using advanced encryption and secure cloud storage to protect sensitive financial information. Startups can trust that their data is safe from breaches and cyber threats.

- Focus on Growth

By outsourcing bookkeeping and accounting tasks, startups can eliminate distractions and focus on their growth. With financial management in the hands of experts, businesses can concentrate on innovation, customer acquisition, and scaling their operations efficiently. Virtual accounting services and outsourced bookkeeping offer startups the tools, expertise, and flexibility needed to manage their finances effectively.

Overcoming Common Challenges

- Moving Your Data

Switching to a virtual accounting service can be tricky when moving your financial data. To make it easier, work with a provider who knows how to transfer data without any mistakes, so your business continues smoothly. - Clear Communication

Good communication is important. Make sure you choose a provider who keeps in touch with you regularly and is easy to reach whenever you need them. This helps avoid confusion and ensures you’re always up to date with your finances. - Customized Services

Every business has different needs. Find a virtual accounting provider who can adjust their services to fit your specific requirements, such as custom reports or using the right tools for your business.

Frequently Asked Questions (FAQs)

- What is outsourced bookkeeping, and how does it differ from in-house accounting?

Ans: Outsourced bookkeeping involves hiring external professionals to manage financial records, while in-house accounting requires employing full-time staff. - Why should startups consider virtual accounting services?

Ans: Startups benefit from virtual accounting services due to their cost-effectiveness, scalability, and access to professional expertise. - Are virtual accounting services secure?

Ans: Yes, most providers use advanced encryption and cloud security measures to protect financial data. - Can virtual accounting services handle taxes?

Ans: Yes, many virtual accounting services include tax preparation and compliance support. - How does outsourced bookkeeping save time?

Ans: By outsourcing financial tasks, startups can delegate time-intensive activities like reconciling accounts and generating reports, freeing up time for strategic planning. - Are virtual accounting services provided by Meru Accounting secure?

Ans: Yes, Meru Accounting employs robust encryption and secure cloud systems to safeguard your financial data, ensuring privacy and compliance. - Can virtual accounting services from Meru Accounting handle taxes?

Ans: Yes, Meru Accounting’s virtual services include expert tax preparation and compliance assistance, helping you stay up to date with tax laws and regulations.

Conclusion

For startups, managing finances efficiently is essential for growth. Virtual accounting services offer a flexible, cost-effective way to handle bookkeeping, reporting, and compliance. With the added advantages of scalability, security, and access to professional expertise, startups can focus on building their businesses while leaving financial management to the experts. Partnering with Meru Accounting, a trusted provider of virtual accounting services, ensures that startups receive tailored financial solutions designed to meet their unique needs.

By integrating outsourced bookkeeping into your operations, you can ensure accurate records, regulatory compliance, and improved decision-making. Embrace virtual accounting services today to streamline your startup’s financial management and drive success.