How Do the Best Virtual Bookkeeping Services Help a Business?

Managing money and records is key to any business, and the best virtual bookkeeping services can make it easier than ever. With the rise of technology, virtual bookkeeping services have become more popular. Many companies now use them to track income, expenses, and taxes. These services offer a smart and affordable way to handle your books. In this blog, we will explain how a virtual bookkeeping service helps a business and why many are switching to this method. Whether you run a small startup or a large business, choosing the best virtual bookkeeping services can save time, money, and stress.

What is a Virtual Bookkeeping Service?

A Virtual Bookkeeping Service is a smart and modern way to handle a company’s books without needing a full-time bookkeeper at your office. Instead of working in person, virtual bookkeepers work from a remote place. They use cloud tools to track income, costs, bank data, payroll, and more. This service gives you all the key tasks of old-style bookkeeping but adds more ease, better access, and lower costs.

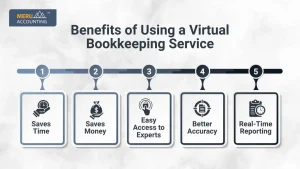

Benefits of Using a Virtual Bookkeeping Service

1. Saves Time

- No need to manage books yourself.

- Frees you to focus on growing your business.

- No travel or in-person meetings needed.

2. Saves Money

- Cheaper than hiring a full-time bookkeeper.

- No need to pay for office space or equipment.

- You only pay for the services you use.

3. Easy Access to Experts

- Access skilled bookkeepers without hiring in-house.

- They stay updated with tax laws and rules.

- You get expert advice for less cost.

4. Better Accuracy

- Reduces errors in records.

- Software checks and corrects mistakes.

- All entries are clean and organized.

5. Real-Time Reporting

- See your reports anytime.

- Helps you know where your business stands.

- You can make faster and smarter decisions.

Why Businesses Choose the Best Virtual Bookkeeping Services

1. Secure and Safe

- Data is stored on the cloud.

- Only authorized users can access it.

- Backup systems protect your data.

2. Scalability

- Services grow with your business.

- Easy to upgrade as you need more help.

- You can add payroll, tax, or financial reports later.

3. Regular Updates

- Your books are updated weekly or even daily.

- You get fresh data to work with.

- It keeps you ready for tax season.

4. Easy Tools and Software

- Uses tools like QuickBooks, Xero, and FreshBooks.

- These tools are easy to use and learn.

- You can log in and view data anytime.

5. Simple Collaboration

- Share data with your team, accountant, or manager.

- All users can see the same numbers.

- No delays or confusion.

Features of a Good Virtual Bookkeeping Service in the USA

If you’re looking for a virtual bookkeeping service in the USA, check for these:

1. Experience in Your Industry

- Every industry has different needs.

- Choose a team that knows your business type.

2. Clear Pricing Plans

- Know what you are paying for.

- Avoid hidden fees or surprise bills.

3. Dedicated Bookkeeper

- One person manages your books.

- Builds trust and understanding of your business.

4. Strong Support

- Quick replies to emails or calls.

- Support through chat, email, or phone.

5. Customized Solutions

- Not all businesses need the same things.

- Choose a service that offers flexible plans.

What Tasks Do Virtual Bookkeepers Handle?

1. Bank Reconciliation

- Matches bank records with your business books.

- Finds missing or wrong entries.

2. Invoicing

- Sends invoices to clients.

- Tracks who has paid and who hasn’t.

3. Expense Tracking

- Records what your business spends.

- Categorizes costs for easy reporting.

4. Payroll Services

- Manages staff payments.

- Files payroll taxes and forms.

5. Financial Reports

- Prepares profit/loss reports.

- Helps with cash flow analysis.

6. Tax Prep

- Gathers records for tax filing.

- Works with your tax advisor or CPA.

Who Needs Virtual Bookkeeping Services?

1. Small Businesses

- Saves cost and time.

- Keeps records neat and ready for tax time.

2. Startups

- Helps new businesses stay on track.

- Offers expert help from the start.

3. Freelancers

- Manages income from multiple clients.

- Tracks expenses for tax deductions.

4. E-commerce Sellers

- Records sales across platforms.

- Helps with inventory and taxes.

5. Service Providers

- Tracks client payments and hours worked.

- Gives clear financial insights.

Why the Best Virtual Bookkeeping Services Make a Difference

Choosing the best virtual bookkeeping services means:

- Peace of mind.

- Better business decisions.

- Stress-free tax filing.

- Higher focus on growth and strategy.

They act like your financial partner. Even if they work online, they are always there when needed.

How to Choose the Right Virtual Bookkeeping Service in the USA

1. Look at Reviews

- Read what other clients say.

- Choose services with happy customers.

2. Ask for a Demo

- Try the software before signing up.

- Make sure it fits your needs.

3. Compare Plans

- Check what’s included in each plan.

- Pick one that matches your business.

4. Check Data Security

- Make sure they use encryption and secure servers.

- Ask how your data is backed up.

5. See If They Offer Tax Support

- Some also help with taxes.

- Makes things easier at year-end.

Mistakes to Avoid with Virtual Bookkeeping

1. Not Reviewing Your Books

- Always check reports.

- Stay aware of your numbers.

2. Ignoring Software Training

- Learn how to use the platform.

- It helps in communication and tracking.

3. Not Communicating

- Stay in touch with your bookkeeper.

- Share any new info or changes.

4. Choosing the Cheapest Only

- Cheap doesn’t mean best.

- Look for quality and support.

Real Business Results With Virtual Bookkeeping

Many businesses in the USA using virtual bookkeeping services have seen clear and lasting gains. Below are the key benefits they report:

More Free Time for Core Work

Business owners save hours each week. They no longer need to do data entry, chase missing bills, or sort paper files. This saved time is used to serve clients, grow the business, and manage key tasks.

Less Stress During Tax Season

With clean and current records, tax time is much easier. There’s no need to search for lost data or fix old errors. Virtual bookkeepers keep your books neat and ready for filing at all times.

Clear Financial Plans and Reports

Virtual bookkeeping gives you clear and correct reports. These include profit and loss, balance sheets, and cash flow data. They help you track spending, set smart goals, and stay on the right path.

Growth Through Better Money Control

When your books are in order, you see where your money goes. This helps you avoid waste, manage cash flow, and plan ahead. Many firms grow faster with this level of control and insight.

How Virtual Bookkeeping Supports Remote Work Culture

Remote and Hybrid Teams Benefit

Many businesses now follow remote or hybrid work models. Virtual bookkeeping fits well with this setup.

Designed for Modern Workflows

These services use cloud tools that allow remote access and quick updates.

Easy Document Sharing

Your team can upload bills, receipts, and records from any place, at any time.

Faster Work Process

With cloud access, work moves faster. Updates happen in real-time with fewer delays.

Improved Team Collaboration

Teams and bookkeepers can work together with ease, even from different places.

No Need for In-Person Meetings

There’s no need for face-to-face meetings, saving both time and effort.

Role of Automation in Virtual Bookkeeping Services

Smart Tools Power the System

Most platforms use built-in tools to handle key tasks with little manual effort.

Automation of Repetitive Tasks

Tasks like data entry, invoice creation, and payment reminders are done by the system.

Fewer Human Errors

With less manual work, there are fewer mistakes in the records.

Quicker Turnaround Time

Automation helps finish tasks faster. Reports and updates are ready in less time.

Cost Savings Over Time

Since fewer people are needed, the cost of the service drops over time.

Instant Alerts and Reports

Business owners get real-time alerts and auto-generated reports without delays.

Better Business Decisions

Fast access to updated data helps owners make smarter and quicker decisions.

A virtual bookkeeping service can make your business life much easier. You save time, reduce costs, and improve how your money is managed. If you choose the best virtual bookkeeping services, you also get trusted help and support. For those in the U.S., finding a good virtual bookkeeping service in the USA is now easy and affordable. It’s a smart choice for any business that wants to grow without the stress of managing the books. At Meru Accounting, we offer some of the best virtual bookkeeping services tailored to your business needs. Whether you’re a startup, freelancer, or growing firm, our expert team ensures your books are clean, updated, and ready for success. For reliable, secure, and efficient virtual bookkeeping service in the USA, Meru Accounting is your trusted partner.

FAQs

- Is a virtual bookkeeping service safe to use?

Yes, most use secure tools and encrypted platforms to keep their data safe. - Can I get real-time updates with virtual bookkeeping?

Yes, many services offer real-time or daily updates. - Is virtual bookkeeping better than hiring in-house?

For small to mid-size businesses, it is often cheaper and more flexible. - Will I get help with taxes too?

Some services offer tax prep or work with your tax advisor. - Do I need special software to use it?

No, most services use easy online tools like QuickBooks or Xero. - Can I cancel my service anytime?

Yes, many offer monthly plans with no long-term contracts. - What if I’m not good with numbers?

No problem. Your virtual bookkeeper will handle the math and reports.