Best Way to Assess Accounting Technology

Accounting technology has changed how businesses handle their books. It makes tasks easier, faster, and more accurate. From invoicing to filing taxes, everything can now be done with a few clicks. Knowing how to use accounting technology can help your business grow.

This blog shows you the best way to assess accounting technology for your needs.

From cloud tech to AI-driven tools, the way accounting is done has changed a lot. With new challenges like remote work, Brexit, and the recent pandemic, the need for solid tech in accounting has grown stronger.

Strong accounting systems help reduce errors, boost output, and keep firms ready for any change. So, let’s look at the best ways to assess accounting technology and make sure it’s the right fit for your business.

What is Accounting Technology?

It refers to software, tools, and systems used to manage accounting tasks. It’s the use of digital tools to record, track, and manage money matters. Examples include QuickBooks, Xero, Zoho Books, and Tally. It also includes cloud software, automation, AI tools, and machine learning features.

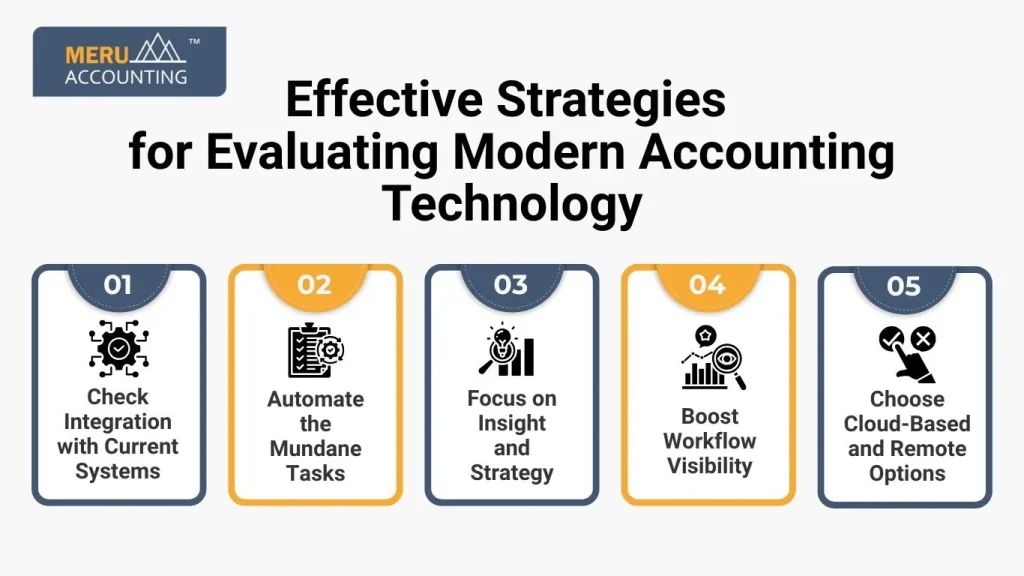

Effective Strategies for Evaluating Modern Accounting Technology

1. Check Integration with Current Systems

Start by asking: Does the tech make work smoother or harder?

Good accounting tools should work well with what you already use. If a new system can’t link with your tools, it might slow things down. On the other hand, a tech tool that syncs fast with your system saves time and helps avoid data errors. This kind of system helps read and sort stats fast, giving you sharp, clear reports.

2. Automate the Mundane Tasks

Most daily tasks in accounting—like payroll, record checks, and sorting files—can take hours. Smart tech can do these in minutes.

Look for a system that can:

- Upload files in bulk

- Handle payroll and audits

- Scan and match receipts

- Create clean records for reports

This frees up your time to do more work that needs deep thought and insight. With the basics handled by tech, your team can focus on growth and client needs.

3. Focus on Insight and Strategy

Modern tools do more than just record data. They can find trends, flag issues, and offer deep insights. With this kind of power, you can spot ways to save money or guide a client’s next move.

As more firms move from paper to digital, they also cut costs on tools like ledgers, printers, and manual logbooks. Digital sheets and tools are cheaper, smarter, and much faster.

4. Boost Workflow Visibility

A good dashboard is a key part of any system. You need a clear, real-time view of what’s done and what’s due.

With better visibility, you can:

- Track each task

- Flag urgent jobs

- Set smart goals

- Avoid missed deadlines

Live dashboards give you all your data in one place. You can plan better, cut delays, and make smarter calls on the spot.

5. Choose Cloud-Based and Remote Options

Cloud tech is a must for any firm that works across sites or from home. With the right cloud setup, your team and clients can log in, view files, and share data with ease.

Cloud tools are often used:

- Intranet: To share news and policy with your team

- Extranet: To let clients view or send files

- Web portals: For secure login and file access

- Email links and live search tools

By using cloud-based systems, you cut costs, work faster, and stay connected no matter where your team is.

How to Use Accounting Technology in Daily Work

1. Record All Bills and Receipts

Scan or upload every bill and receipt into your system. This keeps data in one place and reduces the need for manual entry. It also makes audits and tax prep much easier.

2. Sync It with Your Bank

Link your bank accounts to your software. This gives real-time updates and cuts down on entry errors.

3. Use It to Send and Track Invoices

Create and send invoices within the software. Set payment reminders and track if clients have paid on time.

4. Run Reports to Track Profit or Loss

Use built-in tools to generate profit and loss reports. These help monitor your growth, costs, and income trends.

5. Use It for Payroll and Tax Prep

Handle payroll and taxes inside the platform. You can generate tax forms, pay staff, and stay ready for tax season.

6. Use Mobile Apps When You Travel

Mobile apps help you check balances, send invoices, or scan receipts while you’re away from your desk.

7. Back Up Data Often

Schedule automatic backups or store your files in the cloud. This keeps your data safe from loss or attacks.

Utilizing Tax Accounting Technology for Compliance and Efficiency

1. Tax Tools Can Auto-Calculate Taxes

These tools follow current tax rules to give you exact numbers. That cuts the risk of error.

2. They Reduce Errors in Filing

Built-in checks flag errors before you file, helping you avoid mistakes and penalties.

3. These Tools Help in Tracking Tax Deadlines

Get alerts and calendar updates for tax due dates. No more missed deadlines.

4. Some Tools Offer E-Filing with One Click

File your taxes straight from the software. This saves time and keeps records for future use.

5. Using Tax Accounting Technology Saves Time During Tax Season

Organized data means you don’t waste hours digging for forms or receipts when filing season starts.

6. Helps Small Businesses Follow IRS and GST Rules

These tools follow local rules and help create the right tax forms for your business.

Tips to Train Your Team on New Accounting Software

1. Choose Simple Software with a Short Learning Curve

Pick tools that are easy to use. That way, your team won’t need long training sessions.

2. Offer In-House Training or Webinars

Hold group sessions or online webinars. This helps users learn in a structured way.

3. Use Free Help Videos

Use videos and tutorials that explain how the software works. These are great for self-paced learning.

4. Assign One Person to Lead the Transition

Select someone to guide others and manage the setup. This helps solve issues fast and keeps things on track.

5. Start with One Module at a Time

Don’t train on everything at once. Begin with billing or reports, then move to payroll or taxes.

6. Let Users Test It Before Full Launch

Let your team try the software using a demo version. Their feedback can help improve training.

Mistakes to Avoid When Choosing Accounting Technology

1. Picking a Tool Without Testing

Try before you buy. Use a trial version to see if it fits your needs.

2. Not Checking Tax Compliance Features

Make sure the software follows local tax rules like GST or IRS norms. Skipping this can cause trouble later.

3. Ignoring Customer Support

Support matters. Choose a tool with help via chat, phone, or email in case you get stuck.

4. Overpaying for Extra Features You Don’t Need

Don’t pay for features you won’t use. Pick a plan that fits your business today.

5. Not Planning for the Future

Pick software that can grow with your business. Look for tools that allow upgrades as you expand.

6. Forgetting Mobile or Offline Access

Choose software that works on phones and offline. This helps when your internet is slow or when you’re on the move.

Future of Accounting Technology

1. More AI and Automation

AI will handle data entry, spot errors, and even suggest actions, saving you time and effort.

2. Faster Tax Filing Tools

Tax tools will become quicker with auto-fill, one-click filing, and smart reports.

3. Real-Time Bank Syncing

New tools will show live bank updates, helping you stay on top of cash flow and bank activity.

4. Chatbots for Accounting Help

AI chat tools will answer basic questions, assist with tasks, and reduce the need for support staff.

5. Blockchain for Higher Security

Blockchain will add more safety and clear tracking of all transactions, ideal for audits.

6. More Focus on User-Friendly Design

Modern tools will be simpler to use, even if you don’t have a finance background.

7. Smart Accounting Technology Will Guide Business Decisions

Future tools will give smart tips based on data, helping you make better and faster business choices.

The best way to assess accounting technology is to ask if it adds value, does it makes work faster, reduces errors, and saves costs. Tech should boost your firm’s speed, insight, and trust. It should blend well with your tools, help your team grow, and offer clear data views. In a modern business environment, the smart use of technology is not a choice; it’s a necessity. The right accounting technology helps save time, stay compliant, and grow faster. Knowing what is accounting technology and how to use it gives your business a strong edge.

Choose tools that suit your size, goals, and needs. At Meru Accounting, we help you pick and use the best tools, including tax accounting technology, for your business growth and peace of mind.

FAQs

- What is accounting technology in simple words?

It is software and tools used to handle accounting jobs like billing, payroll, and taxes. - How do I start using accounting technology?

Start by picking a tool, setting it up, and adding your financial data. - Is tax accounting technology safe to use?

Yes, if the tool has proper security features like encryption and access control. - Can I use accounting technology on mobile?

Yes, many tools offer mobile apps to track bills and reports on the go. - What’s the cost of accounting software?

It can range from free to $100+ per month, depending on features and users. - Can accounting software file taxes?

Yes, many tools help file taxes and generate required tax forms. - Why is automation important in accounting software?

It saves time by doing tasks like reminders, entries, and tax checks for you.