Home » What are Bookkeeping Payroll Services and How Can They Help?

What are Bookkeeping Payroll Services and How Can They Help?

You need to make your customers happy, and bookkeeping payroll services can help you manage funds smoothly. You also need to take care of your workers. One big part of that is paying your workers on time and keeping track of your money. This means you need help with bookkeeping and payroll services.

Some small business owners try to do it all by themselves. But it can get confusing. If you make a mistake with money or payroll, it can lead to big trouble. You may forget to pay taxes or miss a paycheck. That’s why many smart business owners use bookkeeping and payroll services to stay safe and organized.

In this guide, we’ll explain what payroll bookkeeping is, how it works, and how it can help your business grow.

What Are Bookkeeping Payroll Services?

Let’s break it down. First, let’s look at the two big parts: bookkeeping and payroll.

- Bookkeeping means keeping track of money in and money out. It shows how much your business earns, spends, and saves.

- Payroll means paying your workers, taking out taxes, and giving them their pay on time.

When you put these together, you get bookkeeping payroll services. These services help your business stay on top of every dollar you make and every dollar you pay.

If you do these jobs yourself, you might feel tired or confused. That’s why payroll bookkeeping is so helpful. You can give this job to a pro, so you can focus on your customers.

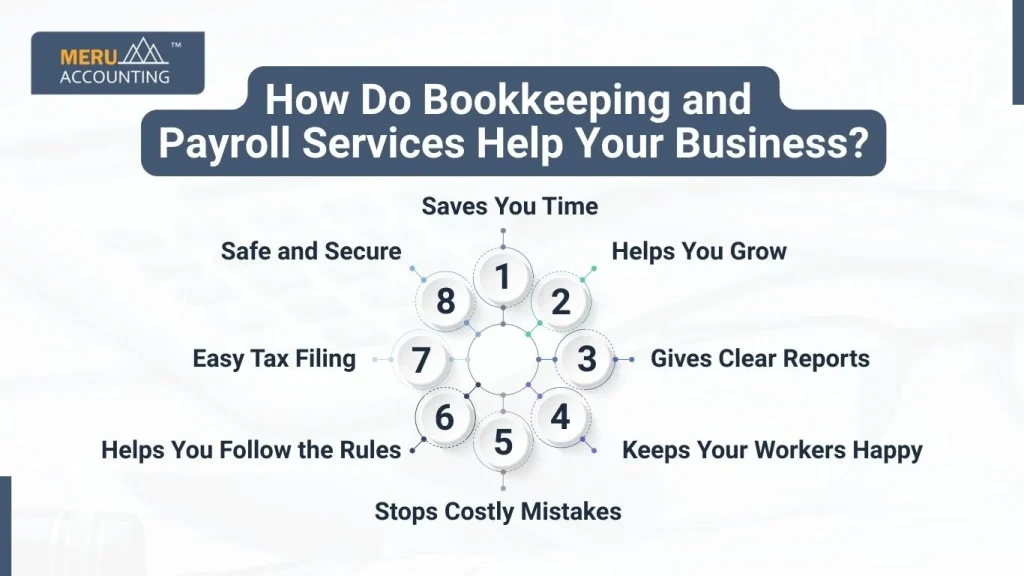

How Do Bookkeeping and Payroll Services Help Your Business?

Now, let’s look at the ways bookkeeping and payroll services can make your business better and stronger.

1. Saves You Time

Time is money. If you spend all day trying to track payments, count hours, and file tax forms, you lose time to run your business. With bookkeeping payroll services, you get that time back. The experts take care of the money stuff while you work on what you love.

2. Stops Costly Mistakes

When you try to do payroll or taxes without help, you may make mistakes. These mistakes can lead to fines or angry workers. Good payroll bookkeeping keeps things correct. It helps make sure everyone gets paid the right amount at the right time.

3. Helps You Follow the Rules

Taxes are tricky. There are lots of rules about how much to take out of a paycheck and how to report it. If you break the rules, you may have to pay fines. But with bookkeeping payroll services, professionals make sure you do it right. You won’t have to worry.

4. Gives Clear Reports

Want to know how much money you made last month? Or how much you spent on supplies? With the help of bookkeeping payroll services, you can see it all in a clear report. These reports help you make smart choices for your business.

5. Keeps Your Workers Happy

When workers get paid the right amount and on time, they are happy. They trust your business. With payroll bookkeeping, paychecks are handled well. There’s no delay, and taxes are taken out the right way.

6. Helps You Grow

Good money tracking helps your business grow. When your books are clean, banks trust you. You can get loans or investors more easily. You can plan ahead and make goals. Bookkeeping and payroll services help you see your full money picture.

7. Easy Tax Filing

Tax time can be scary. But if you’ve been using payroll bookkeeping, your taxes will be easy. Everything is ready to go. Your tax expert or bookkeeper can file the forms for you.

8. Safe and Secure

Using trusted bookkeeping and payroll services keeps your data safe. You don’t need to worry about losing files or having numbers stolen. Many services use secure software to protect your business.

Challenges of Bookkeeping and Payroll Services

Hard to Do Alone

Many small business owners try to do everything by themselves. But bookkeeping and payroll services take a lot of time and care. Doing it alone can lead to mistakes.

Tracking Hours Can Be Tough

If you don’t track work hours correctly, workers may get paid too much or too little. This is a big problem in payroll bookkeeping.

Tax Rules Are Tricky

There are many tax rules, and they change often. If you don’t know them, you may file the wrong amount. This is why bookkeeping payroll services must stay updated.

Missing Pay Dates

If you forget to pay your workers on time, they may lose trust. This can happen if payroll bookkeeping is not done on a set schedule.

Wrong Pay Amounts

If you make a mistake in pay or tax, workers may get upset. These mistakes often happen when bookkeeping and payroll services are rushed or done without care.

Losing Records

If your records are not safe, you may lose proof of payments or tax files. Good bookkeeping payroll services must keep files safe and easy to find.

Hard to Fix Mistakes

If you find a mistake late, it can be hard to fix. This can lead to money loss or tax trouble. That’s why smart bookkeeping payroll services check work early.

No Time to Learn

Many owners don’t have time to learn all the rules. This makes bookkeeping payroll services feel too hard. That’s when hiring help like Meru Accounting is a good idea.

Differences Between Bookkeeping, Payroll Services, and Payroll Bookkeeping

Understanding the difference helps in choosing the right service:

Service | Description | Purpose |

Bookkeeping | Records all financial transactions | Tracks business performance |

Payroll Services | Calculates and pays employee salaries | Ensures employees are paid correctly |

Payroll Bookkeeping | Combines payroll and bookkeeping | Keeps financial records and payroll accurate |

Common Mistakes Without Bookkeeping Payroll Services

- Paying Employees Late or Wrong Amounts

When payroll is done by hand, staff can get paid late or get the wrong pay. This can hurt morale and may cause fines or legal trouble. - Miscalculating Taxes or Missing Deadlines

Manual payroll often brings mistakes in tax work. Missing deadlines can lead to fines, penalties, or legal issues. - Poor Record-Keeping and Audit Risks

Messy records make it hard to track pay, deductions, or filings. This can cause big problems during an audit. - Spending Too Much Time on Payroll

Handling payroll manually takes hours from your main work. Time spent here is time lost on tasks that grow your business. - Missing Employee Benefits or Deductions

Without proper tracking, businesses can skip benefits or deductions. This can upset staff and break rules. - Errors in Employee Data

Wrong addresses, bank info, or job status can cause pay mistakes and tax problems. - Difficulty Managing Multiple Pay Schedules

If staff are paid weekly, bi-weekly, or monthly, manual tracking is hard. Mistakes happen fast. - Compliance Risks with Changing Rules

Tax and labor rules change often. Without payroll services, keeping up can be hard and risky.

How Technology Supports Bookkeeping Payroll Services

- Automated Pay Calculations

Payroll software calculates salaries, overtime, and bonuses automatically. Errors are reduced, and time is saved. - Tax Filing Integration

Systems can handle tax deductions and submissions, keeping the business compliant. - Employee Self-Service Portals

Staff can view pay slips, tax forms, and benefits on their own, cutting down admin work. - Real-Time Reports

Software provides instant insights into payroll costs, helping with planning and growth. - Easy Bank Reconciliation

Payroll payments match bank statements automatically, reducing mistakes. - Centralized Record Storage

All payroll data is in one place. Reports, history, and audit-ready files are easy to access. - Custom Alerts and Reminders

Systems can warn you of tax deadlines, pay dates, or unusual payments. - Mobile Access

Payroll tools often work on mobile devices, so you can manage payroll anywhere. - Security and Data Backup

Software keeps sensitive payroll info secure and backed up automatically.

Signs You Need Bookkeeping Payroll Services

- Frequent Pay Errors

If staff salaries or deductions are often wrong, it’s time for help. - Missed Tax Deadlines

Struggling to meet tax dates or facing penalties shows you need professional payroll services. - Business Growth: Making Payroll Complex

More staff or pay schedules make manual payroll slow and error-prone. - Too Little Time for Finance Tasks

Spending too many hours on payroll can stop you from focusing on business growth. - Disorganized Financial Records

Messy payroll data makes audits, reports, and employee queries hard to manage. - High Employee Turnover or Low Morale

Late or wrong payments can lower morale and increase turnover. - Multi-State or Multi-Country Payroll Challenges

Businesses across regions face complex tax rules, which professional payroll can handle. - Slow Report Generation

If reports take too long, business decisions may be delayed. - Rising Compliance Risks

Not keeping up with new labor or tax rules can cause fines and legal trouble.

Handling money and paying your team is a big part of any business. But you don’t have to do it all alone. With good bookkeeping and payroll services, you can avoid mistakes, save time, and grow with confidence. These services help you track your money, follow the rules, and pay your team the right way.

If you want your business to be strong and safe, it’s time to get help. Meru Accounting has the tools and the team to support you. Our smart and simple payroll bookkeeping can keep your business on the right path. Partner with Meru Accounting and let us handle your payroll and bookkeeping, so you can focus on growing your business with peace of mind.

FAQs

Q1. Can I use bookkeeping payroll services if I have only one worker?

Yes! Even if you have just one worker, it’s important to track money and pay them the right way. Small businesses can get a lot of help from bookkeeping and payroll services.

Q2. What happens if I make a mistake in payroll?

If you make a mistake, your worker may get the wrong pay, or you might pay the wrong tax. This can cause fines. That’s why many owners use payroll bookkeeping to avoid these problems.

Q3. Do I need to buy payroll software?

You don’t have to. Many bookkeeping and payroll services already have good tools and software. When you work with a service like Meru Accounting, they handle it for you.

Q4. Can bookkeeping and payroll services help with taxes?

Yes! These services track all your money and pay info. This helps make tax time easy. Many services also help file tax forms and send them to the IRS.

Q5. How do I know if I need bookkeeping payroll services?

If you feel stressed by money tasks or don’t have time to pay workers or file taxes, you may need help. A good service like Meru Accounting can take care of it all, so you feel calm and ready.