What Are Bookkeeping Services and How Can They Help Your Business

Running a business means keeping track of every dollar that comes in and goes out. Many business owners find it hard to manage their records. This is where bookkeeping services become important. With the help of expert bookkeepers, you can manage your accounts, save time, and focus on growth.

In this blog, we will explain what bookkeeping services are, why they matter, and how they can help your business succeed. We will also share bookkeeping services examples to make things clear.

What are Bookkeeping Services?

Bookkeeping is the process of recording all financial transactions. These transactions include sales, purchases, payments, and receipts. Bookkeeping services help businesses organize these records in a clear way. With proper bookkeeping, you can see where your money is going. A bookkeeping services description includes tasks like tracking expenses, making reports, and reconciling bank accounts.

Importance of Bookkeeping Services

Now that we know what bookkeeping services do, let’s see why they are very helpful for any business. Here are some simple and clear reasons to use them.

Keeps Records Organized

Bookkeeping services help keep all your money records in one place. If you want to check a bill, payment, or sale, you can find it fast. You don’t need to search in ten places. This saves time and keeps your business neat.

Helps With Tax Filing

When it’s time to file your taxes, your papers and records are ready. You don’t have to rush or guess anything. With the right bookkeeping services, you can file taxes without errors. This also helps you follow the law.

Tells about the business’s performance

Do you want to know if your business is doing well? Bookkeeping services show whether you are making money or losing it. This helps you make better choices. If things are going wrong, you can fix them early.

Helps You Get Loans

Banks and money lenders want to see your money records before they give you a loan. If your books are neat and clear, they trust you more. Good bookkeeping services can help you get the support you need to grow.

Saves Time and Energy

When you don’t have to worry about your bills and papers, you can use your time to grow your shop or business. This is one of the biggest reasons why people use bookkeeping services.

Gives You a Clear Picture of Your Spending

Many business owners spend more money than they think. But they only know this when it’s too late. With good bookkeeping services, you can see where every rupee or dollar goes. This helps you plan your budget and spend wisely.

Helps You Grow Your Business

If your money records are correct, it’s easy to plan for the future. You can see which products are selling more. You can also see which items are not doing well. This is part of a good bookkeeping services description, giving you reports that help you grow smarter.

Makes You Look Professional

Having clean and clear records shows that you are serious about your work. If you ever want to work with a big company or investor, your neat money books will impress them. Using bookkeeping services gives your business a more professional look.

Types of Bookkeeping Services

Different businesses have different needs. A small shop does not need the same money to work as a big company. That’s why there are different types of bookkeeping services. Each one fits the size and style of your business. Let’s look at some simple bookkeeping services examples to help understand each one.

Basic Bookkeeping

It’s among the simplest types of bookkeeping services. It is perfect for small shops, home-based businesses, or freelancers.

In basic bookkeeping, the bookkeeper writes down your daily sales, bills, and other money moves. You also get simple reports to show how much you made and spent. Bank accounts are checked to make sure the records match.

This is a common bookkeeping service example for small shops or single-person businesses.

Full-Service Bookkeeping

This is for bigger businesses with more money tasks. It covers everything from simple money tracking to handling payroll, taxes, and more.

A full-service bookkeeper takes care of bills, staff pay, reports, and tax prep. You also get full monthly or yearly reports. These help you make smart choices for your business.

Online Bookkeeping

Online bookkeeping services use computer tools or apps to track money. Some examples are QuickBooks, Xero, and Zoho Books. You or your bookkeeper can log in from any place with internet.

Online bookkeeping services are fast and easy. You don’t need to keep paper bills or receipts. Everything is stored safely in the cloud.

Outsourced Bookkeeping

In this type, you hire a team outside your business to do the work. These are experts in bookkeeping services. They work from their office but help you from anywhere.

It is great for small to medium businesses that don’t want to hire full-time staff. It is often cheaper and still gives you expert service.

This fits the bookkeeping services description for companies that want smart help without extra costs.

Bookkeeping Services Description – What Do They Include?

A bookkeeping services description covers key financial tasks that keep a business on track. Bookkeepers do more than just enter numbers—they help with smooth cash flow, rule compliance, and clear records that support good choices.

Below are the main tasks found in bookkeeping services:

1. Recording Daily Sales and Expenses

Bookkeepers note all sales and costs each day. This ensures every deal is logged correctly and helps track gains and spending trends.

2. Tracking Payments from Customers

They track all payments—cash, online, or by check. This keeps accounts receivable up to date and shows who has paid and who still owes.

3. Recording Supplier Invoices and Bills

Supplier invoices and bills are entered on time. This helps avoid late fees and keeps vendor ties strong.

4. Reconciling Bank and Credit Card Accounts

Each month, bookkeepers match records with bank and card statements. This step finds errors, fraud, or missed deals before they grow.

5. Creating Profit and Loss Reports

Profit and loss (P&L) reports show income, costs, and gains. These reports guide owners in plans and smart money moves.

6. Maintaining Balance Sheets

Balance sheets give a snapshot of assets, debts, and equity. Bookkeepers keep them current so owners see their true money state at any time.

Bookkeeping Services Examples

To understand better, let’s look at some bookkeeping services examples:

1. Recording Sales

- A store sells products daily. Bookkeeping records these sales.

2. Managing Expenses

- All office rent, utility bills, and staff payments are recorded.

3. Bank Reconciliation

- Bank statements are matched with company records to avoid errors.

4. Payroll Support

- Employee salaries, taxes, and deductions are recorded properly.

5. Tax Preparation

- Reports are made ready for smooth tax filing.

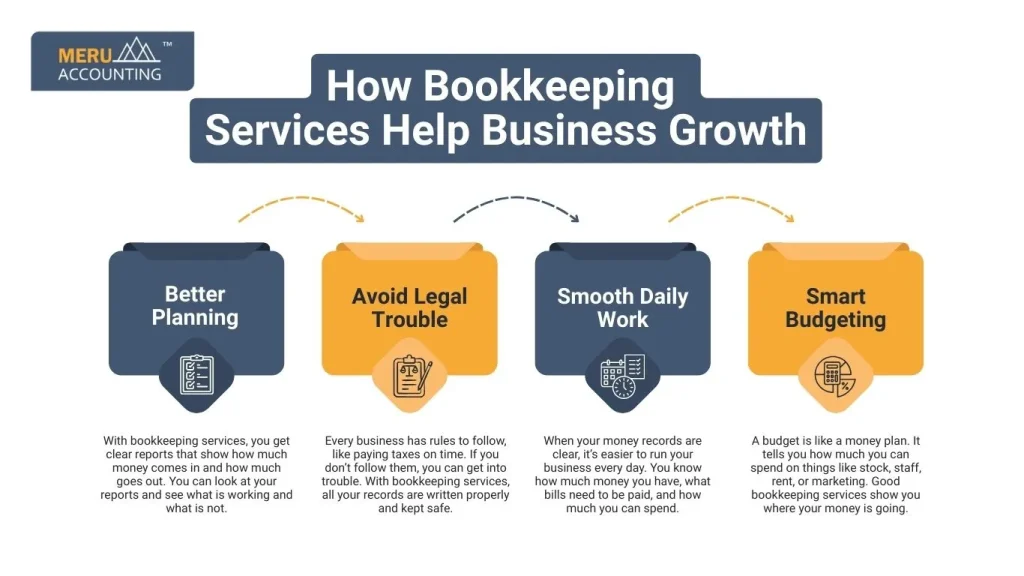

How Bookkeeping Services Help Business Growth

Better Planning

With bookkeeping services, you get clear reports that show how much money comes in and how much goes out. You can look at your reports and see what is working and what is not.

Avoid Legal Trouble

Every business has rules to follow, like paying taxes on time. If you don’t follow them, you can get into trouble. With bookkeeping services, all your records are written properly and kept safe.

This means if the government checks your records, everything is neat and correct. You can also pay your taxes on time with the right amount. This helps you stay out of trouble and build a good name.

Smooth Daily Work

When your money records are clear, it’s easier to run your business every day. You know how much money you have, what bills need to be paid, and how much you can spend.

Bookkeeping services help you manage your business without confusion. This means you can focus on serving customers, improving products, and making more sales, not worrying about missing bills or money mistakes.

Smart Budgeting

A budget is like a money plan. It tells you how much you can spend on things like stock, staff, rent, or marketing. Good bookkeeping services show you where your money is going.

Steps in Bookkeeping Services

Bookkeeping is a step-by-step task that keeps records clear, true, and up to date. A sound flow helps firms stay on track, get ready for audits, and make smart money choices. Below are the main steps in bookkeeping:

1. Collecting Source Records

The first step is to gather all slips, bills, bank notes, pay files, and sales docs. These act as proof for each deal and form the base of the books.

2. Recording Deals in Journals

Once documents are in hand, each deal is logged in a journal—sales, buys, or cash. This step makes sure all events are stored in the right order.

3. Posting to Ledgers

Next, entries move from journals to the ledger. The ledger groups them into cash, receivables, payables, or costs. This helps track each account with ease.

4. Reconciling Accounts

Bank and card notes are matched with in-house records. This step spots gaps, fraud, or errors and fixes them fast.

5. Preparing Trial Balance

A trial balance lists all ledger sums. It checks if debits equal credits. If not, the errors must be found and fixed.

6. Making Reports

From the trial balance, the P&L, balance sheet, and cash flow reports are made. These give a clear view of money, health and gains.

7. Adjusting Entries

Bookkeepers then make changes for items like costs due, prepaid expenses, or wear and tear. This keeps each record in the right time frame.

8. Closing the Books

At the end of each term, temp accounts like sales and costs are closed. Net gain or loss moves to owner’s equity. This clears the way for the next term.

9. Tax Prep Help

Once books are closed, the data is used for tax returns. Good books make sure all claims are right and the rules are met.

10. Review and Audit Readiness

The last step is to check records often and keep them audit-ready. This way, the firm can show true data to tax staff, banks, or investors.

This step-by-step bookkeeping service helps in smooth business operations.

Bookkeeping Services Examples in Different Industries

Retail Stores

- Tracking daily sales, inventory, and supplier bills.

Restaurants

- Recording food costs, staff payroll, and sales revenue.

Freelancers

- Tracking invoices, client payments, and tax deductions.

E-commerce Businesses

- Managing online sales, refunds, and shipping costs.

Healthcare Providers

- Recording patient billing, insurance claims, and payroll.

These bookkeeping services examples show how every industry needs proper records.

Bookkeeping services are not just about recording numbers. They are about giving your business a clear direction. With the right bookkeeping services description, you can stay stress-free, plan for growth, and build trust with clients and investors.

By looking at the many bookkeeping services examples, it is clear that every business, big or small, needs proper records. Investing in good bookkeeping support is one of the smartest moves you can make for long-term success.

At Meru Accounting, we provide expert bookkeeping services tailored to your business needs. Our team ensures accuracy, efficiency, and compliance, helping you focus on growth. Partner with us to simplify your finances and achieve long-term success.

FAQs

- What’s the difference between bookkeeping and accounting?

Bookkeeping is recording day-to-day money activities. Accounting is checking and analyzing those records to make financial decisions. - Can I do bookkeeping myself?

Yes, small business owners can do it. But as your business grows, hiring a professional or using bookkeeping services is better. - How often should bookkeeping be done?

Bookkeeping should be done daily or weekly. This keeps records fresh and errors low. - Is online bookkeeping safe?

Yes, online bookkeeping is safe if you use trusted tools like QuickBooks or services like Meru Accounting. - Do I need bookkeeping if I’m a freelancer?

Yes. Even freelancers need to track income, expenses, and taxes. Bookkeeping helps you see how much you earn and spend.