What are the most important accounts receivable goals?

Accounts receivable goals examples include timely payments, healthy cash flow, and reduced bad debts. These are essential for keeping your business strong. Accounts Receivable is the money your clients owe you for goods or services already delivered. It’s a key part of your company’s cash flow. The goals of accounts receivable are to collect money fast, reduce losses, and run your billing process in a smart way.

In this article, we’ll break down the most important goals of accounts receivable and how you can reach these accounts receivable goals with effective steps.

What Are Accounts Receivable Goals?

- These are clear targets for how a business should manage the money owed by its customers. They help reduce late payments and improve cash flow.

- Setting the right goals for accounts receivable can make your collection process more effective.

- These goals for accounts receivable may focus on short-term wins like monthly collections or long-term targets like cutting overdue balances.

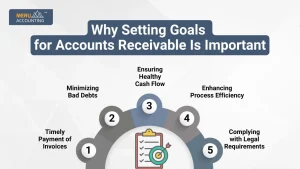

Why Setting Goals for Accounts Receivable Is Important

- Helps you track incoming payments better.

- Keeps your cash flow steady and healthy.

- Reduces the number of unpaid or late accounts.

- Keeps your team focused and clear on what to achieve.

- Ensures good relationships with customers by setting payment expectations.

1. Timely Payment of Invoices

The first and most basic goal of accounts receivable is to get paid on time. Late payments slow down your business. If you don’t have cash coming in, it becomes hard to pay staff or buy new stock.

How to meet this goal:

- Set clear payment terms (like Net 15 or Net 30).

- Send invoices right after work is done.

- Offer small discounts for early payments.

- Charge fees for late payments.

Setting this goal helps boost cash flow and limits risk. It is one of the simplest but most effective accounts receivable goals examples.

2. Minimizing Bad Debts

Bad debt is money you won’t get back. This could be due to customer issues, disputes, or refusal to pay. Keeping bad debt low is another key goal of accounts receivable.

Steps to reduce bad debt:

- Do credit checks before selling on credit.

- Set credit limits per customer.

- Keep a close watch on overdue invoices.

- Use debt collection only when needed.

With the right policies, you can reduce your bad debt risk while still making sales. This makes it a must-have among your goals for accounts receivable.

3. Ensuring Healthy Cash Flow

Good accounts receivable management boosts cash flow. When cash keeps coming in, your business stays strong and can grow. Healthy cash flow stands out as one of the main goals of accounts receivable that fuels business growth.

How to achieve this:

- Monitor cash inflow daily or weekly.

- Track aging reports to spot delays.

- Set up auto-reminders for payments.

- Adjust credit terms if cash gets tight.

Focusing on cash flow means less borrowing and more room to grow. This makes it one of the most practical accounts receivable goals examples for any business.

4. Enhancing Process Efficiency

Another major goal of accounts receivable is to make the process smooth and cost-friendly. This is done through smart tools and software.

Ways to improve A/R efficiency:

- Use automated invoicing software.

- Let clients pay online via secure portals.

- Reduce manual work in billing and tracking.

- Train staff in proper A/R handling.

When processes are lean, the cost to collect drops. This improves the bottom line and makes your goals easier to reach.

5. Complying with Legal Requirements

Legal rules vary by location and industry. You need to follow rules about billing, credit terms, and data handling. This is a key goal of accounts receivable that protects your business.

Best practices for compliance:

- Know and follow tax laws.

- Keep client data safe and private.

- Store invoice records as per law.

- Update your process if rules change.

Failing to meet legal rules can lead to fines or lawsuits. So, this is one of the most important goals for accounts receivable to get right.

Accounts Receivable Goals Examples

Here are some simple and real-life accounts receivable goals examples:

- Goal 1: Reduce DSO from 45 days to 30 days in 3 months.

- Goal 2: Collect 90% of invoices within 30 days.

- Goal 3: Limit bad debt to under 1% of total revenue.

- Goal 4: Automate 70% of invoicing by the next quarter.

- Goal 5: Contact 100% of overdue customers within 5 days.

These are practical goals for accounts receivable that small or big businesses can use.

How to Set Strong Goals of Accounts Receivable

1. Make Them SMART

- Specific: Clear about what needs to be done.

- Measurable: Use numbers to track success.

- Achievable: Not too easy, not too hard.

- Relevant: Linked to overall business success.

- Time-bound: Set a deadline.

2. Involve Your Team

- Your collections team should help set the goals.

- They know what’s realistic and what’s not.

3. Review Regularly

- Don’t just set and forget.

- Check your accounts receivable goals every month.

- Make changes if needed.

Common Mistakes to Avoid

1. No Clear Goals

- Without goals, your team has no direction.

- It leads to poor performance.

2. Ignoring Overdue Accounts

- The older the debt, the harder it is to collect.

- Follow up regularly.

3. Sending Late Invoices

- It causes delays in getting paid.

- Always send on time.

4. Giving Credit Too Easily

- Set rules for giving credit.

- Check the customer’s payment history.

How to Measure the Success of Your A/R Goals

- Check the monthly trend in your Days Sales Outstanding (DSO) to see how fast you get paid.

- Track the cash you collect and compare it to the amount you have billed.

- Watch the number of overdue accounts to see if your follow-ups work.

- Use reports from your software to track all key numbers.

- Note how long it takes to get paid after you send an invoice.

- Track the share of bills paid on or before the due date.

- Count how many customer issues you get and how fast you solve them.

Tips to Achieve Your Accounts Receivable Goals

1. Automate Follow-Ups

- Use reminders via email and SMS.

- Saves time and increases response rate.

2. Offer Payment Plans

- Make it easier for clients to pay in small parts.

- Better than losing the full amount.

3. Reward Prompt Payers

- Give small discounts for early payments.

- Builds good customer habits.

4. Send Friendly Reminders

- Don’t wait till the due date.

- Remind them a few days before and after.

Tools That Help You Meet A/R Goals

1. Accounting Software

- Tools like QuickBooks, Zoho Books, and Xero help track invoices and payments.

- These tools send auto-reminders and create useful reports.

2. CRM Software

- A CRM helps you track customer details and past payment behavior.

- It helps your team stay updated when talking to clients.

3. Collection Apps

- Tools like Chaser and InvoiceSherpa help manage unpaid bills.

- These apps send smart reminders to clients without being too harsh.

These tools support your goals of accounts receivable by saving time and avoiding errors.

Best Practices to Reach Your A/R Goals

1. Set Clear Payment Terms

- Share due dates with your clients from the start.

- Mention any late fees or interest in your terms.

2. Send Invoices Without Delay

- Bill your customers right after the product or service is delivered.

- Don’t wait too long, or they may forget.

3. Use Soft Follow-Ups First

- Start with a friendly reminder before taking strict steps.

- Most customers respond well to polite messages.

4. Review Your A/R Process Often

- Look for gaps or delays in your system.

- Fix slow steps to keep things moving fast.

These tips help achieve your accounts receivable goals smoothly and on time.

How A/R Goals Help Other Areas of Business

- Better Planning: You know when money is coming in, so you plan better.

- Less Borrowing: If customers pay on time, you don’t need loans.

- Stronger Teamwork: Your sales and finance teams work better together.

- Higher Profits: Fewer unpaid bills mean more money for your business.

This shows how strong accounts receivable goals affect the full business.

Strong goals for accounts receivable help you collect faster, reduce bad debts, and improve cash flow. They give your team clear direction and help build better customer relationships. Use the accounts receivable goals examples above to guide your team. Review them often and adjust based on your business needs. With smart planning, you can meet all your accounts receivable goals easily. At Meru Accounting, we help firms set and reach the right goals for receivables. Our team uses smart tools and clear steps to speed up your cash flow. We help you stay on track and grow with ease. Let Meru Accounting help you get paid on time and stay strong in business.

FAQs

Q1. What are the main goals of accounts receivable?

To get payments on time, reduce unpaid invoices, and improve cash flow.

Q2. Why is reducing DSO important?

Because it shows how quickly you collect money from customers.

Q3. How often should A/R goals be reviewed?

At least once a month to check progress and make changes.

Q4. Can small businesses set A/R goals too?

Yes, even small businesses benefit from clear A/R goals.

Q5. What is a good DSO target?

A good DSO is usually under 30 days, but it varies by industry.

Q6. How can automation help in A/R?

It saves time by sending reminders and generating invoices automatically.

Q7. What happens if you don’t set A/R goals?

You may face delayed payments, poor cash flow, and customer issues.