Home » What Does a Personal Bookkeeper Do?

What Does a Personal Bookkeeper Do?

Have you ever felt like your money is hard to track? Maybe you forgot to pay bills on time, or maybe you’re not sure where your money goes each month. This is where a personal bookkeeper can help you, like a teacher helps with school, a personal bookkeeper helps with money. They keep your spending and saving on track.

A personal bookkeeper is someone you can trust with your day-to-day money tasks. These tasks include checking your bills, writing down your spending, and making sure nothing is missed. Personal bookkeeping makes life easier because you know where your money is and where it’s going.

People of all ages can use personal bookkeeping services. Busy workers, parents, or even students may find it helpful. You don’t need to be rich to need help. If you want to stay in control of your money, a personal bookkeeper is a great choice.

What is a Personal Bookkeeper?

A personal bookkeeper is someone who helps you with your personal money records. They do not manage big company books. Instead, they work with people like you and me to make sure personal money matters are handled well. They are not the same as accountants. Accountants often help with taxes or business reports. A personal bookkeeper focuses on the daily money tasks that affect your life.

Here are a few things a personal bookkeeper does:

- Tracks your income

- Records your spending

- Pays bills on time

- Organizes receipts

- Makes simple reports about your money

- Helps you follow a budget

- Prepares your money records for tax time

They use tools like spreadsheets or software to keep their records neat. These records are useful if you want to buy a house, save for school, or plan a trip.

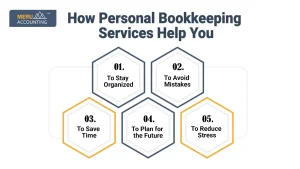

How Personal Bookkeeping Services Help You

People use personal bookkeeping services for many reasons. Here are some of the main ones:

1. To Stay Organized

A personal bookkeeper keeps everything in order so you don’t have to worry. Without it, the task can get a little tough, and you also have to remember and keep all the records by yourself.

2. To Avoid Mistakes

Sometimes people pay bills late, or they forget to write down a big expense. A personal bookkeeper helps avoid these mistakes by keeping everything updated.

3. To Save Time

Tracking your money takes time. If you’re a busy parent, student, or working professional, hiring someone to help can give you more free time.

4. To Plan for the Future

If you want to buy a car, save for college, or go on a trip. A personal bookkeeper can help you plan how to reach that goal without wasting money.

5. To Reduce Stress

Money problems can be stressful. Knowing your money is being tracked gives you peace of mind. You don’t have to feel confused or lost.

What Does a Personal Bookkeeper Actually Do Each Week

A personal bookkeeper helps you take care of your money. They help make sure you don’t spend too much, and that you always know where your money is going. Each week, they do many small but important jobs. Let’s look at what they do:

- Pay Your Bills

The bookkeeper checks your bills, like for your house, phone, or power. They make sure you pay them on time, so you don’t get late fees. - Write Down Money In and Out

They keep track of all the money you make, like from your job or side work. They also write down every time you spend money, like on food, clothes, or gas. - Check Receipts

If you keep your receipts, the bookkeeper will look at them and match them with your spending. This helps make sure the numbers are right and nothing is missing. - Keep Neat Records

They use notebooks or computer tools to keep all their money records neat. This helps if you ever need to check something or show it to someone. - Send You Reports

Every week, the bookkeeper gives you a report. This shows how much money you got, how much you spent, and how much is left. It helps you understand your money better.

Some people hire a personal bookkeeper to visit their home once a week. Others meet online. Many personal bookkeeping services can be done through email or apps.

Benefits of Having a Personal Bookkeeper

A personal bookkeeper helps you stay in control of your money. Let’s look at some of the good things that happen when you have one:

1. You Know Where Your Money Goes

Your bookkeeper keeps neat records of what you spend. So, you can see how much money you use for food, clothes, gas, school stuff, or fun. It’s like having a money map that shows where every rupee goes.

2. You Save More

When you know how much you spend, you can spot places to save. For example, if you see you’re spending a lot on snacks, you might choose to cut back. This way, you can save for things you really want like a trip, toy, or gift.

3. You Avoid Late Fees

If you forget to pay bills, you may have to pay extra fees. But a personal bookkeeper helps you pay on time. They can remind you or even pay the bills for you. That means no more worry and no more extra charges.

4. You Can Budget Better

A bookkeeper helps you make a simple budget. That means planning how much you can spend each week or month. It helps you stay on track and not spend too much.

5. You’re Ready for Tax Time

At the end of the year, you may need to show how much you earned and spent. Your bookkeeper keeps all your money records sorted and safe. This makes it much easier to fill out tax forms without stress.

How to Choose the Right Personal Bookkeeper

Picking the right personal bookkeeper is important. This person will help you with your money, so you want someone you trust. Here are some tips to help you choose the best one for your needs:

1. Look for Experience

Make sure the personal bookkeeper has done this kind of work before. They should know how to keep track of money and use personal bookkeeping tools like apps or spreadsheets.

2. Ask About Services

Different bookkeepers offer different things. Ask what kind of personal bookkeeping services they offer. Do they help pay bills? Do they send reports? Make sure they offer what you need.

3. Check If They Are Honest

Your bookkeeper will see your money details, so they must be honest and fair. You can ask other people or read reviews to find someone you can trust.

4. Pick Someone Who Explains Well

A good personal bookkeeper should explain money matters in simple words. You should feel okay asking questions and understanding what they say.

5. See If They Use Good Tools

Ask if they use easy and safe tools for personal bookkeeping. Some may use computers, apps, or even paper. Pick what works best for you.

6. Make Sure You Can Afford Them

Ask how much the personal bookkeeping services cost. Pick someone who fits your budget but still does a great job.

When you use good personal bookkeeping, you save time and feel calm. It helps you meet your money goals faster. If tracking money feels hard, personal bookkeeping services can help. If you’re busy, tired, or unsure, a personal bookkeeper makes it easy.

A personal bookkeeper helps you manage your money. They watch your spending, pay bills, and don’t miss a thing. Meru Accounting gives safe and simple personal bookkeeping services. Our team is kind and ready to help. We help you track your money, plan your budget, and build a better future. With Meru, your money stays safe, smart, and simple.

FAQs

- Do personal bookkeepers do taxes?

Not always. Some may help you get ready for tax time, but tax filing is usually done by an accountant. - Is a personal bookkeeper only for rich people?

No! Anyone who wants help with tracking money can use personal bookkeeping services. - Can I use a bookkeeper if I work part-time or freelance?

Yes! A personal bookkeeper is great for gig workers or people with many small jobs. - Will my bookkeeper see my bank info?

Only if you allow it. Some bookkeepers work with your bank or use apps with your permission. - How do I start using personal bookkeeping services?

You can call or email a bookkeeper, or use a service like Meru Accounting to match with someone who fits your needs.