Home » What is Amazon bookkeeping?

What is Amazon bookkeeping?

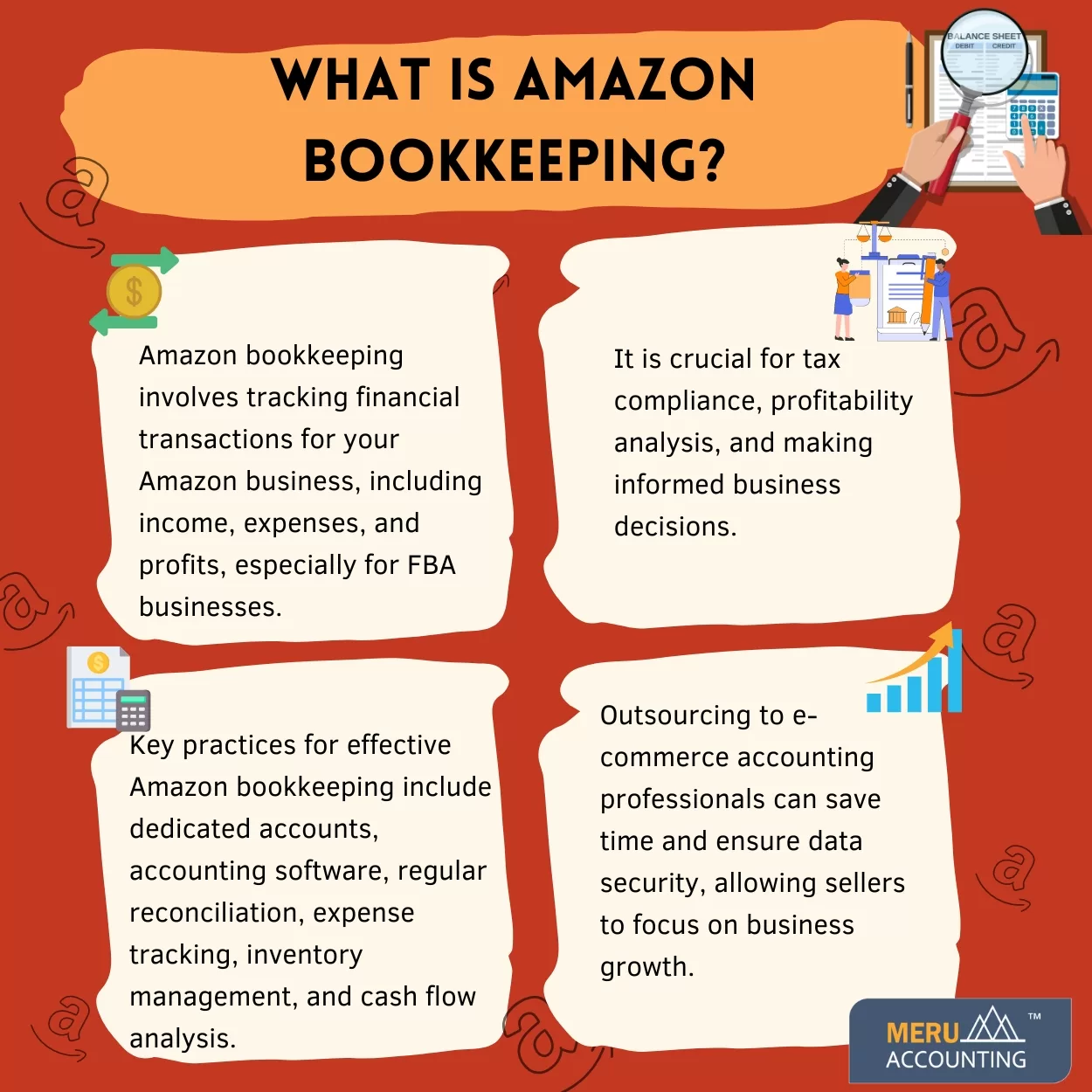

In the ever-expanding world of e-commerce, Amazon stands out as a powerhouse platform for both established businesses and aspiring entrepreneurs. To thrive in this competitive landscape, it’s crucial to have a solid grasp of your finances. Amazon bookkeeping, also known as Amazon FBA bookkeeping, is the process of managing and tracking your financial transactions related to your Amazon business. In this blog, we will understand different aspects of Amazon bookkeeping software and how it can benefit your business.

Understanding Amazon Bookkeeping software:

1. Financial Tracking

- Amazon bookkeeping involves precisely tracking your income, expenses, and profits from your Amazon business. This includes monitoring product sales, fees, refunds, and other financial activities.

2. Amazon FBA

- For those utilizing Amazon’s Fulfillment by Amazon (FBA) service, bookkeeping extends to managing inventory and shipping costs as well. FBA businesses must keep a close eye on their inventory levels to ensure they never run out of stock or overstock.

The Importance of Amazon Bookkeeping Software:

1. Tax Compliance

- Accurate bookkeeping is vital for tax compliance. Amazon sellers must report their earnings to tax authorities, making it essential to have well-organized financial records. Precise records also help in taking advantage of tax deductions.

2. Profitability Analysis

- Amazon bookkeeping enables sellers to assess the profitability of their products. By understanding which items are making the most money and which ones are not, sellers can make informed decisions about their inventory.

3. Business Growth

A clear financial overview helps sellers identify areas for business growth. With the right data at your fingertips, you can make strategic decisions regarding product expansion, pricing, and marketing efforts.

Effective Amazon Bookkeeping:

Dedicated Accounts

To maintain accurate records, it’s advisable to have dedicated business and personal bank accounts. This separation simplifies tracking income and expenses related to your Amazon business.

Accounting Software

Many Amazon sellers rely on accounting software like QuickBooks, Xero, or specialized e-commerce accounting tools. These platforms streamline financial management and provide detailed reports.

Regular Reconciliation

Regularly reconcile your Amazon sales and fees with your bank statements thus helping you in identifying any discrepancies or missing transactions.

Expense Tracking

Document all expenses related to your Amazon business, such as product costs, shipping fees, Amazon fees, advertising expenses, and any other overhead costs.

Inventory Management

Effective Amazon bookkeeping includes tracking inventory levels and valuations. This is especially critical for FBA businesses to avoid overstock or stockouts.

Cash Flow Analysis

Monitor your cash flow to ensure that you have enough funds to cover expenses and restock inventory. A healthy cash flow is crucial for the sustainability of your Amazon business.

Consistent Record Keeping

Create a system for organizing and storing financial records, including receipts, invoices, and statements. This makes it easier to access documents when needed, such as during tax season or audits.

Outsourcing Amazon Bookkeeping:

Professional Assistance

Some Amazon sellers opt to outsource their bookkeeping to professionals who specialize in e-commerce accounting. These experts can provide valuable insights and ensure compliance with tax regulations.

Time and Resource

Savings Outsourcing bookkeeping allows sellers to focus on other aspects of their business, such as sourcing products, marketing, and customer service.

Data Security

Reputable e-commerce bookkeeping services prioritize data security, ensuring your financial information remains confidential and protected.

In conclusion, Amazon bookkeeping is a critical aspect of running a successful e-commerce business on the Amazon platform. Whether you choose to manage your Amazon bookkeeping in-house or opt for professional assistance from Meru Accounting, the benefits of organized financial records are undeniable in the fast-paced world of online selling.

FAQs

- What is Amazon bookkeeping?

It means tracking all money that goes in or out of your Amazon business. - What does Amazon FBA bookkeeping include?

It includes stock tracking, shipping costs, and storage fee records. - Why do Amazon sellers need to track expenses?

It helps manage costs and keeps records clear for tax filing. - How does accounting software help Amazon sellers?

It sorts data, creates reports, and reduces manual work. - Why should Amazon sellers keep personal and business accounts separate?

It makes it easier to track business spending and income. - What is the value of regular account checks?

It helps catch missing entries or mismatched records early. - How does bookkeeping support product profit checks?

It shows which items make money and which ones do not. - Can Amazon sellers outsource bookkeeping work?

Yes. It saves time and keeps financial data safe.