What Makes Accounts Payable Management a Key Element in Financial Strategy?

Accounts payable management plays a critical role in financial strategy by ensuring efficient cash flow management. It helps a company maintain positive vendor relationships, avoid late payment penalties, and optimize working capital. Effective AP management streamlines operations, reduces costs, and supports timely decision-making for investments and financial planning. By analyzing payment terms, managing cash reserves, and maintaining a balance between short-term liabilities and assets, companies can enhance profitability. Additionally, optimizing accounts payable processes contributes to financial stability and long-term growth, making it a key element in achieving overall business objectives and sustaining competitive advantage.

Table of Contents

- Introduction

- Effective Accounts Payable Management as a Pillar of a Robust Financial Strategy

- Strategies to Optimize Accounts Payable Management

- Frequently Asked Questions

- Conclusion

Introduction

Accounts payable management refers to the process of efficiently handling a company’s short-term liabilities, specifically the payments owed to suppliers or vendors for goods and services received. It involves tracking invoices, ensuring timely payments, and maintaining accurate records of all transactions. Effective accounts payable management helps businesses optimize cash flow, avoid late fees, and capitalize on potential discounts for early payments. By organizing and streamlining this process, companies can maintain strong vendor relationships, enhance operational efficiency, and support compliance with financial regulations.

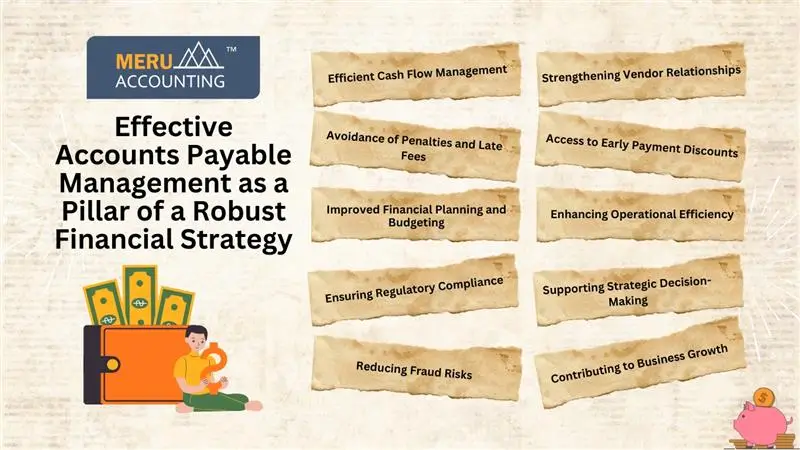

Effective Accounts Payable Management as a key element of a Robust Financial Strategy

- Efficient Cash Flow Management

Accounts payable management plays a critical role in maintaining healthy cash flow. By optimizing payment schedules, businesses can ensure they have enough liquidity to meet their short-term obligations while avoiding unnecessary interest charges or late payment fees. - Strengthening Vendor Relationships

Timely payments and clear communication with vendors enhance trust and reliability. Good accounts payable management ensures suppliers are paid promptly, leading to better business terms and potential discounts for early payments. - Avoidance of Penalties and Late Fees

Proper accounts payable management helps track due dates and ensures payments are made on time. This avoids costly penalties and late fees, preserving the company’s financial resources. - Access to Early Payment Discounts

Many suppliers offer discounts for early payments. Efficient accounts payable management enables businesses to take advantage of these opportunities, resulting in significant cost savings over time. - Improved Financial Planning and Budgeting

Accurate tracking of accounts payable gives businesses a clear view of their outstanding liabilities. This data is vital for effective financial planning and helps create realistic budgets based on actual obligations. - Enhancing Operational Efficiency

Automation and organization in accounts payable processes save time and reduce errors. Well-managed accounts payable systems streamline workflows, minimize manual interventions, and enhance overall operational efficiency. - Ensuring Regulatory Compliance

Accounts payable management ensures compliance with tax regulations and reporting requirements. It prevents financial missteps that could result in audits or penalties, thus safeguarding the company’s reputation. - Supporting Strategic Decision-Making

Detailed accounts payable data provides insights into spending patterns and vendor performance. This information supports strategic decisions, such as renegotiating terms with suppliers or consolidating vendors for better efficiency. - Reducing Fraud Risks

A structured accounts payable process includes checks and balances to identify irregularities. It mitigates the risk of fraud by ensuring all transactions are verified and approved before payment is made. - Contributing to Business Growth

Effective accounts payable management frees up resources and reduces financial uncertainty, enabling businesses to focus on growth initiatives. It creates a stable foundation for scaling operations without cash flow disruptions.

Strategies to Optimize Accounts Payable Management

- Adopt Automation Tools

Using automation for accounts payable management reduces manual errors, speeds up processing, and provides real-time visibility into liabilities. Tools like invoice management software can simplify workflows and enhance efficiency. - Set Clear Policies

Establishing clear accounts payable policies helps standardize procedures and avoids confusion. Define approval hierarchies, payment schedules, and vendor communication protocols to streamline operations. - Monitor and Reconcile Regularly

Frequent reconciliation ensures that financial records are accurate and prevents errors like overpayments or duplicate invoices. It also ensures a clear understanding of outstanding liabilities. - Leverage Vendor Discounts

Negotiate and take advantage of early payment discounts where possible. Accounts payable management strategies that include timely payments can lead to significant cost savings.

Conclusion

Businesses can enhance financial stability and operational efficiency by effectively managing payments, optimizing cash flow, and fostering strong supplier relationships. The strategic handling of payables helps minimize costs, prevent late fees, and improve liquidity, all of which support long-term growth. Implementing best practices and leveraging automation can further streamline the process, ensuring greater accuracy and efficiency. Meru Accounting specializes in providing comprehensive accounts payable management solutions, helping businesses maintain accurate records, automate payment processes, and ensure timely vendor payments.

Frequently Asked Questions (FAQs)

Q1: Why is timely accounts payable management important?

Paying bills on time helps maintain good relationships with suppliers, avoids extra fees for late payments, and improves a business’s financial reputation.

Q2: How does accounts payable management improve cash flow?

By strategically scheduling payments and utilizing credit terms, accounts payable management ensures businesses maintain liquidity while meeting their financial obligations.

Q3: How can Meru Accounting assist with accounts payable management?

Meru Accounting offers comprehensive accounts payable management services, including invoice tracking, payment scheduling, and reconciliation.

Q4: Does Meru Accounting provide automation solutions for accounts payable management?

Yes, Meru Accounting utilizes advanced automation tools to optimize accounts payable processes. These solutions reduce manual errors, enhance efficiency, and provide businesses with real-time insights into financial liabilities.

Q5: What happens if accounts payable is not managed properly?

If accounts payable isn’t handled well, a business might face cash flow issues, damage its relationships with suppliers, miss payment deadlines, or pay extra fees.

Q6: Can Meru Accounting help with legal and tax requirements in accounts payable?

Yes, Meru Accounting makes sure your accounts payable process follows all legal and tax rules. We help businesses avoid fines and other problems by keeping everything accurate and compliant.