Home » What We Do » Bookkeeping for CPA’s

Experience Hassle-Free

Bookkeeping For CPA's & Accountant

Part Time / Full Time Accountants - 10/20/40 Hours Per Week Starting At Just $10 Per Hour

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the US. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of US regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Bookkeeping Services For CPAs

- Often CEOs look for a one-stop solution when it comes to the financial management of their organisation.That’s why they approach a CPA firm that can manage their finances, cash flows, tax planning and other such customer profitability strategies while at the same time provide bookkeeping and accounting service.

- While CPA firms do offer a blanket of services to compliment the unique requirement of their clients, their prime focus is on offering advisory service, conducting audits, managing compliance requirements, tax planning, etc. Profitable CPA firms are well aware of the fact that bookkeeping can be extremely time-consuming and can negatively impact the bottom line. Besides, it can shift the focus from the core business.

- Meru Accounting understands this gap and therefore partners with CPA firms in the USA to offer bookkeeping services to their clients. Regardless of where in the USA you are, we will take care of the bookkeeping requirements of your clients. We believe in delivering results that match up to your expectations and therefore we consult with you to ensure that your client’s books are inline with your preferences.

Who We Are?

- Meru Accounting is anIndia-based outsourced accounting and bookkeeping firm led by a team of CAs, CPAs, CFAs and other professionals with great expertise and knowledge. We cater to major CPA firms in USA, UK, Australia, Singapore and New Zealand.

- We partner with CPA firms to support them with bookkeeping service, clean-up service and backlog accounting which in turn helps them in exclusive decision making strategies. Whichever accounting tool or bookkeeping software you prefer to use, we are flexible and prepared to bring that to the table, whether it is QuickBooks, Net Suite, Quicken, CSA, Peachtree, MYOB, Sage, Creative Solutions’ Ultra-Tax or Intuit’s Pro Series, we specialise in all of these modern cloud accounting tools.

- Our competency lies in our vast experience of outsourcing bookkeeping services for CPAs having their clients across different business verticals. We are a preferred bookkeeping outsourcing company in India owing to our global experience in accounting and bookkeeping services that provides us a competitive edge over our competitors.Besides, we offer cost-effective solutions to our clients that start at as low as US $10 per hour.

Outsourcing For CPA Firms

- Are you a CPA firm looking for reliable outsourcing services? Outsourcing for CPA firms allows you to focus on your core tasks. Outsourced bookkeeping companies for CPA firms are saviors that help in managing their clients. At Meru Accounting, we understand that managing your clients’ financial records can be a time-consuming process. That’s where we come in. Our team of experts specializes in outsourcing for CPA firms, providing a confidential service that lets you concentrate on what you do best—providing expert financial advice.

Bookkeeping For Accountants

- At Meru Accounting, we understand the unique needs of bookkeeping for accountants. Accurate and up-to-date financial records are vital for any accountant. With our specialized expertise in bookkeeping for accountants, we ensure that your financial data is meticulously organized and readily available for analysis whenever you need it.

- There are many firms that offer cheap accountants for small business. At Meru Accounting, we not only offer cost-effective but also reliable solutions. Say goodbye to the headaches of managing your own books and hello to streamlined efficiency with our accountants bookkeeping service. We’re here to take the burden of bookkeeping off your shoulders, so you can focus on providing the best financial guidance to your clients. Let us be your trusted partner in maintaining impeccable financial records.

Virtual Assistant And Bookkeeper

- Our virtual assistants and bookkeepers are not just data entry clerks; they are experienced professionals who can act as both a virtual assistant and a bookkeeper for your CPA firm. They can handle everything from data entry and reconciliation to payroll processing and financial reporting.

- Looking for comprehensive virtual assistant bookkeeping services? Look no further. Our virtual assistants are well-versed in the nuances of accounting and bookkeeping. They will ensure your books are impeccably organized, giving you peace of mind and more time to focus on your clients. Maximize your efficiency with a dedicated virtual assistant for bookkeeping. Whether you’re a solo practitioner or part of a larger CPA firm, our virtual assistants can tailor their services to meet your specific needs.

Virtual Assistant Accounting Bookkeeping Service

- Hiring a virtual assistant for accounting can significantly reduce your operational costs. You only pay for the services you need, making it a cost-effective choice for your CPA firm. Our virtual assistants are skilled in various accounting software, ensuring a smooth and efficient partnership.

- Our virtual assistant accounting bookkeeping service combines the expertise of an accountant with the organizational skills of a bookkeeper. This dynamic approach guarantees that your financial records are not only accurate but also well-organized, making audits and financial analysis a breeze.

- Contact us today to learn how our bookkeeping for CPAs in the USA can revolutionize your practice.

Why choose us?

Professional Competence

- Xero Certified and Silver Partner

- Quickbooks Certified

- Professional team leader responsible for reviewing and delivering the work

- Standardized Payroll approval process

- Advance excel skills

- Monthly reconciliation of Control Accounts

Trust And Long-Term Relationship

- At least 50% reduction in cost

- Complete Transparency in Billing

We Know Your Work Culture

- Standardized New employee setup checklist

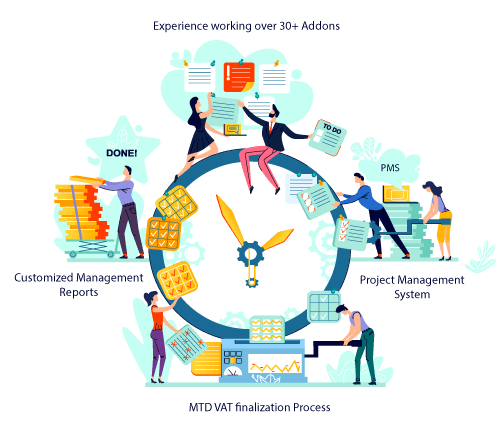

- Professional MTD VAT finalization Process to Optimize the Processes

- MTD Compliant services

- CIS return preparation and filing on time

We Will Add Value To Your Clients

- Professional MTD VAT finalization Process

- In house Standard Task Management System

- Updating accounts on a weekly basis

- Customized Management reports for medium and large-sized clients

- Experience working over 30+ Addons with QBO and Xero

Strong Communication Process

- Use of Cloud technologies in Communication

- Updating accounts on a weekly basis

- Daily Work updates

- Standardized Payroll approval Process

Core Competencies Of Meru Accounting In Bookkeeping And Accounting Services For Accountants:

Bank Reconciliation

Looking into the details of the bank account as well as filling the details related to it is very time consuming and confusing. The management of the cash outflow and inflow through the bank reconciliation is also quite a hectic task. Therefore, one needs to go through a lot of tedious jargon in accounting. Hence, the online accounting done at Meru Accounting easily relieves the businesses from all the bank reconciliation related activities. Here, they maintain all the bank reconciliation activities properly in the bookkeeping to keep all the related records in proper order.

Keeping The Records

For keeping all the financial records in the bookkeeping and accounting needs relevant knowledge in that sector. Meru Accounting has a very good expertise knowledge of keeping the records of the business. So, the businesses can maintain all the financial records in the ledgers, journals, books of accounts, and other related accounting books. The businesses also reduce their costs easily as all the accounting activities here are on the online platform.

Analysis Of The Financial Statements

A business involves a lot of activities like production, a sales campaign, marketing efforts, cost-cutting related activities and several other business-related activities. Therefore, the businesses need to get the proper idea related to the cost incurred in it. Meru Accounting has a very fantastic format of charts, graphs, tables, and different ratios to give the proper picture of the business finance. This also helps the businesses refine and make the modifications in their strategy to improve the business. So, the businesses can easily get the common requirement for the finances like income statement, profit & loss ratio, balance sheets and many other finance-related activities in the businesses.

Receivable Management

Receivable management is very important for businesses to ensure that the cash flow at the time intervals. Therefore, Meru Accounting services helps to send all the invoices to all the important clients in a very proper way. The tracking of the overdue payments can be along with regular email alerts. It will also ensure that the businesses get all the payments soon

Payroll Accounting

Managing the payments of the staff is a very essential factor for any of the organizations. It helps to keep their staff happy along with maintaining the proper financial control over the business. Hence, Meru Accounting service involves proper management of all the finance related to the payroll department. It will also ensure that all the staff gets the proper salary along with the proper tax, Provident Funds, and other deductions. They do all the computations in a very accurate format which can help to make proper payroll accounting.

Proper Taxing

Meru Accounting has good experience of working with the organizations. They also know all the tax-related aspects accurately here. So, the accounting service done here will make all the tax deductions, as per the industry norms. Hence, businesses need not worry regarding the tax deducted from the businesses.

Provide Efficient Accounting

Meru Accounting has relevant knowledge and years of experience in providing accounting services. They have all the certified accounting professionals, so they can bring a lot of efficiency in the accounting work here. Therefore, the businesses here can get all the error-free accounting statements which they can directly use

From the basic bookkeeping needs to the more complex financial needs, Meru Accounting can be your trusted business partner. Our certified advisors have helped many businesses achieve great efficiency and productivity. We aim to provide customized and accurate accounting and bookkeeping services to businesses.