Home » What We Do » Tax Returns » Form 1040

Form 1040

Individual Tax Return Preparation Service

Experts In Individual 1040 Tax return with Schedule C, D & E Pricing starts from $350

Get Expert Advice

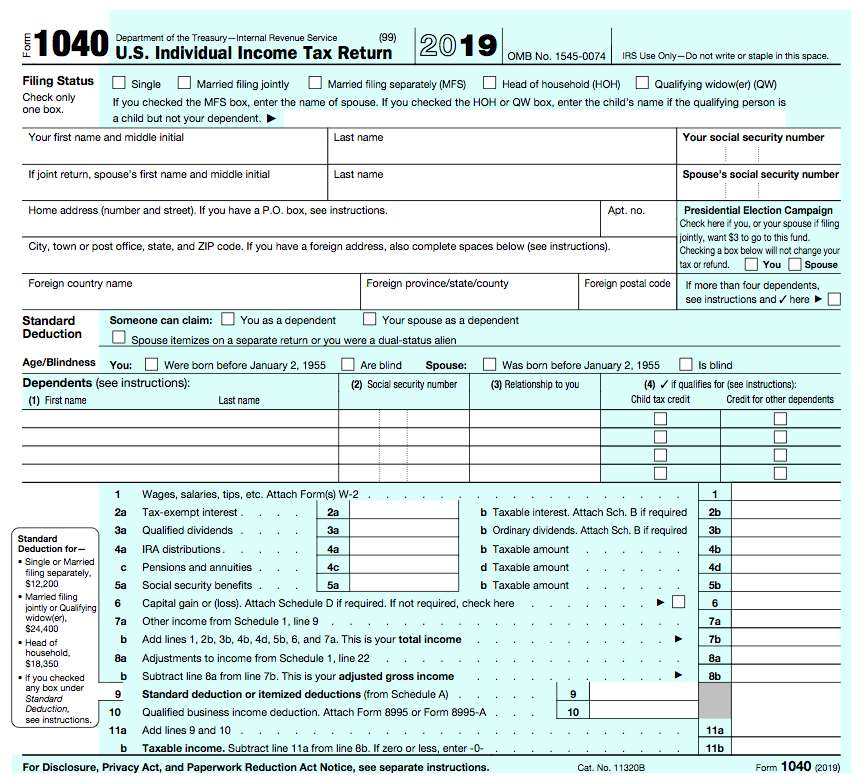

Form 1040 – Individual Tax Return Preparation Service

Individual Tax Return Preparation – If you are contributing to the economy of the nation through business income or else wise, you have to mandatorily pay taxes. You can use Form 1040 to file the federal tax payment for the income earned. Legally, it is the U.S. Individual Income Tax Return under the Internal Revenue Service (IRS). You will have to pay additional taxes depending on business income, along with other sources, which include rental income, investments and others.

Additionally, you will also have to pay state tax returns and multi-state tax returns along with the income tax. As per the rules, you have to submit the Form 1040 by 15th April of each year.

What Are Social Security Income And The Structure Of Form 1040?

It is the amount provided to the individuals after retirement or during tough times to the family or the individual themselves. The benefits that you will get as social security income depends on the financial status and income history.

Form 1040 comprises two pages in which all the details about the individual or the business have to be filled properly. The details in the structure of form 1040 include:

- Filing status information

- Name

- Address

- Social security number

- Deduction and number of dependents

- Health coverage details

- Reporting the following details:

- Wages

- Salary

- Taxable interest

- Capital gains

- Pension

- Social security income and benefits

- Deductions depending on several parameters

Along with the business income, other sources of income including rental income are taxable. However, filing the form 1040 has additional benefits including state tax returns, multi-state tax returns and credits.

If you get your dividend income through investment, you have to fill the dividend income-1099. The Internal Revenue Service (IRS) issues the dividend income-1099 form. In certain cases of dividend and distributions, it exempts the individuals from filing the dividend income-1099 form.

Information We Would Require

- Personal and professional identification proofs

- Salary income W2

- Bank details

- Schedule K1 form

- Social security numbers

- Other details including rent income details, etc

Due Date Of Filing

Normally you are supposed to file your U.S. Income Tax Return for Estates and Trusts by the 15th of April. But in 2020, due to the Corona-virus pandemic, the date has been extended till 15th July 2020 under The Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Our Process

At Meru Accounting, we make the Form 1041 return procedure smooth and hassle-free.

The client needs to send us the required documents. We will send a checklist and a standard format of the essential documents to our clients. Meru Accounting operates in the following modes:

Why Meru Accounting

Meru Accounting is India’s leading accounting outsourcing agency for the last 10 years and it has a strong client base all over the world. We provide end to end outsourcing solutions for the U.S. Income Tax Return for Estates and Trusts.

We have a team of experts who provide specialized services in Accounts outsourcing and we specialize in various accounting applications.

We have expertise in all type of 1040

It is beneficial for all the taxpayers to get their state tax returns and multi-state tax returns, additionally benefiting the government to keep a track of the income earned by the individuals. The form 1040 includes the following types,

- Form 1040-NR

- Form 1040 NR-EZ

- Form 1040-ES

- Form 1040-V

- Form 1040-X

- Form 1040-SR