Home » What We Do » Tax Returns » Form 1040-X

Form 1040-X

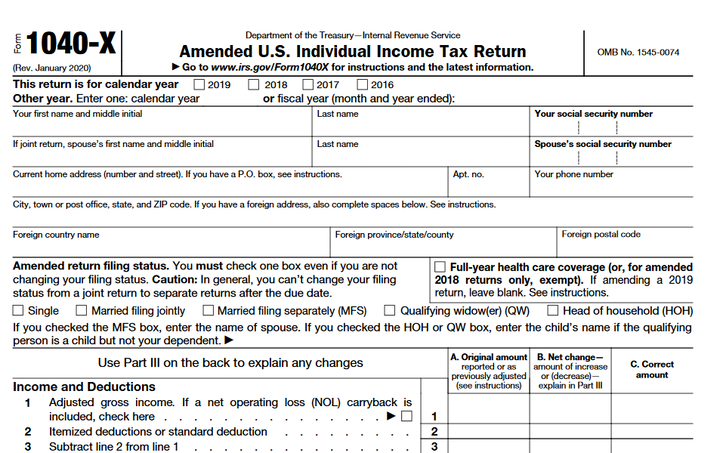

Amended U.S. Individual Income Tax Return

Get Expert Advice

Overview

Form 1040X is given to taxpayers who need to correct their tax returns for some reason by the Internal Revenue Service. Form 1040X is mandatory to submit for the amended U.S. Individual Income Tax Return. It includes changes to the number of dependents, filing status or corrections in income credits or deductions. If you want to submit a Form 1040X, you may also need to amend your state tax return. If you are looking for a professional service to submit 1040X form, then you have come to the right place.

Structure Of Form 1120

Information Required From The Client

You have to file form 1040X if you already have filed a tax return and want to do the following changes

Basic Information

- Correct Forms 1040-A, 1040-EZ, 1040-NR, 1040-NR E.Z.

- Make elections after the given deadline

- Change the refund amount previously adjusted by the IRS

- Claim for a carryback due to unused credit or loss

You can file two or more amendments, but you should use a different form for each Tax Year and mail each one in a separate envelope. The tax year has to be mentioned on the top of each form 1040X.

Due Date Of Filing

2021 is the deadline for 2016 tax year returns of an increased tax refund based on an amendment tax on April 15, 2020. You cannot claim tax refunds via a tax amendment for previous years.

If you owe taxes after your tax amendment, you should make your tax payment as early as possible to avoid penalties. If you owe taxes, you can file an amended U.S. Individual Income Tax Return even if three years have passed.

For your current year tax return, you should wait till you receive your refund before you file Amended U.S. Individual Income Tax Return. It may take up to 16 weeks for the IRS to process amended returns. A tax amendment should be filed within three years of the original tax return if you want to claim a tax refund. This includes extensions. You can also apply within two years of paying the tax, whichever is later. If you do not use it within three years, you cannot claim a refund. The money will go to the government.

Our Process

At Meru Accounting, we make the Form 1040X return procedure smooth and hassle-free.

The client needs to send us the required documents. We will send a checklist and a standard format of the essential documents to our clients. Meru Accounting operates in the following modes:

Why Meru Accounting?

- The qualified team- All our accountants are highly qualified and well-trained and work under the supervision of CPA.

- Reasonable Charge- We charge the only US $15 per hour tax return service.

- Technology-driven- We have experience in various add on in Cloud Environment and along with accounting software.

- Standardised process- We have a decent Project management system that helps to communicate with our clients effectively.

- Real and Error-Free Work- We follow standard Procedures and checklist to provide error-free work.

- Quick Response- We assure timely response and generally reply to every email in a day or within 24 hours.

Experience in Use of Accounting Software:

- Thomas Reuters

- Gosystem Tax Solution

- ProSeries Tax S Lacerte

- Ultra tax solution and many more.

We have expertise in preparing a Tax return for Federal and State Governments. We bring on table Customized solution for our Clients.

FAQs

Currently, the IRS does not allow tax amendments to be e-Filed. You need to mail your amended return to the IRS.

If there is a simple calculation mistake in your previous tax return, then you don’t need to file. The IRS generally corrects the errors while they process your original return. If the IRS wants additional information, they usually send you a mail.

If it has been more than 12 weeks, you can find information about your refund by calling the IRS customer support. However, it takes the IRS 16 weeks to process a return, so you should wait 12 weeks before checking on the status.