When Are Corporate Taxes Due in 2025?

Corporate taxes are mandatory payments businesses must make to the IRS on their profits. Every year, the IRS provides clear deadlines for filing and paying these taxes. Missing these dates can lead to penalties, extra charges, and other legal problems. In this guide, we provide a detailed breakdown of corporate tax deadlines for 2025, explain IRS rules, discuss IRS Form 1040 for business owners, and show how experts can help you avoid tax troubles.

Introduction: Corporate Tax Deadlines in 2025

1. Definition of Corporate Taxes

Corporate taxes are federal payments companies make on their profits. The funds help improve public infrastructure, education, and government services. Businesses of all sizes must file these taxes to stay compliant with the law.

2. Role of the IRS

The IRS regulates tax filings, provides forms, and collects payments. It ensures businesses report their earnings accurately. Companies must follow IRS rules each year to avoid financial penalties and maintain credibility.

3. Importance of Deadlines

Meeting tax deadlines helps businesses avoid interest fees and audits. Paying on time builds a trustworthy financial history. It also prevents legal complications and ensures your company operates without unnecessary tax stress.

4. Changes in 2025

Corporate tax laws evolve often. In 2025, there may be updates to deductions, filing procedures, or IRS forms. Staying updated ensures you pay the right amount and claim eligible credits.

5. Planning Ahead

Proper planning makes tax season easier. Keep organized records, estimate payments quarterly, and consult experts. Early preparation helps avoid last-minute filing mistakes or missed IRS deadlines.

6. Corporate Taxes and Business Growth

Proper management of these taxes helps businesses reinvest profits for growth. Companies that plan taxes strategically can reduce liabilities and increase their overall financial health.

Importance of Planning for Corporate Taxes

Planning for corporate taxes helps businesses avoid last-minute stress. Early preparation ensures proper documentation, accurate calculations, and timely filing with the IRS. Companies can also plan deductions and credits better to lower tax liability.

Proper planning avoids penalties for missing deadlines. Businesses should track all quarterly payments, keep updated financial records, and review IRS updates for 2025. This approach reduces errors and supports smooth corporate tax filing.

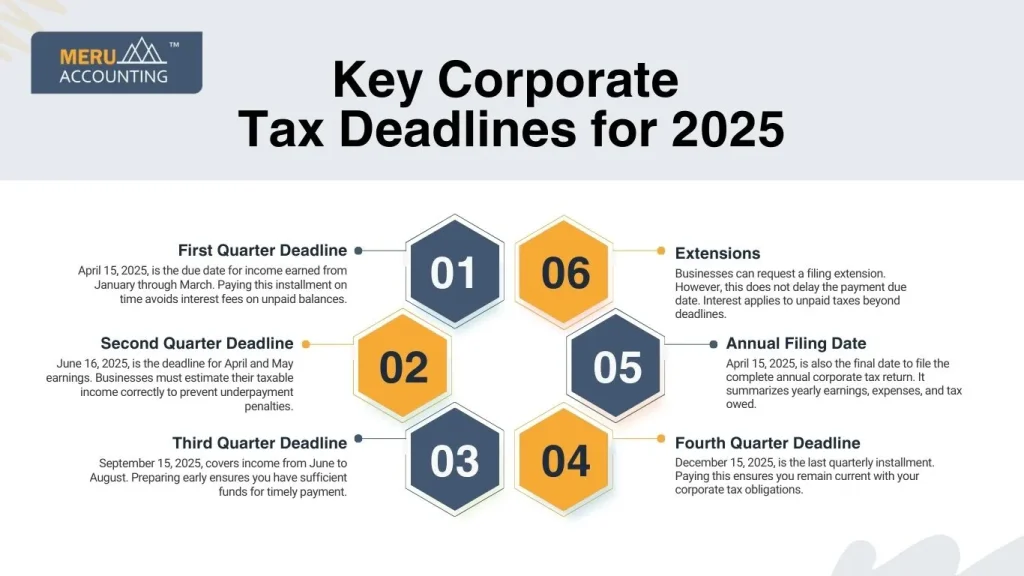

Key Corporate Tax Deadlines for 2025

1. First Quarter Deadline

April 15, 2025, is the due date for income earned from January through March. Paying this installment on time avoids interest fees on unpaid balances.

2. Second Quarter Deadline

June 16, 2025, is the deadline for April and May earnings. Businesses must estimate their taxable income correctly to prevent underpayment penalties.

3. Third Quarter Deadline

September 15, 2025, covers income from June to August. Preparing early ensures you have sufficient funds for timely payment.

4. Fourth Quarter Deadline

December 15, 2025, is the last quarterly installment. Paying this ensures you remain current with your corporate tax obligations.

5. Annual Filing Date

April 15, 2025, is also the final date to file the complete annual corporate tax return. It summarizes yearly earnings, expenses, and tax owed.

6. Extensions

Businesses can request a filing extension. However, this does not delay the payment due date. Interest applies to unpaid taxes beyond deadlines.

Understanding IRS Forms for Business taxes

1. IRS Form 1120

This is the standard form for C-Corporations. It reports income, deductions, and tax owed for the fiscal year.

2. IRS Form 1120-S

Used by S-Corporations, this form is due on March 15 or three months after the fiscal year ends. It passes profits to shareholders for individual reporting.

3. IRS Form 1040

Sole proprietors and LLC owners use this form to report both personal and business income. It links corporate earnings with individual tax obligations.

4. Other IRS Forms

Partnerships use Form 1065, while non-profits have separate filing requirements. Choosing the correct form is crucial for accurate reporting.

5. E-Filing Options

The IRS encourages digital filing for speed and accuracy. Online tools help avoid errors and provide quick confirmation of submission.

6. Supporting Documents

Attach schedules, receipts, and other financial records to support your reported figures. This ensures transparency and reduces audit risks.

Penalties for Missing IRS Deadlines

1. Late Filing Fees

Delays in submitting returns lead to automatic fines. These fees increase based on how late the filing is completed.

2. Interest Charges

The IRS adds interest to unpaid taxes daily. This grows your total balance and adds to business costs.

3. Underpayment Penalties

Failing to pay estimated quarterly taxes accurately may result in penalties, even if you pay later in full.

4. Audit Risk

Consistently missing deadlines may trigger IRS audits. These reviews can be stressful and time-consuming for businesses.

5. Impact on Business Credit

Late tax payments can harm your credit score, making it harder to secure loans or funding for future growth.

6. Legal Consequences

In severe cases, unpaid taxes can result in liens or other legal actions, affecting the company’s operations.

Tips for Accurate and Timely Filing

1. Keep Records Updated

Organize receipts, invoices, and other financial data throughout the year. This reduces errors during tax preparation.

2. Plan Quarterly Payments

Calculate your income estimates correctly for each quarter. This prevents surprises at the end of the fiscal year.

3. Use IRS Online Tools

Leverage calculators and filing tools provided by the IRS for easier compliance and reduced mistakes.

4. File Early

Submitting forms well before deadlines allows time to correct any errors before penalties apply.

5. Hire a Professional

Tax experts ensure forms are accurate, deadlines are met, and deductions are maximized for your benefit.

6. Review IRS Updates Regularly

Check the IRS website for news and changes in tax laws affecting your business.

Latest IRS Updates for 2025 Corporate Taxes

1. Changes to Tax Rates

The IRS may adjust corporate tax percentages in 2025. Stay informed to calculate liabilities correctly.

2. Digital Filing Requirements

E-filing is becoming the norm, reducing paperwork and improving accuracy for most businesses.

3. Updates in IRS Form 1040

The form instructions may change, especially for LLCs or self-employed owners. Read updates carefully before filing.

4. New Deductions

The government may introduce additional credits or deductions, helping businesses save money on taxes.

5. Reporting Deadlines

Certain types of income or foreign earnings may have adjusted reporting dates in 2025.

6. IRS Audit Guidelines

There could be new criteria for selecting returns for audits, impacting how companies prepare documents.

Meru Accounting prepares and files accurate tax returns, ensuring full IRS compliance every year. We help businesses choose and complete the correct IRS forms, including IRS Form 1040 for certain owners. Our team organizes financial data for clarity and a stress-free tax season. If the IRS reviews your taxes, Meru Accounting provides full assistance throughout the audit process.

FAQs

- When are corporate taxes due in 2025?

These taxes are due on April 15, 2025, for most businesses, but quarterly estimated payments are due on April 15, June 16, September 15, and December 15.

- What IRS forms do corporations need to file?

Businesses typically use IRS Form 1120 for C-Corporations, IRS Form 1120-S for S-Corporations, and IRS Form 1040 for sole proprietors or single-member LLC owners reporting business income.

- What happens if you miss the corporate tax deadline?

Missing a tax deadline can lead to late filing penalties, daily interest charges, potential audits, and even legal action from the IRS in severe cases.

- Can I request an extension to file business taxes?

Yes, you can file for an extension, but this only extends the time to submit paperwork. The tax payment is still due by the original deadline to avoid penalties.

- How do quarterly estimated payments work?

Businesses must pay estimated taxes quarterly based on projected income. This helps avoid underpayment penalties and large lump-sum payments later in the year.

- Is IRS Form 1040 used by all businesses?

No, IRS Form 1040 is mainly for sole proprietors and single-member LLCs. Larger corporations typically use IRS Form 1120 or 1120-S.

- What deductions can reduce corporate tax liability?

Deductions may include operational costs, employee benefits, depreciation, and approved business expenses. These vary based on business type and IRS guidelines.