Home » Where can I file Form 1065 online?

Where can I file Form 1065 online?

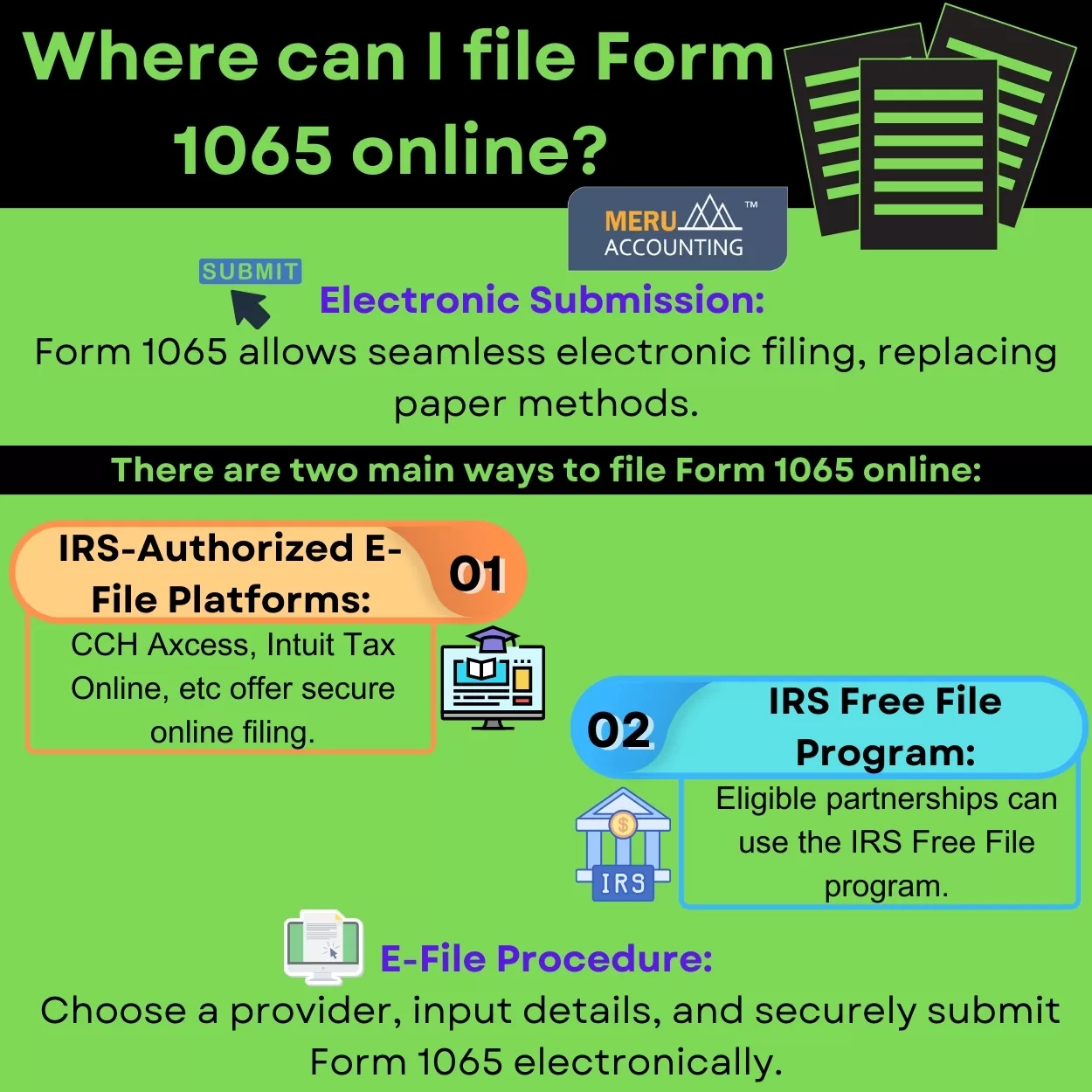

In the domain of partnerships, Form 1065(the U.S. Partnership Return of Income) stands as a crucial document, encapsulating the financial activities of the business entity. While traditionally filed in paper format, the advent of technology has opened up a convenient and efficient alternative – filing Form 1065 online. In this article we shall discuss how to file form 1065 online, empowering you to navigate the tax maze with ease.

Embarking on the Online Filing Journey:

The decision to file Form 1065 online is often driven by the allure of convenience and efficiency. This method eliminates the hassle of paper forms, allowing for seamless submission and tracking of your partnership’s tax return. However selecting the most suitable online filing platform can be a daunting task.

There are two main ways to file Form 1065 online:

1. IRS-Authorized E-File Providers: Your Gateway to Secure and Reliable Online Filing

Recognizing the growing preference for online filing, the IRS has established a network of authorized e-file providers. These providers, adhering to stringent IRS standards, offer a secure and reliable platform for submitting Form 1065 electronically. They ensure the integrity and confidentiality of your partnership’s financial data, providing peace of mind throughout the filing process.

Some popular IRS-authorized e-file providers include:

CCH Axcess:

Renowned for its user-friendly interface and robust features, CCH Axcess streamlines the Form 1065 online filing process, making it a popular choice among partnerships.

Intuit Tax Online:

A widely used platform, Intuit Tax Online provides comprehensive support for various tax forms, including Form 1065, offering a familiar and reliable experience.

Thomson Reuters Tax & Accounting:

Catering to businesses of all sizes, including partnerships, Thomson Reuters Tax & Accounting offers a suite of tax solutions, ensuring seamless integration with existing financial systems.

Wolters Kluwer CCH Tagetik:

A leading provider of tax and accounting software, Wolters Kluwer CCH Tagetik delivers advanced functionalities for managing complex tax matters, making it ideal for larger partnerships.

To find an IRS-authorized e-file provider that meets your needs, you can visit the IRS website.

2. Use the IRS Free File program:

If you have a low to moderate income, you may be eligible to use the IRS Free File program to file Form 1065 online for free. The IRS Free File program is offered by a number of different tax software providers, and you can find a list of participating providers here.

E-Filing Procedure:

Once you have chosen an e-file provider, you will need to create an account and provide your partnership’s information. You will then be able to upload your completed Form 1065 and any other required forms or attachments. The e-file provider will then submit your return to the IRS electronically.

Filing Form 1065 online could be a daunting task, but with the help of Meru Accounting, you can navigate the process with ease and confidence. Our team of experienced tax professionals will guide you through the online filing process, ensuring that your partnership’s financial information is accurately and securely submitted to the IRS. With Meru Accounting by your side, you can rest assured that your partnership’s tax obligations will be met with precision and efficiency, allowing you to focus on growing your business.

FAQs

- Where can I submit Form 1065 online?

You can send Form 1065 online through IRS-approved e-file providers or IRS Free File. - What tools can I use to file Form 1065 online?

You can use CCH Axcess, Intuit Tax Online, Thomson Reuters, or Wolters Kluwer CCH Tagetik. - Can I file Form 1065 online at no cost?

Yes. If your income is low or moderate, you may use the IRS Free File. - Is it safe to e-file Form 1065?

Yes. IRS-approved tools follow rules that keep your tax data safe. - What steps must I follow to e-file Form 1065?

Open an account, add your details, upload the form, then send it online. - What does CCH Axcess offer for Form 1065 filing?

It gives a clean layout, useful tools, and smooth steps to finish the form. - Can I check my Form 1065 after I send it?

Yes. Most tools let you track your form after you send it to the IRS. - Who can help me file Form 1065 online?

Meru Accounting can guide you and file your form with care and skill.