Why Are Online Accounting and Bookkeeping Services the Future of Financial Management?

Online accounting and bookkeeping services are rapidly transforming the way businesses manage their finances. By utilizing technology, these services offer flexibility, efficiency, and cost savings that traditional methods simply cannot match. These services often use automation and artificial intelligence to simplify tasks like invoicing, tax filing, and reporting, saving time and resources. In this article, we’ll explore why online accounting and bookkeeping services are the future of financial management and their key features to maximize their value.

Table of Contents

- Introduction

- Future of Financial Management Lies in Online Accounting and Bookkeeping Services

- Key Features to Look for in Online Accounting and Bookkeeping Services

- Conclusion

- Frequently Asked Questions (FAQs)

Introduction

Online accounting and bookkeeping services provide businesses with anytime, anywhere access to their financial data. These services use cloud-based technology to provide businesses with easy access to their financial data, eliminating the need for manual processes or physical paperwork. Online accounting and bookkeeping services offer a wide range of features such as invoicing, tax filing, payroll management, and financial reporting. The popularity of online accounting and bookkeeping services is growing rapidly due to their affordability, accessibility, and efficiency.

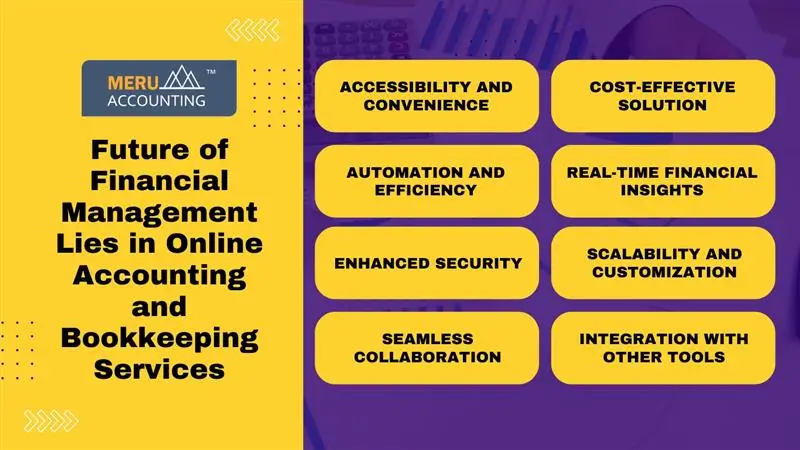

Future of Financial Management Lies in Online Accounting and Bookkeeping Services

- Accessibility and Convenience

Online accounting and bookkeeping services allow businesses to access their financial data from anywhere at any time. With cloud-based platforms, business owners and accountants can view up-to-date financial reports on-demand without being tied to a specific location or device. This flexibility makes managing finances simpler, especially for businesses with remote teams or multiple locations. - Cost-Effective Solution

Traditional accounting methods often require hiring in-house staff or contracting with expensive accounting firms. Online accounting and bookkeeping services, however, offer affordable subscription-based pricing, which is more budget-friendly for small to medium-sized businesses. By reducing the need for office space, equipment, and paper-based systems, businesses can save significantly on operational costs. - Automation and Efficiency

These services use automation to streamline many manual accounting tasks, such as invoicing, payroll processing, and reconciliation. Automation reduces the likelihood of human errors and ensures that financial tasks are completed quickly and accurately. - Real-Time Financial Insights

Online accounting and bookkeeping services provide real-time access to financial data, helping businesses make timely, informed decisions. Business owners can track income, expenses, and cash flow instantly, allowing them to identify potential issues or opportunities more quickly. - Enhanced Security

Online accounting platforms prioritize data security by using encryption, secure login protocols, and regular backups. Financial data stored on these platforms is less vulnerable to theft, loss, or damage compared to physical records. - Scalability and Customization

Online accounting and bookkeeping services offer scalability, allowing businesses to adjust their services according to size, industry, or specific requirements. These platforms can be easily customized with add-ons or integrations to suit various business needs, providing flexibility as the business expands. - Seamless Collaboration

Online accounting platforms enable seamless collaboration between business owners, accountants, and other stakeholders. Multiple users can access the same platform, sharing financial data, reports, and insights in real time. This promotes better communication and more efficient decision-making processes. - Integration with Other Tools

Online accounting and bookkeeping services integrate easily with other business tools, such as CRM, inventory management, and payment processing systems. This integration streamlines financial workflows, improves data accuracy, and reduces the need for manual data entry across multiple platforms.

Key Features to Look for in Online Accounting and Bookkeeping Services

- Cloud-Based Access

Make sure the service is cloud-based. This allows you to access your financial data from any device, anytime, without being tied to a specific location. - Automation

A good service will automate tasks like invoicing, tracking expenses, and payroll. This saves time, reduces mistakes, and makes financial management easier. - Real-Time Updates

Choose a service that gives you real-time financial data. This helps you stay on top of your business’s finances and make quick decisions. - Integration with Other Tools

The service should work well with other business tools like payment systems, inventory software, and CRMs. This helps keep everything connected and saves time. - Easy to Use

The service should have a simple, user-friendly interface. Even if you’re not an accounting expert, it should be easy to navigate and manage your finances. - Security

Look for services with strong security features, like data encryption and two-factor authentication, to keep your financial data safe. - Customizable Reports

Choose a service that lets you create financial reports that fit your business needs, such as profit and loss statements or cash flow reports. - Tax Help

A good service will help with taxes by tracking deductions, calculating taxes, and creating reports to make filing easier.

Conclusion

With automation, cloud accessibility, and enhanced security, Online accounting and Bookkeeping services simplify complex tasks and allow business owners to focus on growth. The scalability and integration features make them suitable for businesses of all sizes. As the digital landscape continues to evolve, online accounting will remain a crucial tool for businesses, ensuring that financial operations are streamlined, accurate, and secure. Adopting online accounting services is not only a smart choice but also a step toward a more efficient and future-proof business model. Meru Accounting utilizes automation, cloud accessibility, and enhanced security in its online accounting and bookkeeping services, helping businesses simplify their financial operations and focus on growth with scalable and integrated solutions.

Frequently Asked Questions (FAQs)

- How secure is my financial data with online accounting services?

Ans. Online accounting services use encryption and secure login protocols to protect your financial data. - Can small businesses use online accounting services?

Ans. Yes, online accounting services are affordable and scalable, making them ideal for small businesses. - Do online accounting services automate financial tasks?

Ans. Yes, they automate processes like invoicing, payroll, and reconciliation, reducing manual effort and errors. - Can I access my financial data anytime with online accounting services?

Ans. Yes, you can access your financial information 24/7 from anywhere with an internet connection. - How does Meru Accounting ensure the security of my financial data?

Meru Accounting uses advanced encryption and strict data protection measures to ensure the confidentiality and safety of your financial information. - Can Meru Accounting tailor its online accounting services to my business needs?

Yes, Meru Accounting offers customizable solutions to fit the unique needs of your business, regardless of its size or industry.