Tax Services for Small Businesses: What You Need to Know

Small firms face many tax problems each year. Getting the right tax help can make a big difference. Good tax help saves time, cuts costs, and keeps your firm safe from fines. Whether you are new or growing, having expert help means you follow the rules and pay what you owe. In this post, we will explore what tax services for small businesses include, common tax problems small firms face, and how professional help can make managing taxes easier.

Introduction to Tax Services for Small Businesses

Knowing tax help is key for small firm owners. This help covers all steps from making and filing taxes to plans that cut what you owe. Small firm taxes can be hard, with many forms and due dates to meet. Hiring pros who know the rules can save cash and stress. It also lets you spend time on your firm. Good tax help shields you from audits and fines while making sure you don’t miss tax breaks or credits you can get. In short, tax help keeps small firms safe and sound with their cash.

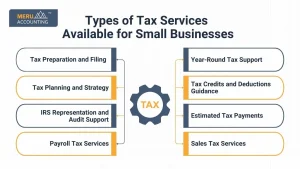

Types of Tax Services Available for Small Businesses

There are many kinds of tax services designed for small businesses, including:

Tax Preparation and Filing

Tax preparation and filing work means you get all your firm’s income and cost data, fill out the right tax forms, and send them in on time. This helps you meet tax rules and avoid high-cost slips.

Tax Planning and Strategy

Tax plan work looks at your firm’s money state throughout the year to cut the tax you owe. Experts develop strategies such as timing purchases or expenses and identifying credits to save you money legally.

IRS Representation and Audit Support

If the IRS has questions about your returns or initiates an audit, tax professionals can represent you. They communicate directly with the IRS, prepare necessary documents, and help resolve disputes or penalties.

Payroll Tax Services

Payroll tax services manage tax withholdings from your employees’ wages and ensure timely deposits with tax authorities. This service reduces errors and keeps your business compliant with payroll tax regulations.

Sales Tax Services

For businesses that sell products or taxable services, sales tax collection and reporting are essential. These services help calculate, collect, and remit the correct sales tax to avoid fines or audits.

Estimated Tax Payments

Many small businesses must pay taxes quarterly. Tax services assist in calculating these estimated payments accurately to avoid penalties and help manage cash flow better.

Tax Credits and Deductions Guidance

Professionals review your business activities to find all possible tax credits and deductions. This guidance ensures you don’t miss opportunities to reduce your tax bill.

Year-Round Tax Support

Beyond tax season, continuous support throughout the year can help with ongoing tax questions, financial planning, and responding quickly to tax law changes.

Industry-Specific Tax Services for Small Businesses

Each trade has its own tax rules and needs. With the right tax services, small businesses can steer clear of big, costly slips.

Retail Firms

Shops must track sales tax on each sale and keep stock lists up to date. Trade-based tax helps stop errors that can cause audits or fines.

Service Firms

These firms may have rules on when to note income and what costs they can claim. Tax help built for this field keeps you in line and helps you save on tax.

Home-Based Firms

Home-run firms can claim costs for a home office and linked needs. Tax pros make sure these claims meet IRS rules and cause no issues.

Food and Drink Firms

Dealing with staff tax, tip logs, and sales tax is tough. Trade-based tax help keeps these firms in line and cuts costs.

Build and Contract Work

Build-to-order firms face tax tasks like job cost logs and gear value drop. Tax pros help with these tasks in the right way.

Freelance and Consult Work

Self-run pros need help with four-time-a-year tax and self-tax. Tax help built for them stops fines and helps plan cash.

Nonprofits and Charities

These groups must meet strict rules to keep their tax-free status and file the right forms. Tax pros make sure this is done right.

Online Shops

Web shops must track sales tax in more than one state and log all sales correctly. Tax help made for online trade makes this easy.

Common Tax Challenges Faced by Small Businesses

Small businesses often struggle with:

Complex Tax Codes

Tax laws change often, making it hard for small businesses to stay updated. Missing new rules can lead to mistakes and penalties.

Deadline Management

Small businesses have many tax deadlines. Missing even one can cause costly late fees or audits.

Proper Record Keeping

Keeping organized records of income and expenses is vital for accurate tax filing but is often overlooked, leading to errors.

Payroll Tax Compliance

Calculating and submitting payroll taxes correctly is complicated but necessary to avoid IRS fines and employee issues.

Sales Tax Confusion

Sales tax rates and rules vary by location and product, creating confusion and risk of non-compliance.

Maximizing Deductions

Many small businesses fail to identify all possible deductions, missing opportunities to lower their tax bill.

Handling Audits

Facing an IRS audit can be stressful and time-consuming without professional support.

Cash Flow Management

Poor tax planning can lead to large, unexpected tax bills that hurt business cash flow and operations.

How Technology is Changing Tax Services for Small Businesses

Technology helps small businesses handle taxes faster and more accurately.

Cloud Book Tools

Cloud tools let firms store and get money data at any time. They make books and tax prep easy by keeping records up to date.

Auto Data Entry

Auto tools cut the need to type data by hand. This drops errors and saves time when you file taxes.

Live Reports

Live money reports give firm owners fresh views on tax status and what they owe.

Link with Pay Tools

Linking pay and tax tools makes tax math and pay work auto, so they are right and on time.

Phone Apps for Costs

Apps let you snap and sort costs fast, which makes record work easy and right.

Safe File Store

Tech gives safe web space to store tax files, which cuts loss risk and makes them easy to get in audits.

E-file and Pay Sites

Web file and pay sites make filing fast and cut file errors.

Analytics and Tax Forecasting

Advanced tools analyze financial data to predict tax obligations, helping businesses plan and budget properly.

Benefits of Using Professional Tax Services for Small Businesses

Tax Services for Small Businesses give many benefits. Hiring tax professionals helps you save time, cut stress, and avoid costly slips.

Time Savings

Tax professionals take over the complex tax tasks, freeing you to focus on growing your business.

Stress Reduction

Knowing experts handle your taxes reduces anxiety and helps you avoid costly mistakes.

Accurate Filing

Professional services ensure forms are completed correctly, reducing the risk of audits or penalties.

Maximized Tax Savings

Tax experts identify all applicable credits and deductions to lower your overall tax bill.

Compliance Assurance

They keep you updated with tax law changes, ensuring your business remains compliant.

Better Financial Planning

Tax professionals offer advice to improve cash flow and avoid surprises at tax time.

Audit Support

If audited, experts represent you, explain your records, and communicate with the IRS.

Year-Round Advice

Ongoing support helps you stay on track throughout the year, not just at tax time.

How to Pick the Best Tax Help for Your Small Firm

Picking the best tax service takes careful thought.

Experience with Small Businesses

Look for providers who understand the specific tax needs of small businesses in your industry.

Personalized Service

Choose a firm that tailors their services based on your unique business situation and goals.

Clear Pricing

Understand fees upfront to avoid unexpected costs and ensure the service fits your budget.

Reputation and Reviews

Read reviews and ask for references to find a trustworthy and reliable tax service.

Accessibility

Select a provider who is easy to reach and responsive when you need support or have questions.

Technology Use

Working with a firm that uses modern tax and accounting software speeds up processes and reduces errors.

Range of Services

Find a service offering comprehensive tax help, from filing to planning and audit support.

Support for IRS Issues

Make sure your tax service can represent you if you face IRS audits or questions.

At Meru Accounting, we know the tax problems small firms face. We bring years of skill to guide you. We make our tax help fit your business needs. This way, you only pay what you must. Our rates are fair and clear, with no secret fees. We make good tax help easy to get.

FAQs

- What papers do I need for tax help?

Keep your income records, receipts, bank statements, payroll info, and last year’s tax forms ready to give to your tax expert. - When should I start tax preparation?

Start to gather your tax papers right after your year ends. This helps you avoid last-minute rush and get things done well. - Can I do my small business taxes alone?

You can, but hiring pros cuts errors, saves time, and makes sure you get all the tax breaks you deserve. - How often do I pay estimated taxes?

Most small firms pay taxes four times a year to avoid fees and keep cash flow steady. - What if I get audited?

Tax pros guide you and stand by you to handle audits with less stress. - Are there tax credits for small firms?

Yes, there are many, like hiring workers, buying tools, and using green tech. - How can Tax Services for Small Businesses help me cut costs?

They find all tax breaks you can claim, help you plan for less tax owed, and stop costly slips that lead to fines.